US CRUDE OIL

WTI oil price is up 1.5% on Monday, recovering after last Friday's 5% drop (the biggest one-day fall since 17 Sep).

Oil was hit by fears that trade talks would be disrupted and conflict would escalate, following US support to Hong Kong protesters last week that sparked strong sell-off on Friday.

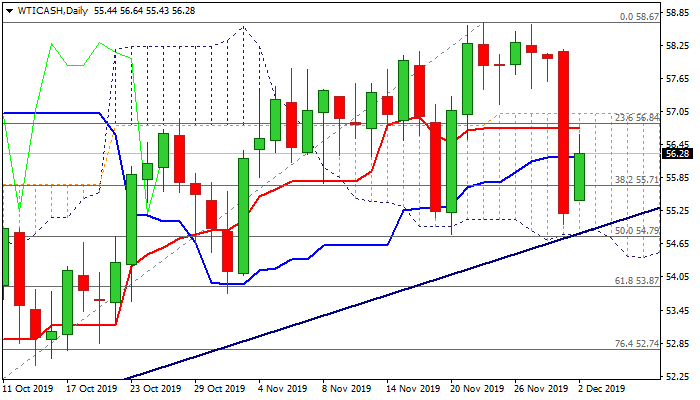

Strong fall after repeated failures to clearly break above key Fibo barrier at $58.46 (61.8% of $63.12/$50.91) shifted near-term focus lower, as Friday's strong bearish acceleration surged through thick daily cloud (spanned between $57.02 and $54.82) and pressured cloud base, but failed to break below. Today's recovery was supported by upbeat China's manufacturing data which boosted expectations for increased energy demand from the second biggest world's economy. Markets maintain hopes that OPEC would increase its current production cut that would tighten global oil supply.

The cartel and its close associates will meet later this week to discuss these matters.

Near-term action is weighed by Friday's massive bearish daily candle, with Friday's close below pivotal Fibo support at $55.71 (38.2% of $50.91/$58.67) adding to negative near-term tone, which is expected to persist while recovery attempts remain capped by daily cloud top ($57.02).

Fading bearish momentum on daily chart helps recovery, but recovery so far lacks strength to break above daily cloud top and signal reversal. Conversely, firm break below daily cloud base ($54.82), reinforced by bull-trendline off $50.91 low, would generate strong negative signal for extension of pullback from $58.67 (22 Nov high).

Res: 56.64; 56.75; 57.02; 57.54

Sup: 55.71; 55.43; 55.00; 54.82

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD hold comfortably above 1.0750 as USD recovery loses steam

EUR/USD clings to small daily gains above 1.0750 in the early American session on Monday. In the absence of high-tier data releases, the US Dollar finds it difficult to gather recovery momentum and helps the pair hold its ground.

GBP/USD struggles to find direction, holds near 1.2550

GBP/USD stays under modest bearish pressure and trades near 1.2550 on Tuesday. The neutral risk mood, as reflected by the mixed action seen in US stocks, doesn't allow the pair to make a decisive move in either direction. The Bank of England will announce policy decisions on Thursday.

Gold rebounds to $2,320 as US yields edge lower

After falling to $2,310 in the early European session, Gold recovered to the $2,310 area in the second half of the day. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.5% and helps XAU/USD find support.

Ripple lawsuit develops with SEC reply under seal, XRP holders await public redacted versions

Ripple lawsuit’s latest development is SEC filing, under seal. The regulator has filed its reply brief and supporting exhibits and the documents will be made public on Wednesday, May 8.

The impact of economic indicators and global dynamics on the US Dollar

Recent labor market data suggest a cooling economy. The disappointing job creation and rising unemployment hint at a slackening demand for labor, which, coupled with subdued wage growth, could signal a slower economic trajectory.