With June hike probability, Fed recedes into the rearview mirror

Outlook: The dollar got a double boost from the China recovery fizzling and a fresh round of hawkishness assumed at the Fed. The FT reports Cleveland Fed Pres Mester saying she sees no compelling reason for a June pause. This is on top of former TreasSec Summers saying US inflation is far stickier than anyone thinks and will remain about double the Fed target so that even more hikes will be needed. “My guess is that Fed funds are going to have to get to a point 50 basis points or more ahead of where they are.” And oh, yes, taxes will need to go up to bring in the needed revenue.

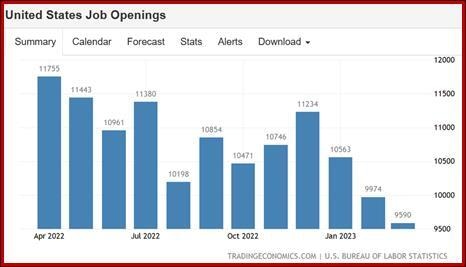

We get JOLTS, the Beige Book and no fewer than three Feds speaking today. Tomorrow it’s the ADP private sector jobs ahead of payrolls on Friday. JOLTS (for April) will likely show another drop in openings, the March report showing a decline by 384,000 to 9.6 million in March, the lowest since April 2021 and “below the market's expectation of 9.775 million, indicating that the labor market may be cooling off.” But on other measures, JOLTS disappointed. “Meanwhile, the number of hires and total separations remained relatively stable at 6.1 million and 5.9 million, respectively. Within separations, the number of quits (3.9 million) did not show significant changes, while layoffs and discharges (1.8 million) increased.”

See the Trading Economics chart. Note that even 9 million openings is still far bigger than 5.6 million unemployed.

The ADP private sector jobs count is expected to fade down to about 170,000 from the average year-to-date of 204,500 but with wild swings.

Unless there is a surprise, the probability of a June hike will continue to get a foothold. Today the CME FedWatch tool shows a 65.3% probability of a June hike—from 36.4% a week ago.

Notice that there is no talk of regional banks fragility or the Fed pausing to mitigate any credit crunch.

Forecast: We had expected risk aversion to fall back on the resolution of the US debt ceiling problem, but instead it surged again on China’s sub-par recovery from pandemic shutdowns. In addition, the June pause by the Fed is now in the rearview mirror, with a fresh 65.3% probability of a June hike (from 36.4% a week ago). Both factors contribute to dollar firmness and put the kybosh on the nascent sterling rally, among other effects.

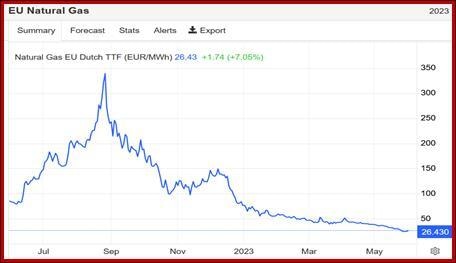

Tidbit: We should not neglect that falling inflation in the eurozone gets its big push from declines in the price of natural gas, down to the lowest since June 2021 and the year-to-date decline at a whopping 66%.

Trading Economics notes the causes include “abundant LNG supplies, reduced consumption, mild weather conditions, stronger renewable power generation and subdued demand from Asia. Furthermore, the European economy is displaying signs of weakness, with Germany experiencing a recession in Q1 2023, raising further concerns about a potential decline in natural gas demand. Currently, gas demand in Europe is weak as the winter heating season has concluded and summer demand has yet to commence while gas consumption from industries remains subdued.”

But we can’t count this Wonderland set of conditions to persist. “Despite the current downward pressure driven by weak demand and ample supply, there is a possibility that abnormal heatwaves, drought conditions during the summer, and a resurgence in Asian LNG demand could lead to an increase in prices.”

Tidbit: The FT reports the ECB is worried about Japan normalizing interest rate policy and wooing investors with a “big footprint” in Europe back home. The risk of Japanese investors withdrawing is one of top threats to the eurozone financial system, especially because the ECB is aiming to cut its own holdings.

“Japanese investors have significant holdings in eurozone government bonds, particularly French debt, as well as vast investments in US Treasuries and Australian bonds. The ECB said normalisation of Japanese monetary policy could lead to ‘a rapid decline in rate differentials and increased exchange rate volatility, which it said could ‘reduce the attractiveness’ of carry trades — in which investors borrow at low rates in Japan to invest in higher-yielding bonds abroad.

“Higher Japanese rates could prompt investors to repatriate money, it said, while ‘valuation losses on local bond portfolios and higher risk-free rates could inhibit the investors’ risk-seeking behaviour, including their willingness to invest abroad’.”

Meanwhile, the banks themselves should be setting aside higher reserves given signs of “deterioration in the credit quality of loans on banks’ balance sheets as higher borrowing costs, weak growth and high inflation triggered a rise in insolvencies.” And investment funds in real estate face some disruption.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

Author

Barbara Rockefeller

Rockefeller Treasury Services, Inc.

Experience Before founding Rockefeller Treasury, Barbara worked at Citibank and other banks as a risk manager, new product developer (Cititrend), FX trader, advisor and loan officer. Miss Rockefeller is engaged to perform FX-relat