European markets: In QE we trust

Despite protestations to the contrary by European Central Bank policymakers, markets have been increasingly supported by the prospect of quantitative easing as a silver bullet for European woes. However, this could be seen as a case of rational irrationality, with market participants rationally anticipating the irrational optimism of others.Markets will probably get what they want

Fundamentally, the Eurozone as an entity continues to struggle with high unemployment, sluggish job growth, rigid labour markets, weak credit creation and at the periphery, political instability concerns. However, addressing structural and fiscal concerns with monetary policy tools seems to be what Europe wants, and so that’s what Europe is going to get.

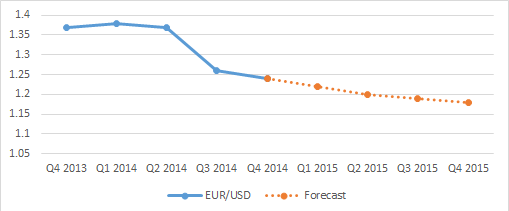

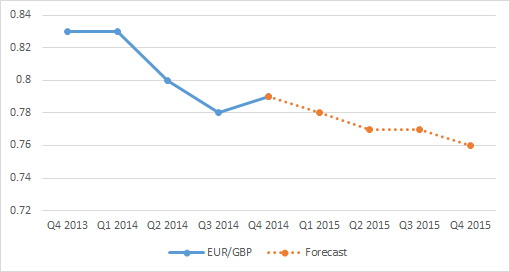

As such, the single biggest deciding factors in the trajectory of the euro in 2015 will be the likelihood, size, timing and scope of sovereign debt purchasing programme from the European Central Bank

The dangers of the US comparison

_20150112090931.png)

Mario Draghi has been quick to point to the current robustness of US and UK markets as (post hoc ergo propter hoc) being aided by the respective central banks’ decision to fire up asset purchase programmes early on in the financial crisis. However, ignoring any malinvestment effects and Bastiat’s question of the opportunity cost of that “which is seen and what is unseen", there is also the question of the effectiveness of a European QE programme.

Lower wealth perception potential

Average European households hold a lower percentage of their assets in equity and bond markets as well as having lower participation rates in equity markets. The participation rate of US adults in equity markets, whether outright or as part of a mutual fund or self-directed retirement account is around 26 percent. The UK is higher at around 30 percent, while Europe is a long way behind. Average French participation is 15 percent, Greece 10 percent, Germany 9 percent and Italy 7 percent. As a result, any inflation of European equity markets by a large-scale asset purchase programme is unlikely to result in the higher nominal and perceived wealth effects seen in the US or UK, meaning it isfar less likely to bolster European household spending.Legal challenges to QE

Though perhaps a more controversial policy, a quantitative easing programme from the ECB could face fewer legal challenges than Outright Monetary Transactions.As the OMT operation links bond buying to fiscal adjustment, it is being challenged by the German Constitutional Court (Bundesverfassungsgericht) at the European Court of Justice. January 14 may be a key date for the future of OMT when we will hear from the ECJ advocate general as to whether the link between fiscal and monetary policy is strong enough to warrant further constitutional consideration.

However, despite some comments (particularly from the Bundesbank’s hawkish Jens Weidmann) that QE would face significant legal challenges, it is unlikely that this would be the case. The aim of QE would be to expand the ECB balance sheet and to target Eurozone deflationary pressures – something that falls within the ECB mandate and does not tray into fiscal policy

QE - Scope, size, effects, probability

Scope

So far, we have had little in the way of explicit guidance as to what form an ECB QE programme would take, beyond comments from Mario Draghi on 4 December that policymakers have discussed asset purchases including “anything but goldâ€. As a result, it is feasible that corporate bond purchases may form part of a QE operation.

However, just because the ECB could buy up corporate bonds, it doesn’t mean that it should do so. An important emphasis has been made by the ECB in relation to asset-backed security and targeted long-term repayment operations and that is the important of their respective impact on the banking channel for monetary policy transmission.

_20150112091023.png)

Is buying up debt through European corporate bond markets something that is going to achieve that objective of monetary policy transmission? Probably not. And heavy-handed corporate bond operations are more likely to do damage than good given that there is already a healthy market there.

Instead, the most logical route is probably the most likely – the ECB buying up government bonds, and if it is going to go down the QE route, the bigger the better.

Size

It is probably that a quantitative easing programme would, if not abandon altogether, at least take a very loose interpretation of the capital key, given the restraints this would place on the size of the QE programme and the risk of the ECB becoming a monopsonistic holder of Greek, Cypriot or Latvian debt. Instead, it might be the case that the capital key is used to limit the ratio of respective sovereign debt purchases._20150112091110.png)

Consensus forecasts place the estimated size of a bond purchase programme at the EUR200-EUR350bn/year range, something that would be limited to the lower end of the scale if constrained by the capital key. But in the likelihood that it wouldn’t be, there is a higher probability that the ECB would go big on QE with something more in the EUR32-350bn/year+ territory.

Effects

How much would QE affect FX rates? You really have to ask yourself how much to what degree QE has already been priced into the euro. EUR has been in a long bearish trend throughout the second half of 2014 suggesting this might be the case. However, further downside to the euro is something that will look to encourage in the hope of importing some much-desired inflation. Although delays in any ECB action, or disappointingly weak ECB action, may cause some rallies (bear in mind that ECB meetings will be pushed out to 6-week intervals) this may be offset by weakening equity inflows restraining too much EUR resurgence.Thestronger effect is likely to be felt (unsurprisingly) in periphery yields being pushed down further in line with core yields. However, the question is whether this will improve business lending conditions in those regions is debatable – we have already seen some fairly sustained compression in European yields but banks have yet to roll out of diminishing yields on government debt in favour of lending to businesses.

_20150112091147.png)

We’ve seen an increasing convergence of Treasury – Bund breakeven expectations while 10y Bund yields have been pushed lower – one could hypothesise that this is the result of anticipation of a price insensitive buyer of European bonds (ECB) however, it is also in line with the global decline in high quality sovereign yields. But this convergence begs the question of whether, while Treasury and Bund yields are correlated, are they also co-dependent? Can the ECB pursue aggressive monetary easing at the same time as the Fed approaches a tightening phase? The respective central banks will be hoping that the answer is yes, but we may see a diversion of bond yields, but pressure from interest rate differentials may exert pressure on real interest rates meaning that the ECB and the Fed could end up in a tug of war, with the Fed limiting the loose monetary policy ambitions of the ECB, while the ECB causes a spillover of liquidity into US markets, hampering the Fed’s tightening phase.

_20150112091239.png)

Onthe other hand, if the ECB either fails to roll out a full-blown sovereign debt buying programme, or the size of that programme fails to meet expectations in terms of scale or scope, then we will see another decoupling of market perceptions between the central bank and the fundamental Eurozone. We have seen an increasing conflation of perceptions of the ECB’s ability to act and the overall health of the Eurozone in terms of market pricing. No QE to distract the markets and they will return to asking whether anything has fundamentally changed since the crisis.

Conclusions

Consensus probably correct

We believe that the consensus expectation is probably correct unconstrained by the capital key. However, it is important to bear in mind that the fundamentals and the dynamics of the European market in 2015 are very different to those in the US in 2008 onwards and so traders should be vigilant for signs of unexpected consequences of ECB action. on ECB action – large scale US-style quantitative easing unconstrained by the capital key. However, it is important to bear in mind that the fundamentals and the dynamics of the European market in 2015 are very different to those in the US in 2008 onwards and so traders should be vigilant for signs of unexpected consequences of ECB action.

Recommended Content

Editors’ Picks

AUD/USD stalls ahead of Reserve Bank of Australia’s decision

The Australian Dollar registered minuscule gains compared to the US Dollar as traders braced for the Reserve Bank of Australia monetary policy meeting. A scarce economic docket in the United States and a bank holiday in the UK were the main drivers behind the “anemic” AUD/USD price action. The pair trades around 0.6624.

EUR/USD propped up near 1.0750 ahead of European Retail Sales

EUR/USD churned around 1.0770 to kick off the new trading week, with the pair rising after better-than-expected Purchasing Managers Index figures early Monday before settling into familiar chart territory above 1.0750 ahead of Tuesday’s pan-European Retail Sales figures.

Gold rises as US job slowdown dampens Treasury yields

Gold price rallied close to 1% on Monday, late in the North American session, bolstered by an improvement in risk appetite due to increased bets that the US Federal Reserve might begin to ease policy sooner than foreseen. The XAU/USD trades at around $2,320 after bouncing off daily lows of $2,291.

Ethereum traders show uncertainty following huge whale sale, Robinhood Crypto Wells notice

Ethereum holdings on centralized exchanges continue to decline despite recent whale sales. With Robinhood Crypto as the latest recipient of the SEC's Wells notice, Ethereum spot ETFs look more unlikely.

RBA expected to leave key interest rate on hold as inflation lingers

Interest rate in Australia will likely stay unchanged at 4.35%. Reserve Bank of Australia Governor Michele Bullock to keep her options open. Australian Dollar bullish case to be supported by a hawkish RBA.