Quantitative Easing or QE (the process through which a Central Bank prints money, with which to buy assets, in the hope of stimulating the economy) was first deployed in Japan. The unconventional monetary policy was meant to overcome decades of economic inertia since the “bubble economy” burst in the late eighties and early nineties. Subsequent rounds of QE have failed to move Japans economic situation forward and one could now argue that the expansion and continuation of the policy is starting to have a negative effect. Creating as it has a form of economic moral hazard for the Government of Shinzo Abe. I say that because the notion that the Bank of Japan would buy government debt has perhaps allowed the Abe Government to press ahead with its spending plans, which are funded through the issuance of debt, safe in the knowledge that this new debt would always find a home or a willing buyer.

Back stopped demand

Japanese Institutions are happy to take on Japanese debt in the knowledge that the BOJ is spending circa $60 billion per month on QE (bond buying) In fact the BOJ became the largest holder of JGBs or Japanese Government Bonds last June when its holdings rose above 20% of outstanding issues. Japanese institutions Banks, Insurers and government agencies hold another 57% or so.Foreign holders of Japanese bonds account for less than 9% of the outstanding issuance.

An Increasing debt burden

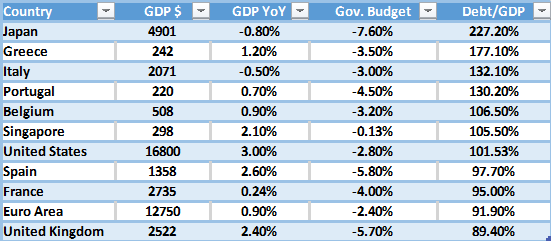

According to data compiled by Trading Economics Japans national debt, as a percentage of GDP has grown to a figure well head of any other major developed economy.As can be seen from the table below:

Stimulus is failing to deliver

Note as well that Japan is also running a larger budget deficit as percentage of GDP than its developed peers. Which alongside the negative annualised GDP figure suggests that the combination of fiscal stimulus (more government spending) and monetary stimulus (more BOJ printing and bond buying) are failing to achieve the economic recovery that the government is hoping for. After all if the economy was growing tax revenues should rise allowing the government to run a balanced budget, if not a budget surplus.Erratic economic performance

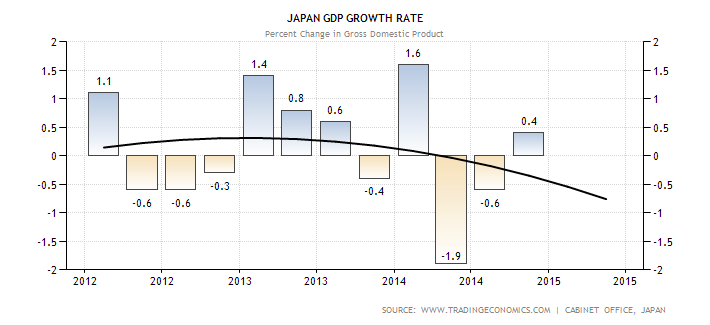

GDP is the measure that is used by economists to determine the state of play in an economy and to compare the performance of that economy against its own history and the performance of its peers.The chart below shows the quarterly performance of the Japanese economy since 2012 when the current administration came to power. Worryingly despite the considerable efforts of the government and the BOJ, the economy has not been able to produce four consecutive quarters of growth in this period and has seen as many negative quarter as positive ones. The black line on the chart is the forecasted direction of future Japanese GDP growth, as we can see this in negative territory.

Inflation remains low

Not only is GDP growth a cause for concern so is the level of inflation. Inflation is often thought of as a bad thing in an economy if and when its gets out of control however inflation at moderate levels can actually be seen as a barometer for a healthy economy within which demand is leading supply.Japan in common with the UK and the Eurozone has an official inflation target of 2% but as with those economies the underlying rates of inflation are well below target.

Falling prices are of course common too many developed economies at the current time. But given the massive depreciation in the yen against the dollar, >50% since the autumn of 2012. One might have expected to see prices rise dramatically especially as during this period Japan became reliant on energy imports to replace power previously generated by its nuclear plants which went offline in the wake of the Fukishima disaster.

Recommended Content

Editors’ Picks

EUR/USD stays weak near 1.0700 ahead of key EU inflation, GDP data

EUR/USD is keeping the red near 1.0700, undermined by a broad US Dollar rebound and a mixed market mood early Tuesday. Germany's Retail Sales rebound fail to impress the Euro ahead of key Eurozone inflation and GDP data releases.

GBP/USD remains pressured toward 1.2500 on US Dollar rebound

GBP/USD is extending losses toward 1.2500 in European trading on Tuesday. A cautious risk tone and a decent US Dollar comeback weigh negatively on the pair. The focus now shifts to mid-tier US data amid a data-light UK docket.

Gold price remains depressed near $2,320 amid stronger USD, ahead of US macro data

Gold price (XAU/USD) remains depressed heading into the European session on Tuesday and is currently placed near the lower end of its daily range, just above the $2,320 level.

BNB price risks a 10% drop as Binance founder and ex-CEO Changpeng Zhao eyes Tuesday sentencing

Binance Coin price is dumping, with the one-day chart showing a defined downtrend. While the broader market continues to bleed, things could get worse for BNB price ahead of Binance executive Changpeng Zhao sentencing on Tuesday, April 30.

Data fuels China optimism

China's factory activity has expanded for a second consecutive month, marking the best streak in over a year and fueling optimism for the sustainability of the world's second-largest economy's recovery.