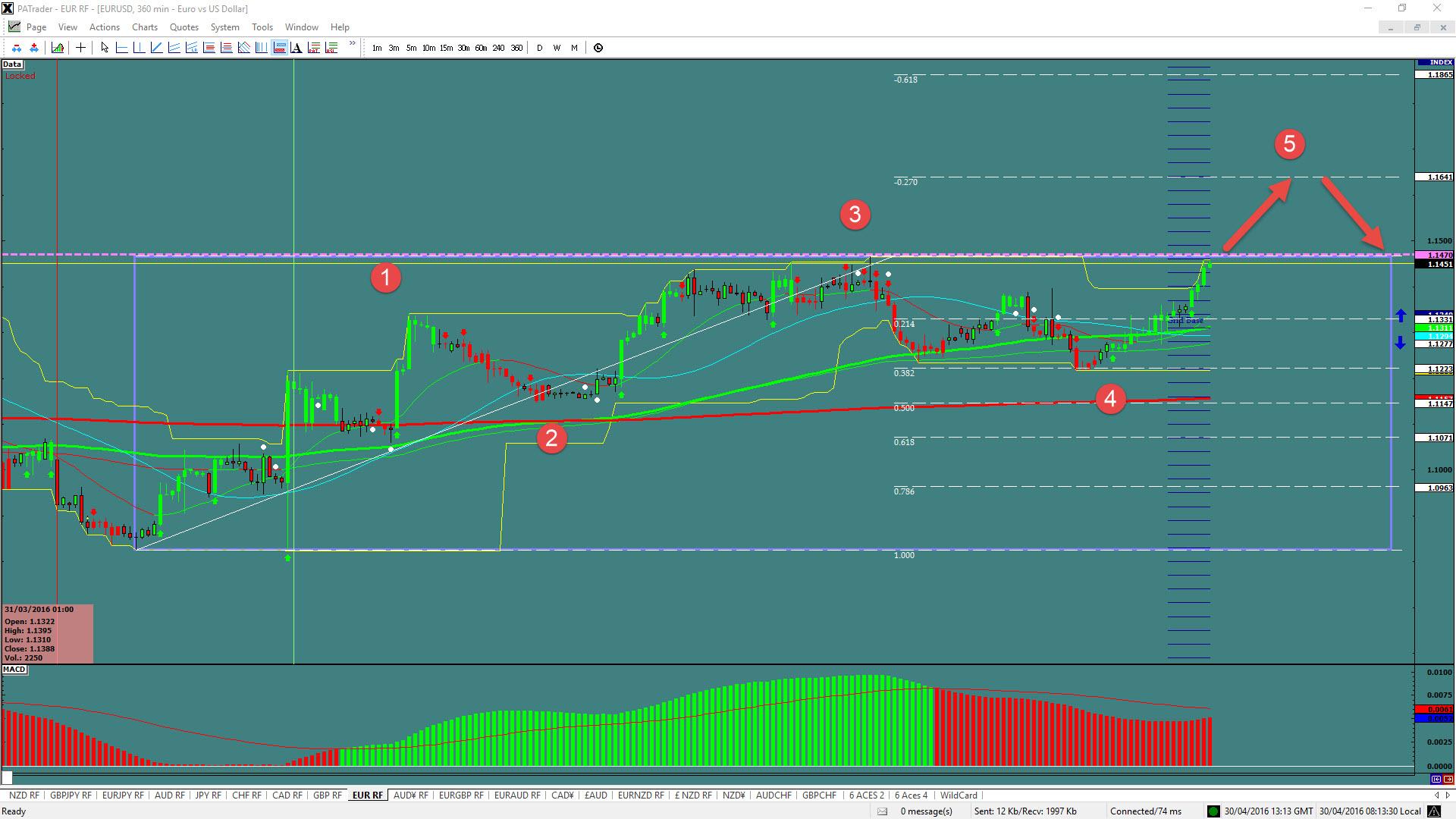

$EURUSD

What ProAct Forex Target Traders See: We are currently sitting @ 1.1222 in a range. As long as USDX is shorting we are looking for a continuation move up to the 1.270 Fibo@ 1.1641 and then a correction. The break up would confirm a fifth wave in place. The average daily true range (ATR) for the pair currently is 86 pips.

————————————————————————--

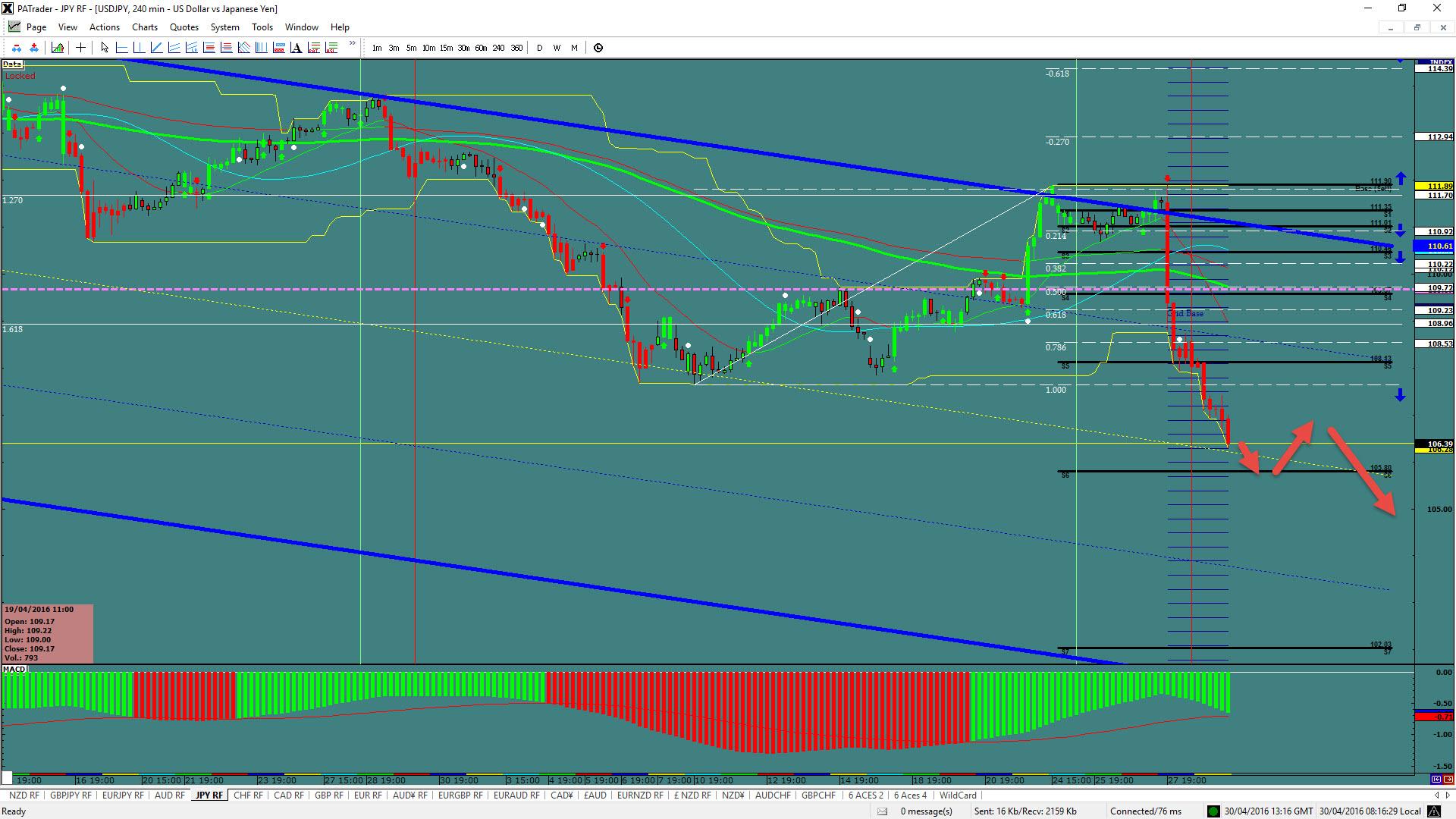

$USDJPY

What ProAct Forex Target Traders See: We are currently @ 106.39. We are looking to the S8 @ 105.82 with a bounce there and possible continuation to the 105.00 Psychological number. The average daily true range (ATR) for the pair currently is 122 pips.

——————————————————————————–

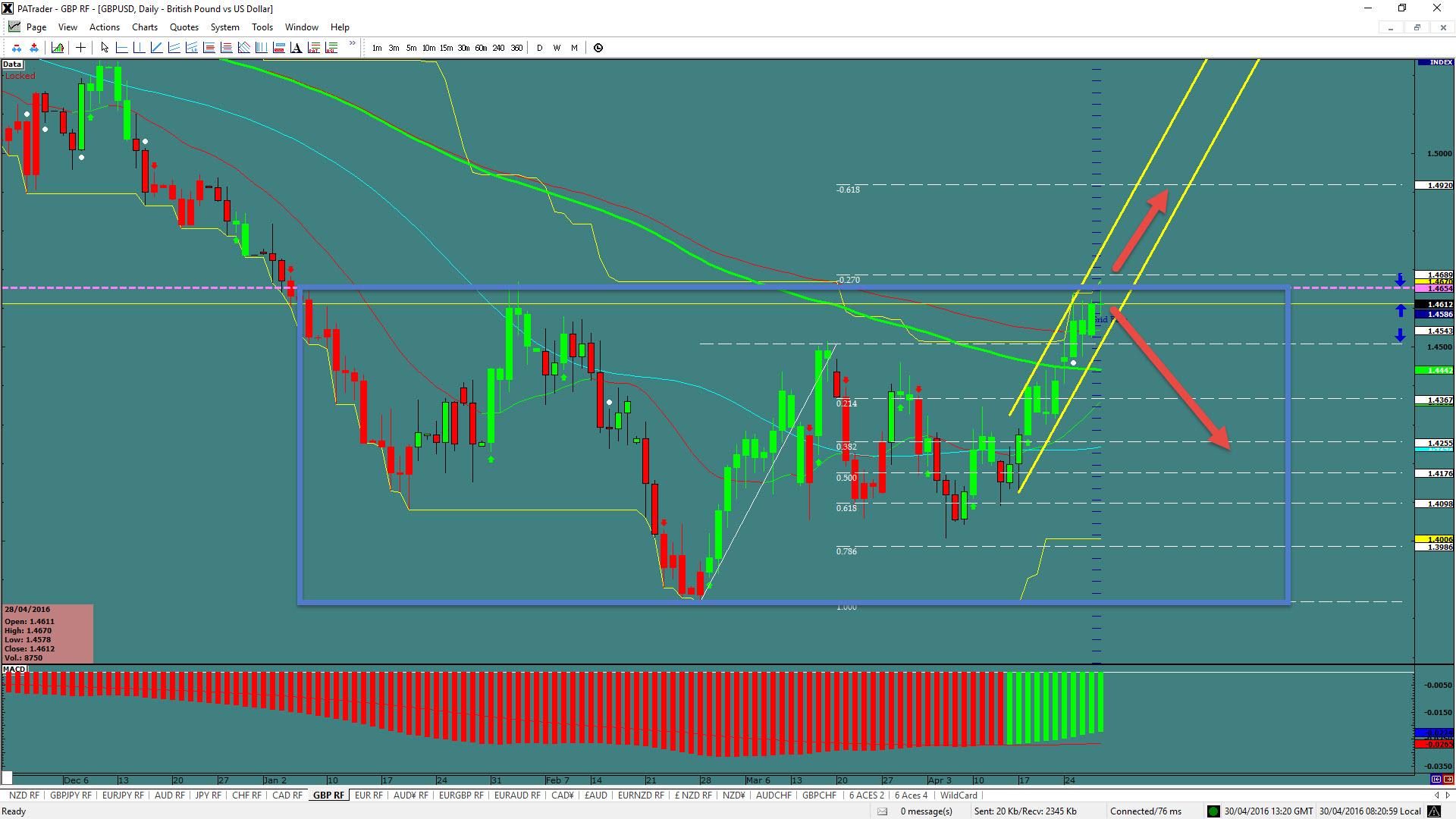

$GBPUSD

What ProAct Forex Target Traders See: Cable is currently @ 1.4126 and in a large range. A couple of different scenarios: 1: As long as USDX is shorting Bullish: a move to the 1.618 Fibo @ 1.4920 area and 2: Bearish: A break down to the 0.382 Fibo support @ 1.4255. The average daily true range (ATR) for the pair currently is 129 pips.

——————————————————————————–

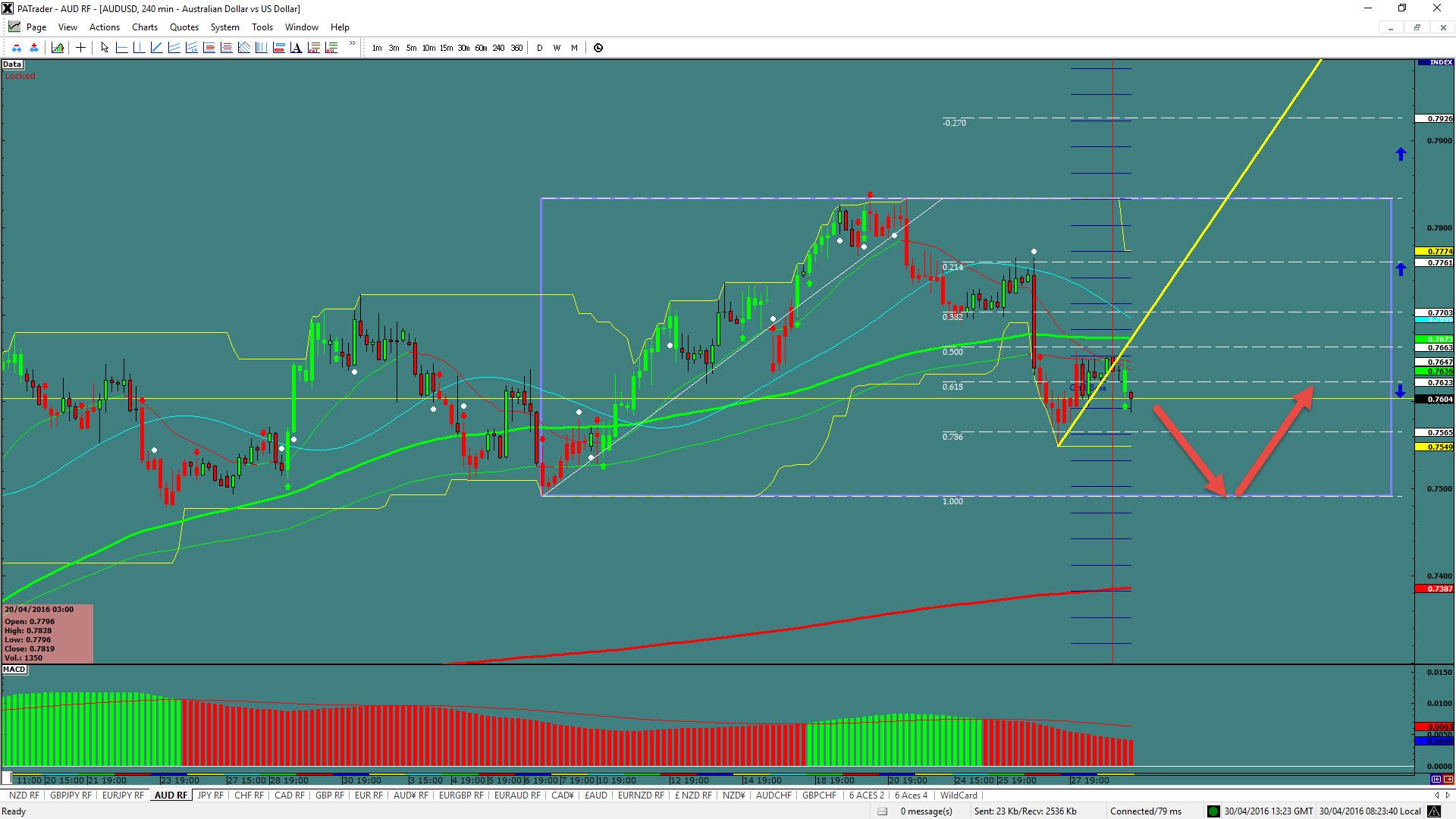

$AUDUSD – A great smooth currency for Newbie’s!

What ProAct Forex Target Traders See: Aussie is @ 0.7604 and in a range. We are looking for a continuation move down to the bottom @ 0.7500. A possible bounce to be expected there. The average daily true range (ATR) for the pair currently is 95 pips.

ProAct Traders™ (hereafter, PAT) assumes no responsibility for errors, inaccuracies, or omissions, nor does it warrant the accuracy or completeness of the information in the materials that comprised the text, graphics or other items contained in the ProAct Charts as a result of computer or power failures or interruptions in the electronic delivery systems via the Internet. PAT shall not be liable for any special, indirect, incidental or consequential damages including without limitation losses, lost revenue, or lost profits that may result from these materials.

Foreign Currency Trading carries a level of risk / reward that may not be suitable for all considering participation in the market known as Forex. The Forex is a "zero sum" market and its end effect is that there are an equal number of winners and losers. Consequently, the possibility exists that you could sustain an eventual loss of some or all of you initial investment. Therefore, you should never invest money that you cannot afford to lose. Before deciding to trade the Forex, you should become thoroughly educated in how the market works, have a sound money management plan and then carefully consider your investment objectives, level of experience, and risk appetite. If you have any doubts, seek advice from an independent financial advisor.

Recommended Content

Editors’ Picks

AUD/USD retargets the 0.6600 barrier and above

AUD/USD extended its positive streak for the sixth session in a row at the beginning of the week, managing to retest the transitory 100-day SMA near 0.6580 on the back of the solid performance of the commodity complex.

EUR/USD keeps the bullish bias above 1.0700

EUR/USD rapidly set aside Friday’s decline and regained strong upside traction in response to the marked retracement in the Greenback following the still-unconfirmed FX intervention by the Japanese MoF.

Gold advances for a third consecutive day

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Bitcoin price dips to $62K range despite growing international BTC validation via spot ETFs

Bitcoin (BTC) price closed down for four weeks in a row, based on the weekly chart, and could be on track for another red candle this week. The last time it did this was in the middle of the bear market when it fell by 42% within a span of nine weeks.

Japan intervention: Will it work?

Dear Japan Intervenes in the Yen for the first time since November 2022 Will it work? Have we seen a top in USDJPY? Let's go through the charts.