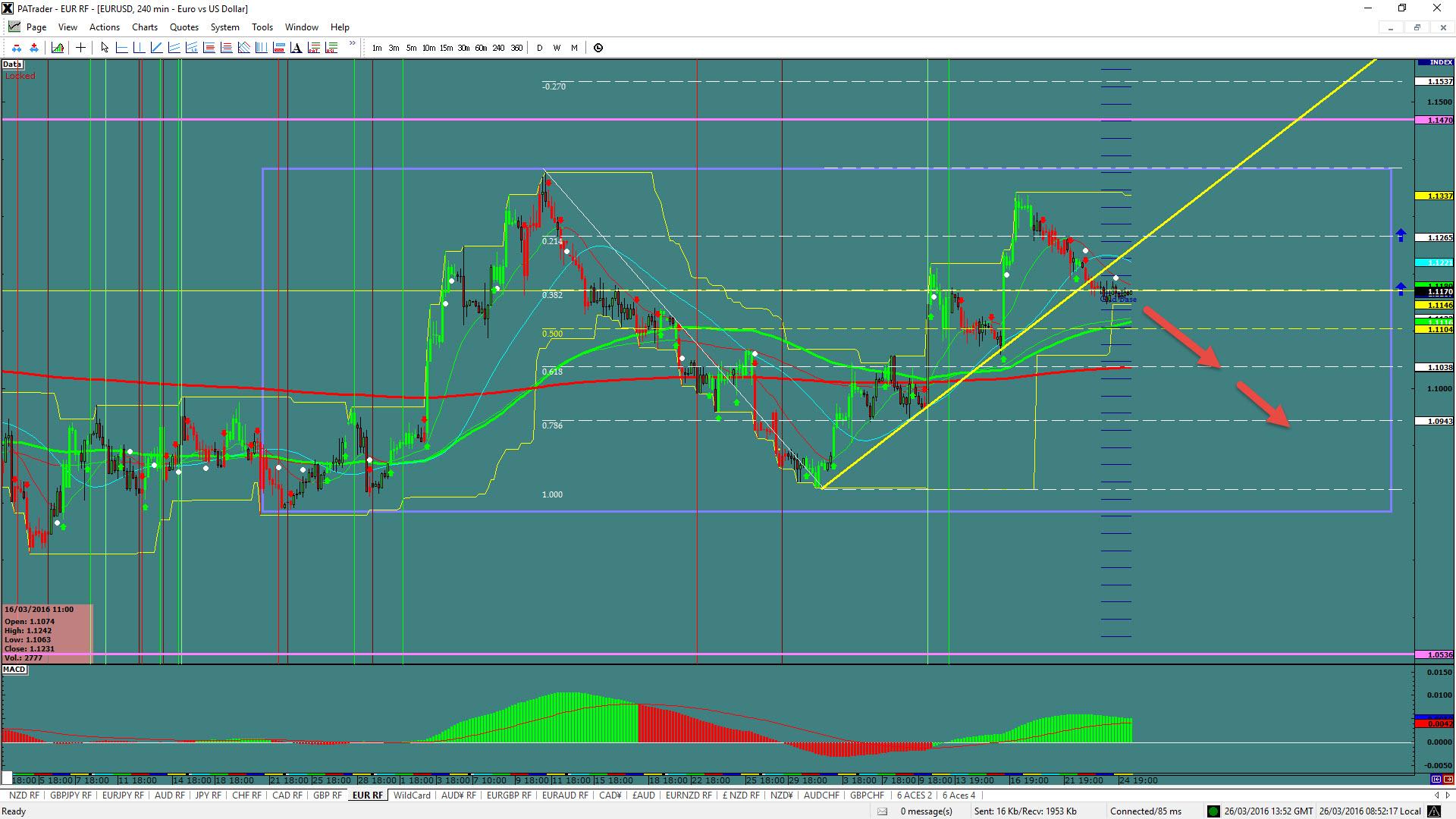

What ProAct Forex Target Traders See: We are currently sitting @ 1.1170 in a large range. We are looking for a continuation move to the 0.786 fibo @ 1.1401 (maybe 1.1470) then reversal and an overall target of the 0.500 Fibo @ 1.0943. The average daily true range (ATR) for the pair currently is 106 pips.

————————————————————————--

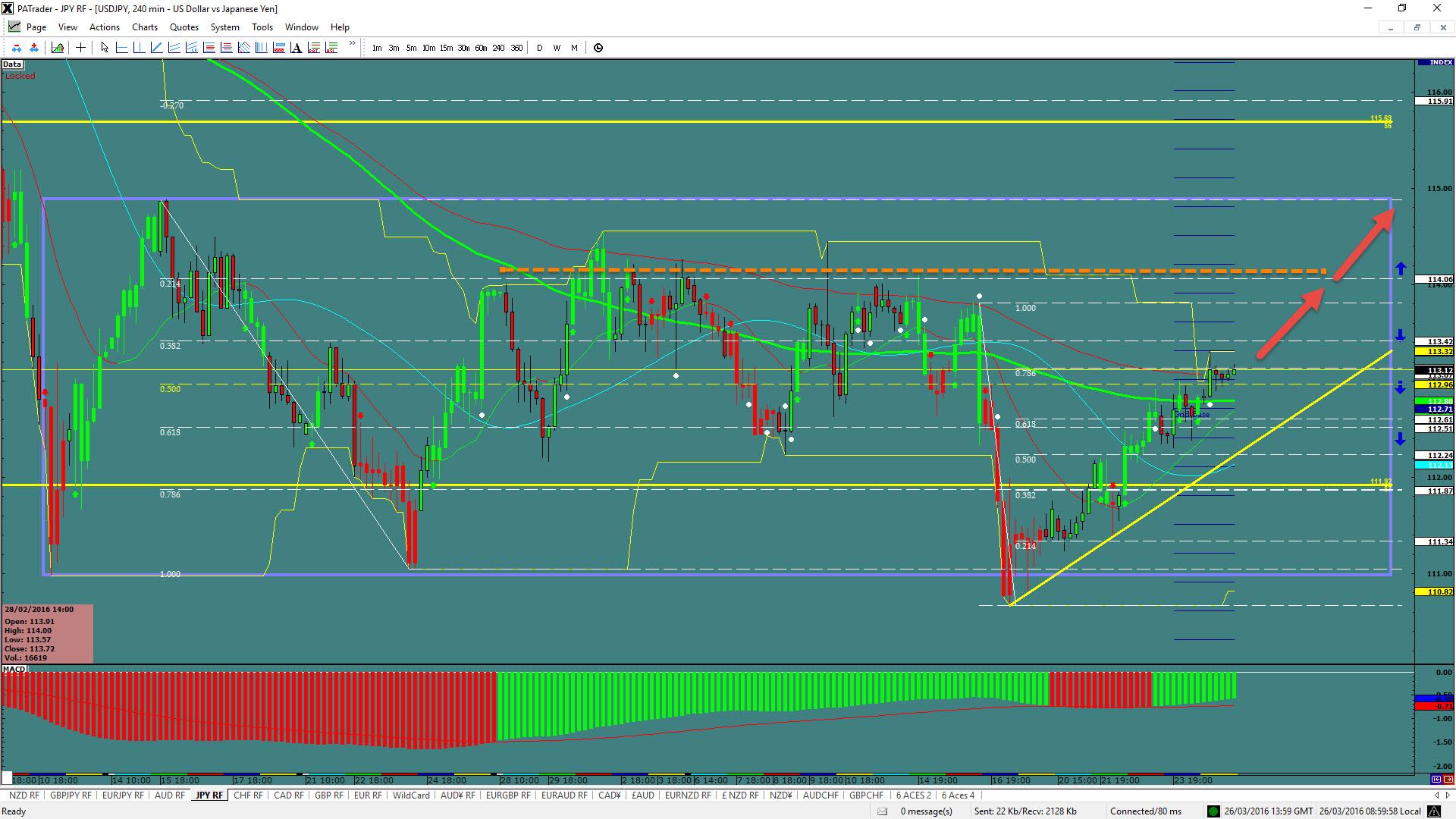

$USDJPY

What ProAct Forex Target Traders See: We are currently @ 113.12. We are ranging and looking for a move first to the strong resistance @ 114.06 and then to the range top @ 115.00 area. The average daily true range (ATR) for the pair currently is 114 pips.

——————————————————————————–

$GBPUSD

What ProAct Forex Target Traders See: Cable is currently @ 1.4140. We are looking for a continuation to the 0.786 Fibo @ 1.3980 then a pullback and resumption to the S6 @ 1.3900. The average daily true range (ATR) for the pair currently is 147 pips.

——————————————————————————–

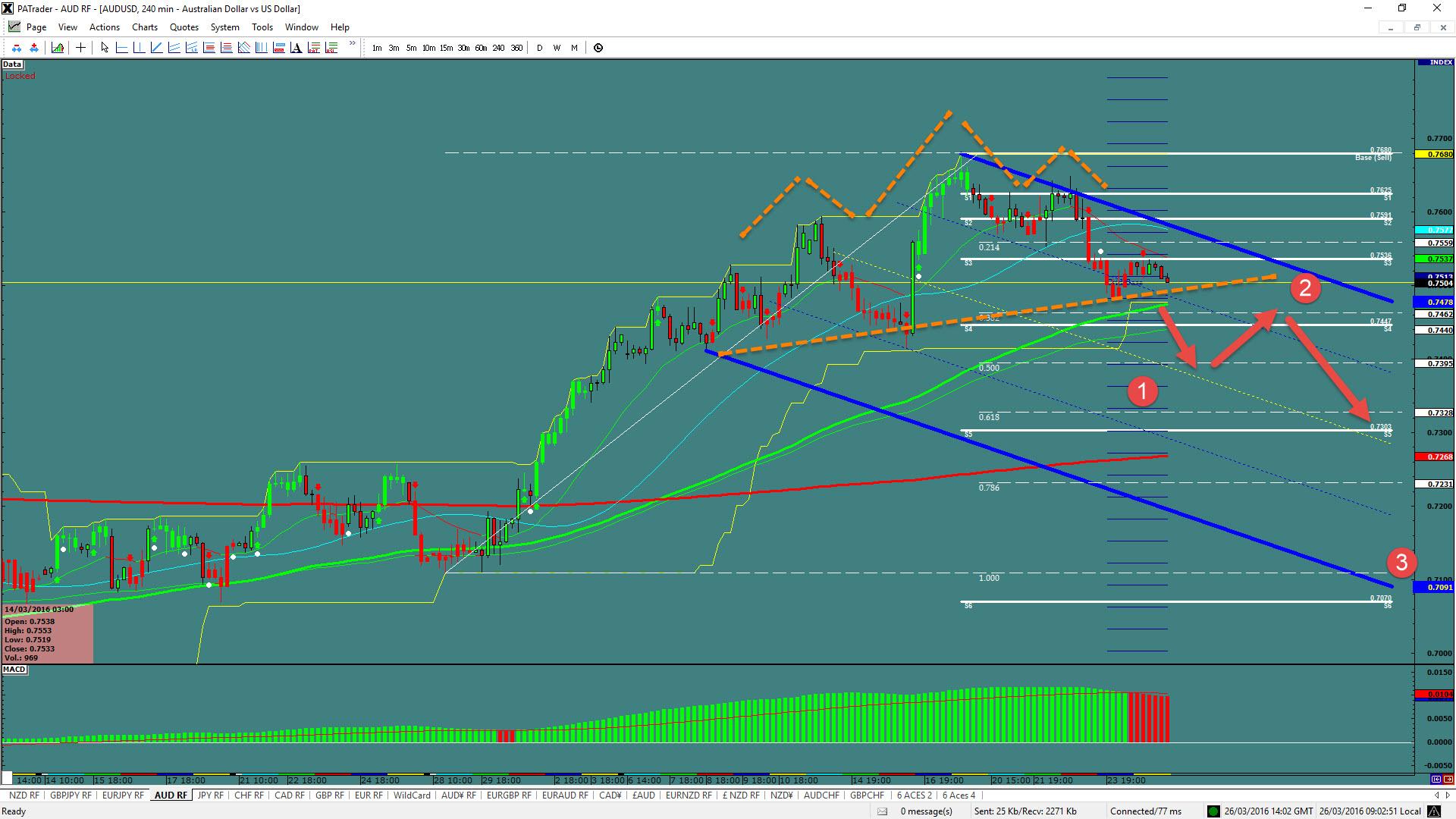

$AUDUSD – A great smooth currency for Newbie’s!

What ProAct Forex Target Traders See: Aussie is @ 0.7504 with a head and shoulders pattern printed. We are looking for a move to the 0.500 Fibo @ 0.7395 then a 2nd wave bounce with the overall target at the 0.618 Fibo/S5 @ 0.7300. The average daily true range (ATR) for the pair currently is 94 pips.

ProAct Traders™ (hereafter, PAT) assumes no responsibility for errors, inaccuracies, or omissions, nor does it warrant the accuracy or completeness of the information in the materials that comprised the text, graphics or other items contained in the ProAct Charts as a result of computer or power failures or interruptions in the electronic delivery systems via the Internet. PAT shall not be liable for any special, indirect, incidental or consequential damages including without limitation losses, lost revenue, or lost profits that may result from these materials.

Foreign Currency Trading carries a level of risk / reward that may not be suitable for all considering participation in the market known as Forex. The Forex is a "zero sum" market and its end effect is that there are an equal number of winners and losers. Consequently, the possibility exists that you could sustain an eventual loss of some or all of you initial investment. Therefore, you should never invest money that you cannot afford to lose. Before deciding to trade the Forex, you should become thoroughly educated in how the market works, have a sound money management plan and then carefully consider your investment objectives, level of experience, and risk appetite. If you have any doubts, seek advice from an independent financial advisor.

Recommended Content

Editors’ Picks

AUD/USD gains ground on hawkish RBA, Nonfarm Payrolls awaited

The Australian Dollar continues its winning streak for the third successive session on Friday. The hawkish sentiment surrounding the Reserve Bank of Australia bolsters the strength of the Aussie Dollar, consequently, underpinning the AUD/USD pair.

USD/JPY: Japanese Yen advances to nearly three-week high against USD ahead of US NFP

The Japanese Yen continues to draw support from speculated government intervention. The post-FOMC USD selling turns out to be another factor weighing on the USD/JPY pair. Investors now look forward to the crucial US NFP report for a fresh directional impetus.

Gold recoils on hawkish Fed moves, unfazed by dropping yields and softer US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s Federal Reserve decision to hold rates unchanged.

Solana price pumps 7% as SOL-based POPCAT hits new ATH

Solana price is the biggest gainer among the crypto top 10, with nearly 10% in gains. The surge is ascribed to the growing popularity of projects launched atop the SOL blockchain, which have overtime posted remarkable success.

NFP: The ultimate litmus test for doves vs. hawks

US Nonfarm Payrolls will undoubtedly be the focal point of upcoming data releases. The estimated figure stands at 241k, notably lower than the robust 303k reported in the previous release and below all other readings recorded this year.