What ProAct Forex Target Traders See: We are currently sitting @ 1.1145 and starting a 3rd wave. Short term of course you can see a potential move down to the 1.1019 but looking to continue to the 0.618 Fibo @ 1.1385 with a continuation to the R7 @ 1.1500. The average daily true range (ATR) for the pair currently is 95 pips.

————————————————————————--

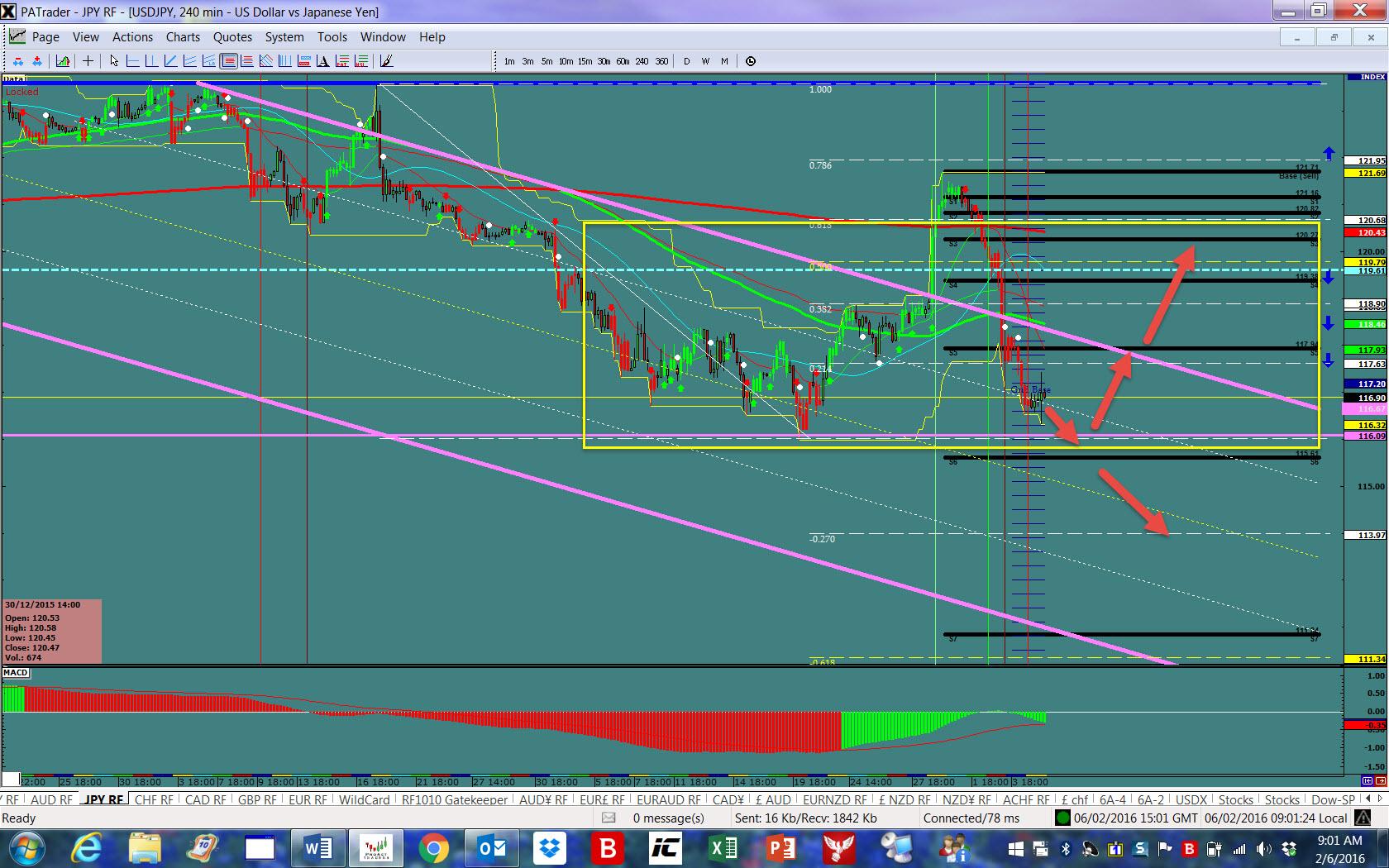

$USDJPY

What ProAct Forex Target Traders See: We are currently @ 116.90. We are looking for a pullback to the S5 and then a decision. Range: look to the 120.43. Trending: move to 113.97. The average daily true range (ATR) for the pair currently is 126 pips.

——————————————————————————–

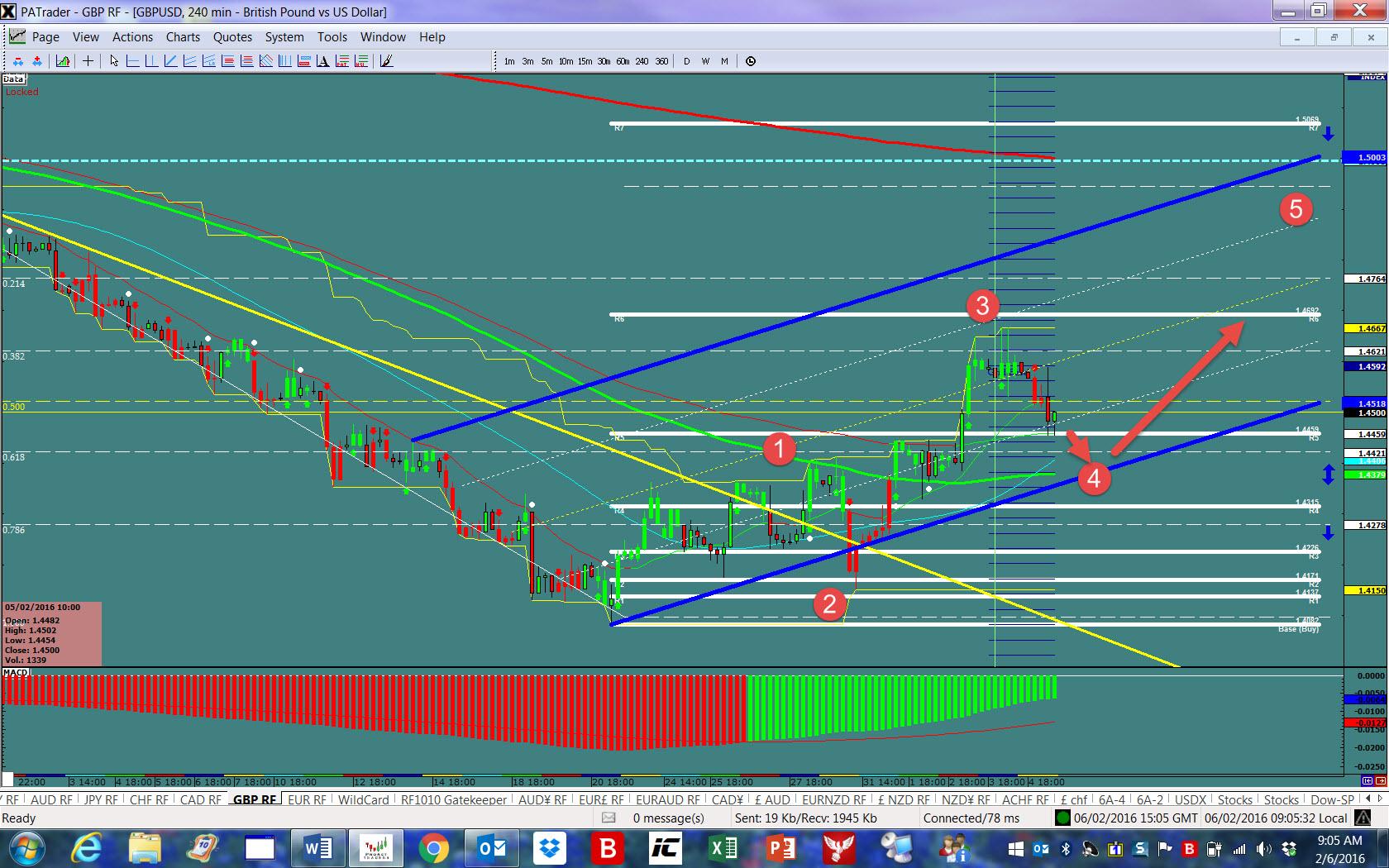

$GBPUSD

What ProAct Forex Target Traders See: Sterling is currently @ 1.4500 and we are looking to finish the correction and then bounce to the R6 @ 1.4692 The average daily true range (ATR) for the pair currently is 148 pips.

——————————————————————————–

$AUDUSD – A great smooth currency for Newbie’s!

What ProAct Forex Target Traders See: Aussie is @ 0.7067 and possibly still in a large range. A couple of different scenarios: 1: Bullish: a move to the square up @ 0.7267 area) and 2: Bearish: A break down to the support @ 0.6816. The average daily true range (ATR) for the pair currently is 95 pips.

ProAct Traders™ (hereafter, PAT) assumes no responsibility for errors, inaccuracies, or omissions, nor does it warrant the accuracy or completeness of the information in the materials that comprised the text, graphics or other items contained in the ProAct Charts as a result of computer or power failures or interruptions in the electronic delivery systems via the Internet. PAT shall not be liable for any special, indirect, incidental or consequential damages including without limitation losses, lost revenue, or lost profits that may result from these materials.

Foreign Currency Trading carries a level of risk / reward that may not be suitable for all considering participation in the market known as Forex. The Forex is a "zero sum" market and its end effect is that there are an equal number of winners and losers. Consequently, the possibility exists that you could sustain an eventual loss of some or all of you initial investment. Therefore, you should never invest money that you cannot afford to lose. Before deciding to trade the Forex, you should become thoroughly educated in how the market works, have a sound money management plan and then carefully consider your investment objectives, level of experience, and risk appetite. If you have any doubts, seek advice from an independent financial advisor.

Recommended Content

Editors’ Picks

EUR/USD holds positive ground above 1.0700, eyes on German CPI data

EUR/USD trades on a stronger note around 1.0710 during the early Monday. The weaker US Dollar below the 106.00 mark provides some support to the major pair. All eyes will be on the Federal Reserve monetary policy meeting on Wednesday, with no change in rate expected.

USD/JPY extends recovery after testing 155.00 on likely Japanese intervention

USD/JPY is recovering ground after crashing to 155.00 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

Gold tests critical daily support line, will it defend?

Gold price is seeing a negative start to a new week on Monday, having booked a weekly loss. Gold price bears the brunt of resurgent US Dollar (USD) demand and a risk-on market mood amid Japanese holiday-thinned market conditions.

XRP plunges to $0.50, wipes out recent gains as Ripple community debates ETHgate impact

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.