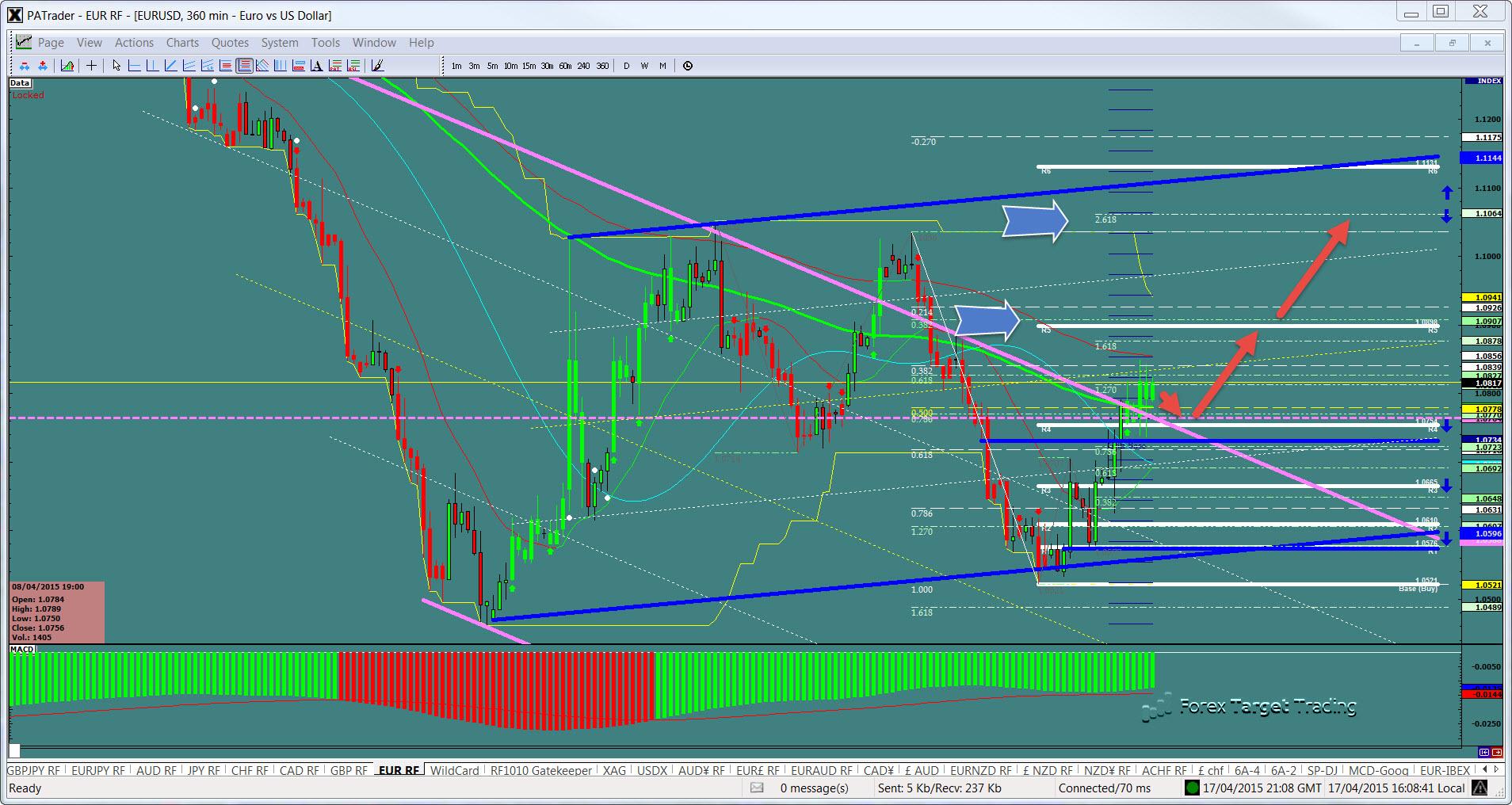

What ProAct Forex Target Traders See: We are currently sitting @ 1.0817 anticipating that this will be a real break out to the upside. We are looking for the upside target initially at the R5 @ 1.0907 and a continuation to the 2.618 Fibo @ 1.0164. The average daily true range (ATR) for the pair currently is 137 pips.

————————————————————————--

$USDJPY

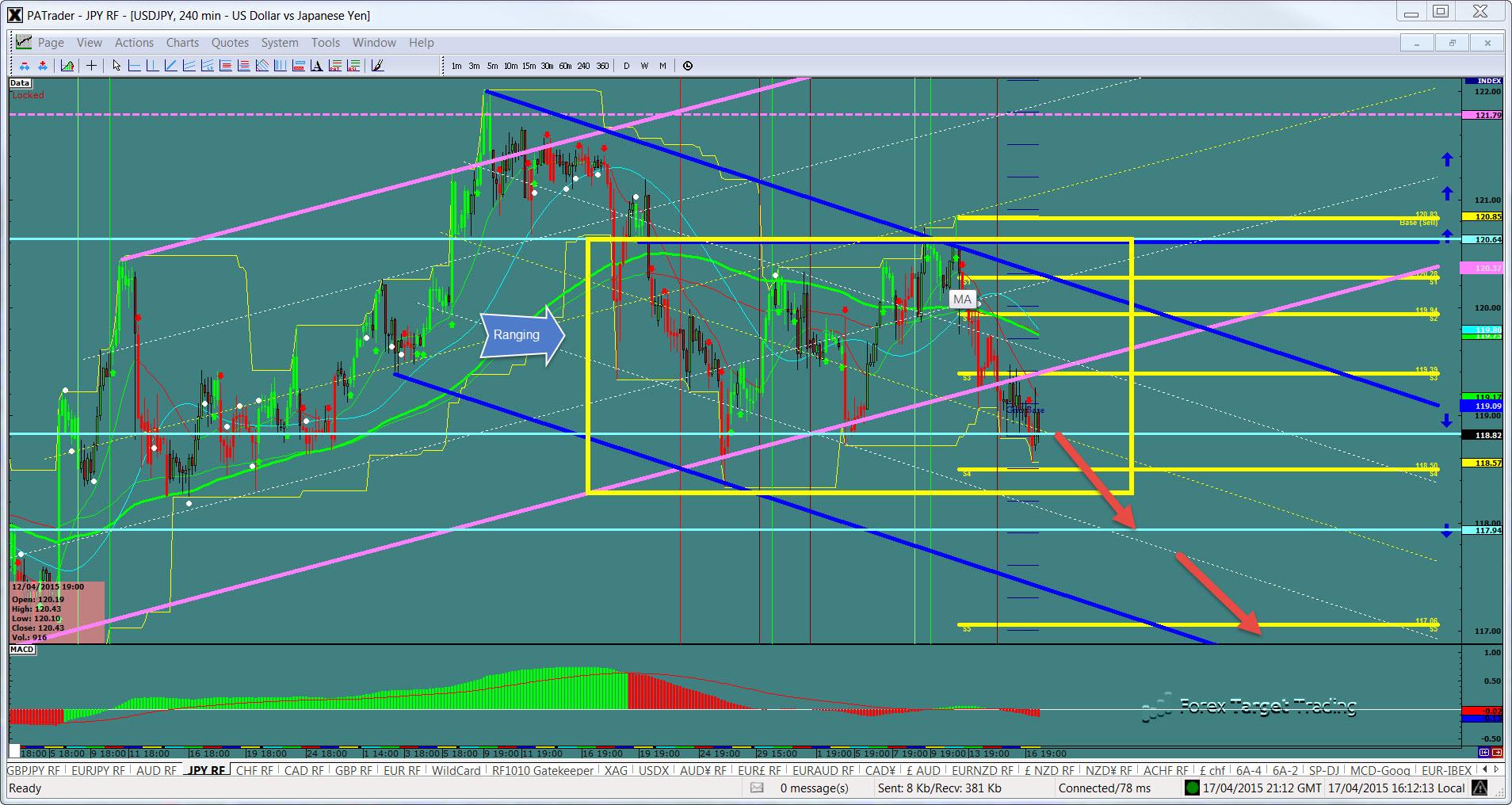

What ProAct Forex Target Traders See: We are currently @ 118.82 in a big downtrend but still ranging. Looking now for a move up to support @ 117.94. If we get that, look to the S5 area @ 117.06. The average daily true range (ATR) for the pair currently is 84 pips

——————————————————————————–

$GBPUSD

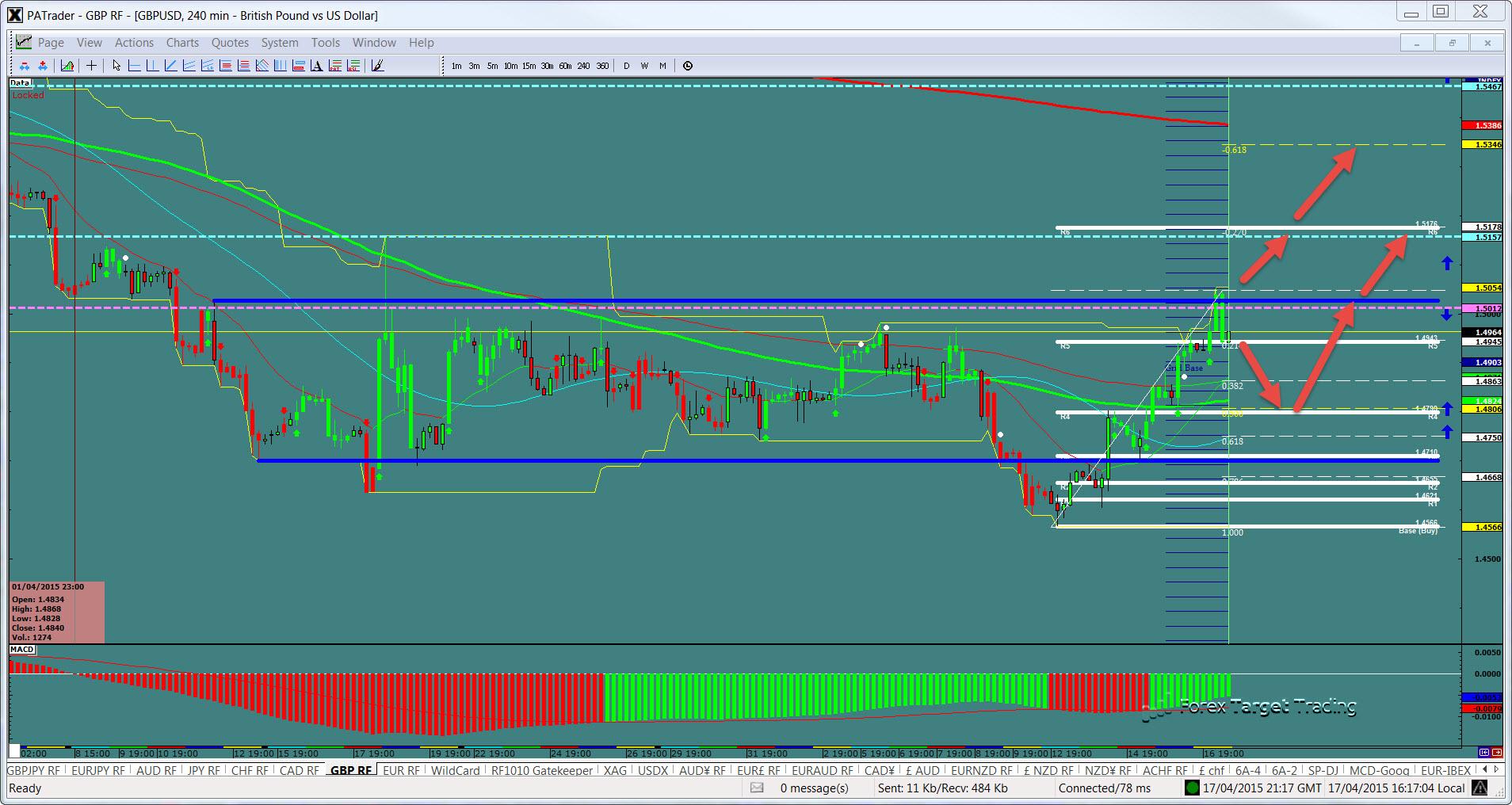

What ProAct Forex Target Traders See: Cable is currently sitting @ 1.4646 and we are still in the range. A couple of different scenarios: 1: Bullish: a move to the R6 @ 1.5178 with a higher target @ 1.5346 area) and 2: Bearish: A break down to the 0.500 Fibo and then a move to the upside. The average daily true range (ATR) for the pair currently is 141 pips.

——————————————————————————–

$AUDUSD – A great smooth currency for Newbie’s!

What ProAct Forex Target Traders See: Aussie is @ 0.7781 at a trend top. We are waiting to see if this trend will hold for a move down. A couple of different scenarios: 1: Bullish: a move to the R5 @ 0.7930 area) and 2: Bearish: A break down to the square up @ 0.7610 which would mean it is still in a range. The average daily true range (ATR) for the pair currently is 101 pips.

Recommended Content

Editors’ Picks

EUR/USD holds positive ground above 1.0700, eyes on German CPI data

EUR/USD trades on a stronger note around 1.0710 during the early Monday. The weaker US Dollar below the 106.00 mark provides some support to the major pair. All eyes will be on the Federal Reserve monetary policy meeting on Wednesday, with no change in rate expected.

USD/JPY crashes nearly 450 pips to 155.50 on likely Japanese intervention

Having briefly recaptured 160.00, USD/JPY came under intense selling to test 155.00 on what seems like a Japanese FX intervention underway. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

Gold tests critical daily support line, will it defend?

Gold price is seeing a negative start to a new week on Monday, having booked a weekly loss. Gold price bears the brunt of resurgent US Dollar (USD) demand and a risk-on market mood amid Japanese holiday-thinned market conditions.

XRP plunges to $0.50, wipes out recent gains as Ripple community debates ETHgate impact

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.