A snapshot view of last week's money flow and technical notes for the week ahead.

KEY EVENTS THIS WEEK:

AUD: Retail Sales; Building Approvals; Trade Balance

CAD: GDP; Trade Balance

CNY: Final PMI; Manufacturing PMI

EUR: GER PMI; EUR Flash Estimate; Minimum Bid Rate; ECB Press Conference

GBP: Current Account; Manufacturing PMI; Construction PMI; Services PMI

JPY: Retail Sales; Tenkan Non/Manufacturing

NZD: Business Confidence; GDT Price Index

USD: Core PCR; Consumer Confidnce; ISM Manufacturing; Trade Balance; Nonfarm Payroll

FOREX:

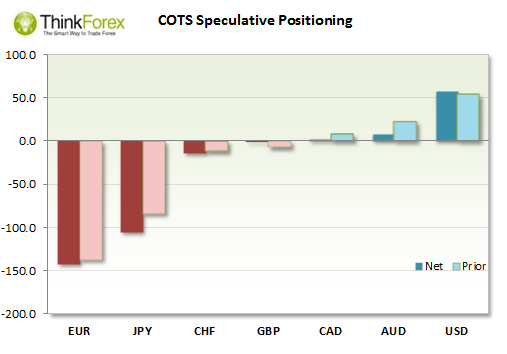

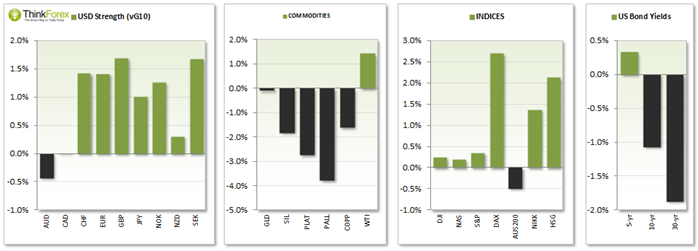

US Dollar

Continues to see heavy inflows with Net Longs at their highest levels on record. With NFP this Friday a decent jobs figure will be required to keep this many bulls happy.

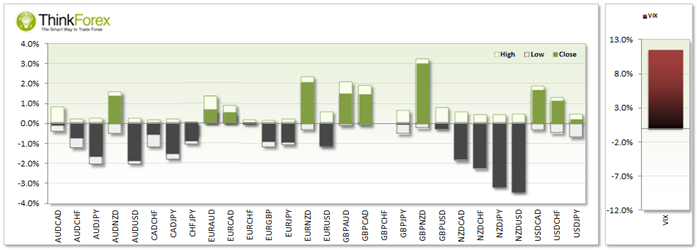

USDCAD reached 1.16 target and continues to favour buy-the-dip strategies

USDJPY Spinning Top on W1 warns of sideways trading/correction. D1 has Bullish Engulfing

USDCNH building bullish momentum above support and suspect swing low is forming on D1

Australian Dollar

Further reduction of Net longs and now very close to becoming Net Short for the first time since April '14. AUD futures bearish move has been confirmed by steady volume, to suggest no threat to the trend.

AUDJPY is resting on bullish trendline form Feb '14 lows; Bears eyeing the break below

AUDUSD targeting 0.866 with resistance at 0.82 and 0.88

Kiwi Dollar

Continued to unwind with increasing momentum following comments from RBNZ and the Kiwi Dollar being "unsustainably high'. Breaking below key support levels across all majors the week starts off with a continued bearish sentiment, with traders likely to sell into any rallies.

British Pound

Saw a slight reduction of Net Short positions following the NO vote for Scotland and continued expectations off BoE to raise interest rates.

GBPAUD is on track to reach 2AUD within a few weeks,

GBPCHF on cusp of breaking to its highest since July 2012 to confirm a Double Bottom on W1

GBPNZD breaking to

GBPJPY targets are 184, 192 per coming weeks; D1 amid correction with support at 176, 175

EURGBP targeting 0.775 (July '12 lows)

GBPNZD broke to 2.5yr highs and formed an inverted H&S on W1

GBPUSD remains within 'referendum range' awaiting a directional catalyst for W1

Euro

Net Shorts continue to dominate with many questioning when the short-side will become overcrowded and end with the inevitable sharp reversal. For now however we have to assume trend continuation and not try to bottom pick with such bearish momentum.

EURUSD printed 2-year lows suffering heaviest weekly loss since Jan '13

EURJPY building potential base above 138.30 support

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

AUD/USD gains momentum above 0.6500 ahead of Australian Retail Sales data

AUD/USD trades in positive territory for six consecutive days around 0.6535 during the early Asian session on Monday. The upward momentum of the pair is bolstered by the hawkish stance from the Reserve Bank of Australia after the recent release of Consumer Price Index inflation data last week.

EUR/USD: Federal Reserve and Nonfarm Payrolls spell action this week

The EUR/USD pair temporarily reconquered the 1.0700 threshold last week, settling at around that round level. The US Dollar lost its appeal following discouraging United States macroeconomic data indicating tepid growth and persistent inflationary pressures.

Gold trades on a softer note below $2,350 on hotter-than-expected US inflation data

Gold price trades on a softer note near $2,335 on Monday during the early Asian session. The recent US economic data showed that US inflationary pressures staying firm, which has added further to market doubts about near-term US Federal Reserve rate cuts.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.