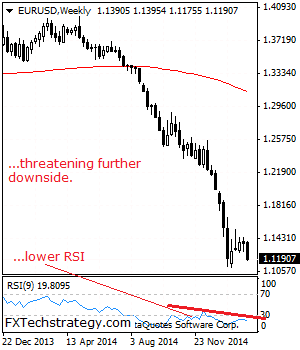

EURUSD: Risk Builds On 1.1096 Level

EURUSD: With EUR breaking down out of its consolidation range to close lower the past week, risk now builds on its key support located at 1.1096 level. We expect that level to give in for the pair resume its broader downside pressure. However, this might not happen first test. Support is seen at 1.1100 level with a cut through here opening the door for more downside towards the 1.1050 level. Further down, support lies at the 1.1000 level where a break will expose the 1.0950 level. Its daily RSI is bearish and pointing lower supporting this view. On the upside, resistance lies at the 1.1250 level where a violation will aim at the 1.1300 level. A break of here will aim at the 1.1400 level, its psycho level with a turn below that level targeting the 1.1450 level. Further out, resistance comes in at the 1.1500 level. All in all, EUR remains biased to the downside in the medium term with eyes on key support.

USDCHF: Strengthening With Warning

USDCHF: With USDCHF closing higher the past week, further bullishness is envisaged though with caution. Resistance resides at the 0.9600 level. Further out, resistance resides at the 0.9650 level. A breather may occur here and turn the pair lower but if taken out, expect a push higher towards the 0.9700 level. Its weekly RSI is bullish and pointing higher supporting this view. On the downside, support comes in at the 0.9450 level. A turn below here will open the door for more weakness to occur towards the 0.9400 level and then the 0.9350 level. All in all, the pair remains biased to the upside in the short term.

This report is prepared solely for information and data purposes. Opinions, estimates and projections contained herein are those of FXTechstrategy.com own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed to be reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness and neither the information nor the forecast shall be taken as a representation for which FXTechstrategy.com incurs any responsibility. FXTstrategy.com does not accept any liability whatsoever for any loss arising from any use of this report or its contents. This report is not construed as an offer to sell or solicitation of any offer to buy any of the currencies referred to in this report.

Recommended Content

Editors’ Picks

EUR/USD remains above 1.0700 amid expectations of Fed refraining from further rate hikes

EUR/USD continues to gain ground on Thursday as the prevailing positive sentiment in the market provides support for risk-sensitive currencies like the Euro. This improved risk appetite could be attributed to dovish remarks from Federal Reserve Chairman Jerome Powell on Wednesday.

GBP/USD gains traction above 1.2500, Fed keeps rates steady

GBP/USD gains traction near 1.2535 during the early Thursday. The uptick of the major pair is supported by the sharp decline of the US Dollar after the US Federal Reserve left its interest rate unchanged.

Gold price struggles for a firm intraday direction, hover above $2,300

Gold price fails to lure buyers amid a fresh leg up in the US bond yields, modest USD uptick. A positive risk tone also contributes to capping the upside for the safe-haven precious metal. Traders, however, might prefer to wait for the US NFP report before placing aggressive bets.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Fed meeting: The hawkish pivot that never was, and the massive surge in the Yen

The Fed’s latest meeting is over, and the tone was more dovish than expected, but that is because the rate hike hype in the US was over-egged, and rate cut hopes had been pared back too far in recent weeks.