EURUSD: Despite its marginal close higher at the end of the week, it continues to face further downside.

Support lies at the 1.3500 level where a break will expose the 1.3450 level. Below here will pave the way for a move lower towards the 1.3400 level. If this continues, expect further downside to occur towards the 1.3350 level. On the downside, On the upside, resistance lies at the 1.3700 level, its psycho level followed by the 1.3750 level. Further out, resistance comes in at the 1.3800 level followed by the 1.3850 level. All in all, EUR remains biased to the downside in the short term.

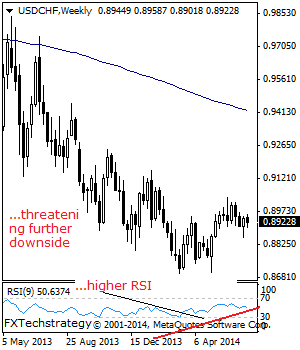

USDCHF: Consolidates, Corrective Risk Seen

USDCHF: Although USDCHF failed to follow through on the back of its previous week gains, its recovery risk remains. On the downside, support lies at the 0.8855 level. A cut through here will target the 0.8800 level where a violation will open the door for more weakness towards the 0.9742 level. A turn below here will set the stage for a run at the 0.8700 level. On the upside, resistance resides at the 0.8950 level where a break will aim at the 0.9000 level where a break will retarget the 0.9050 level. A breather may occur here and turn the pair lower but if broken it will aim at the 0.9100 level. All in all, the pair remains biased to the upside on recovery.

This report is prepared solely for information and data purposes. Opinions, estimates and projections contained herein are those of FXTechstrategy.com own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed to be reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness and neither the information nor the forecast shall be taken as a representation for which FXTechstrategy.com incurs any responsibility. FXTstrategy.com does not accept any liability whatsoever for any loss arising from any use of this report or its contents. This report is not construed as an offer to sell or solicitation of any offer to buy any of the currencies referred to in this report.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of US jobs report

EUR/USD stays in a consolidation phase above 1.0700 after closing the previous two days in positive territory. Investors eagerly await April jobs report from the US, which will include Nonfarm Payrolls and Unemployment Rate readings.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2550 amid the softer US Dollar on Friday. Market participants refrain from taking large positions as focus shifts to April Nonfarm Payrolls and ISM Services PMI data from the US.

Gold remains stuck near $2,300 ahead of US NFP

Gold price struggles to gain any meaningful traction and trades in a tight channel near $2,300. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support to XAU/USD ahead of the key US NFP data.

XRP edges up after week-long decline as Ripple files letter in reply to SEC’s motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.