This week we present two strategies: sell EUR/USD and buy USD/RUB.

EUR/USD – 2 year rising wedge break weakens the outlook further

Summary – Sell into any short-term rallies for weakness to 1.3249 and then 1.3020. Place a stop above 1.3701.

EUR/USD has broken down through a two year trendline to complete a major rising wedge pattern. This follows earlier negative signals from a 1.3967/1.3995 double top and a shorter timed framed rising wedge. 90 and 50 day moving averages have also crossed lower to support/confirm the negative structure. Below the 3 Feb 2014 low at 1.3477 is now also seeing the market register fresh year-to-date lows.

Momentum has clearly turned lower and the loss of 1.3477 has shifted the immediate focus onto 1.3399, the 21 November 2013 reaction low. A further loss here will then sight 1.3295, the 7 November 2013 spike low, ahead of 1.3249, the 38.2% retracement level of the major 1.2042 to 1.3995 rise. Further out, 1.3105 and 1.3020, the 6 September 2013 low and 50% retracement point, are also likely to be tested.

Above, 1.3549 provides a lower ceiling that should cap any immediate rallies. However, to shift the longer-term focus higher again the early July lower top at 1.3701 must be breached.

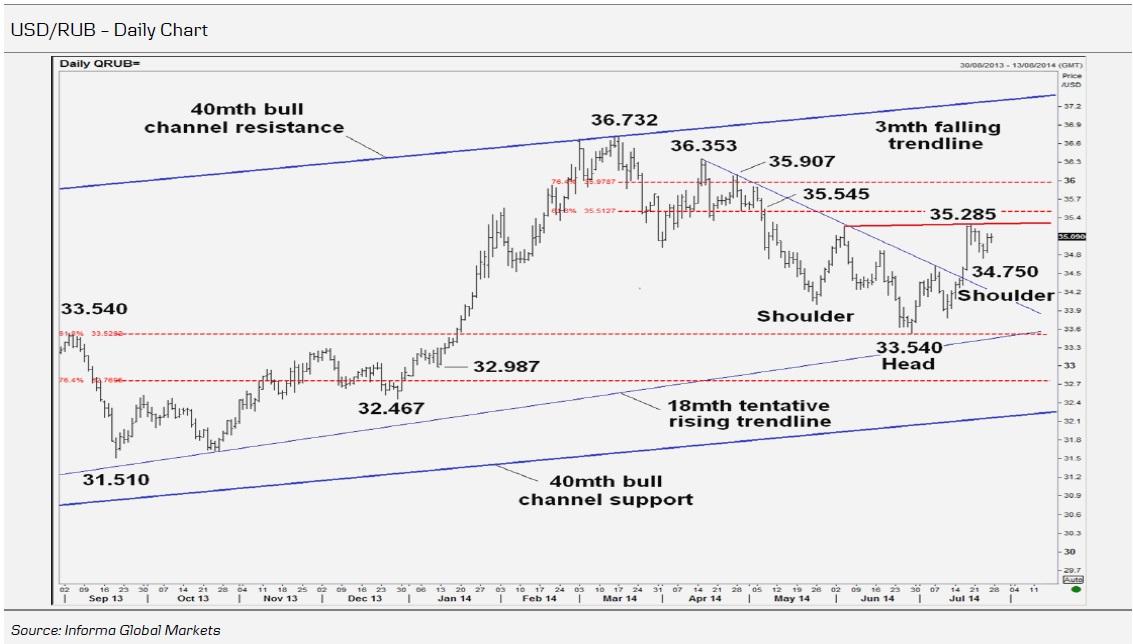

USD/RUB – A clearance of 35.285 completes a higher base/opens 35.907

Strategy Summary – Look to buy into near-term weakness for an extension of the lterm uptrend through 35.285 targeting 35.907 then 36.732. Place stops below a former broken 3mth falling trendline now at 34.134.Corrected from 36.732 (17 March record high, also 40mth bull channel top) to 33.540 (27 June low, also 3 September 2013 high and near 61.8% of 31.510/36.732) before bouncing. A multi-tested three month falling trendline was breached in mid July and the market has since extended to reach 35.285 (18 July high, nr 50% retracement of 36.732/33.540), before ranging. Daily/weekly and monthly studies (not shown) are all building in confirmation of the l-term uptrend resumption and a sustained clearance of 35.285 would complete a potential 2-1/2mth inverted head and shoulders base formation over the key 33.540 low and project an initial advance to 35.545 (7 May high/ 61.8% retrace) then 35.907 (2 May high/nr 76.4% retrace). Beyond would re-open 36.353 (15 April lower high), which protects the 36.732 record high.

It would take a return through the former multi tested 3mth falling trendline at 34.134 (nr 61.8% retrace of the 33.540/35.285) to compromise thoughts of an inverted head and shoulders base and re-open very significant support at 33.540 (also nr an 18mth rising trendline). Below negates upside scope and risks 32.987 (10 January higher low), possibly 32.742 (76.4% retrace of 31.510/36.732).

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

AUD/USD dips below 0.6600 following RBA’s decision

The Australian Dollar registered losses of around 0.42% against the US Dollar on Tuesday, following the RBA's monetary policy decision to keep rates unchanged. However, it was perceived as a dovish decision. As Wednesday's Asian session began, the AUD/USD trades near 0.6591.

EUR/USD lacks momentum, churns near 1.0750

EUR/USD cycled familiar levels again on Tuesday, testing the waters near 1.0750 as broader markets look for signals to push in either direction. Risk appetite was crimped on Tuesday after Fedspeak from key US Federal Reserve officials threw caution on hopes for approaching rate cuts from the Fed.

Gold wanes as US Dollar soars, unfazed by lower US yields

Gold price slipped during the North American session, dropping around 0.4% amid a strong US Dollar and falling US Treasury bond yields. A scarce economic docket in the United States would keep investors focused on Federal Reserve officials during the week after last Friday’s US employment report.

Bitcoin price coils up for 20% climb, Standard Chartered forecasts more gains for BTC

Bitcoin (BTC) price remains devoid of directional bias, trading sideways as part of a horizontal chop. However, this may be short-lived as BTC price action consolidates in a bullish reversal pattern on the one-day time frame.

Living vicariously through rate cut expectations

U.S. stock indexes made gains on Tuesday as concerns about an overheating U.S. economy ease, particularly with incoming economic reports showing data surprises at their most negative levels since February of last year.