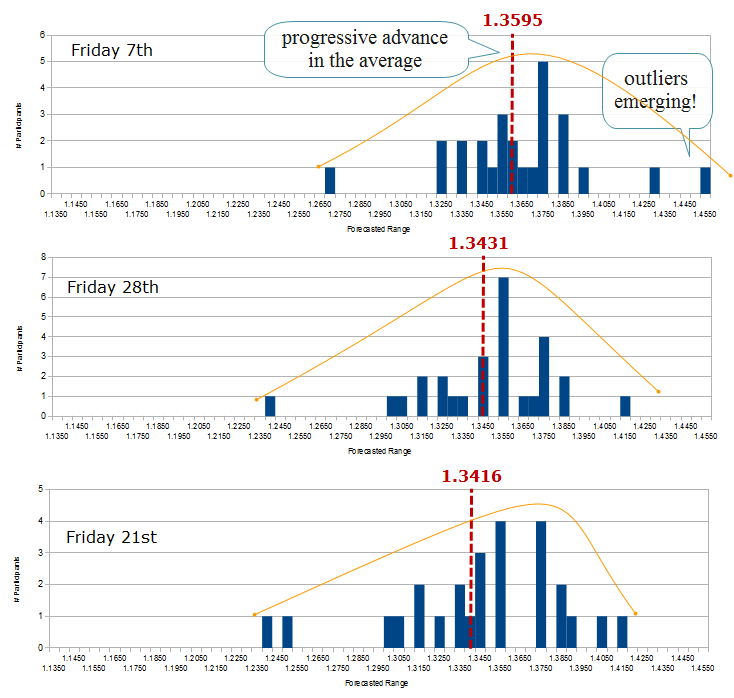

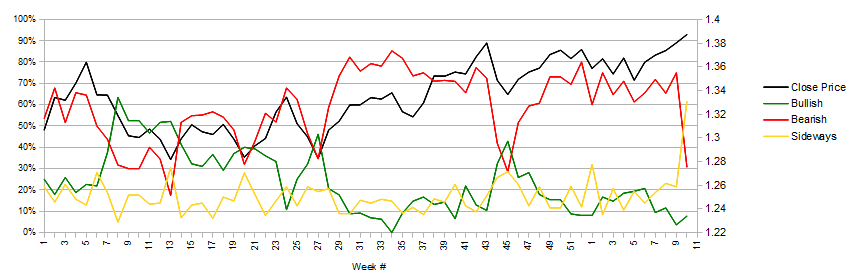

On Friday, the euro hit 1,3913 and with the NFP-induced thrust the exchange rate was carried into new high ground, allowing it to flirt with the 27th December spike high. Usually burdened by tremendous negativity, the euro now enjoys a more elevated mood judging by the several consecutive weeks of rising forecasts in the FXStreet sentiment poll.

The consecutive higher weekly close prices had surely a brightening impact on the traders' expectations and contributed to the decreased number of bearish views across the three time horizons (1-week, 1-month, 1-quarter). But what stands out to be the most noticeable change is the low percentage of these bearish forecasts (40%) compared to the previous week (75%). Such a plunge in 1-quarter forecasts is the missing piece to an already lopsided market sentiment in the shorter time horizons, and as often happens when the market gets too bullish or too bearish, conditions become ripe for a reversal.

What does it mean for traders? Traders had already become more bullish in the shorter time horizons, but no so in the long-term. The fact that we finally saw a sentiment shift in the long-term forecasts which remained muted for so long in the context of a continued EUR out performance against a plethora of other currencies may present some decent opportunities to trade wide price swings in the next two weeks.

Note: The Weekly Sentiment Report provides a breakdown of the data published in the Currencies Forecast Poll through the use of descriptive statistics. The Currencies Forecast Poll is published every Friday at 17:00 Central European Time by FXStreet and aggregates the forecasted values from individuals and companies that were reported from Wednesday to Friday of the same week.The data represents what direction members feel the market will be in the next week, one month and three months.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD hold comfortably above 1.0750 as USD recovery loses steam

EUR/USD clings to small daily gains above 1.0750 in the early American session on Monday. In the absence of high-tier data releases, the US Dollar finds it difficult to gather recovery momentum and helps the pair hold its ground.

GBP/USD struggles to find direction, holds near 1.2550

GBP/USD stays under modest bearish pressure and trades near 1.2550 on Tuesday. The neutral risk mood, as reflected by the mixed action seen in US stocks, doesn't allow the pair to make a decisive move in either direction. The Bank of England will announce policy decisions on Thursday.

Gold rebounds to $2,320 as US yields edge lower

After falling to $2,310 in the early European session, Gold recovered to the $2,310 area in the second half of the day. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.5% and helps XAU/USD find support.

Ripple lawsuit develops with SEC reply under seal, XRP holders await public redacted versions

Ripple lawsuit’s latest development is SEC filing, under seal. The regulator has filed its reply brief and supporting exhibits and the documents will be made public on Wednesday, May 8.

The impact of economic indicators and global dynamics on the US Dollar

Recent labor market data suggest a cooling economy. The disappointing job creation and rising unemployment hint at a slackening demand for labor, which, coupled with subdued wage growth, could signal a slower economic trajectory.