EURUSD – Pennant Price Pattern

Last week the price of EURUSD has tried to break the resistance are from 1.1000 several times. On Thursday, when the volatility was at its highest point EURUSD bounced once more from the resistance area, retested the support from 1.0830. During the ECB’s press conference the price bounced from 1.0830 and had an incredible rally, hitting a high at 1.1217.

Currently the price of EURUSD has drawn a Pennant. In most of the cases, this patterns signals a continuation of the previous move. In this situation a break above the upper line of the price pattern would signal another rally, most probably above the current highs,targeting the next important resistance from 1.1400. On the other hand, a drop below 1.1000 would be a strong bearish signal. In this second scenario I will be expecting the Euro to lose against the greenback at least 100 more pips.

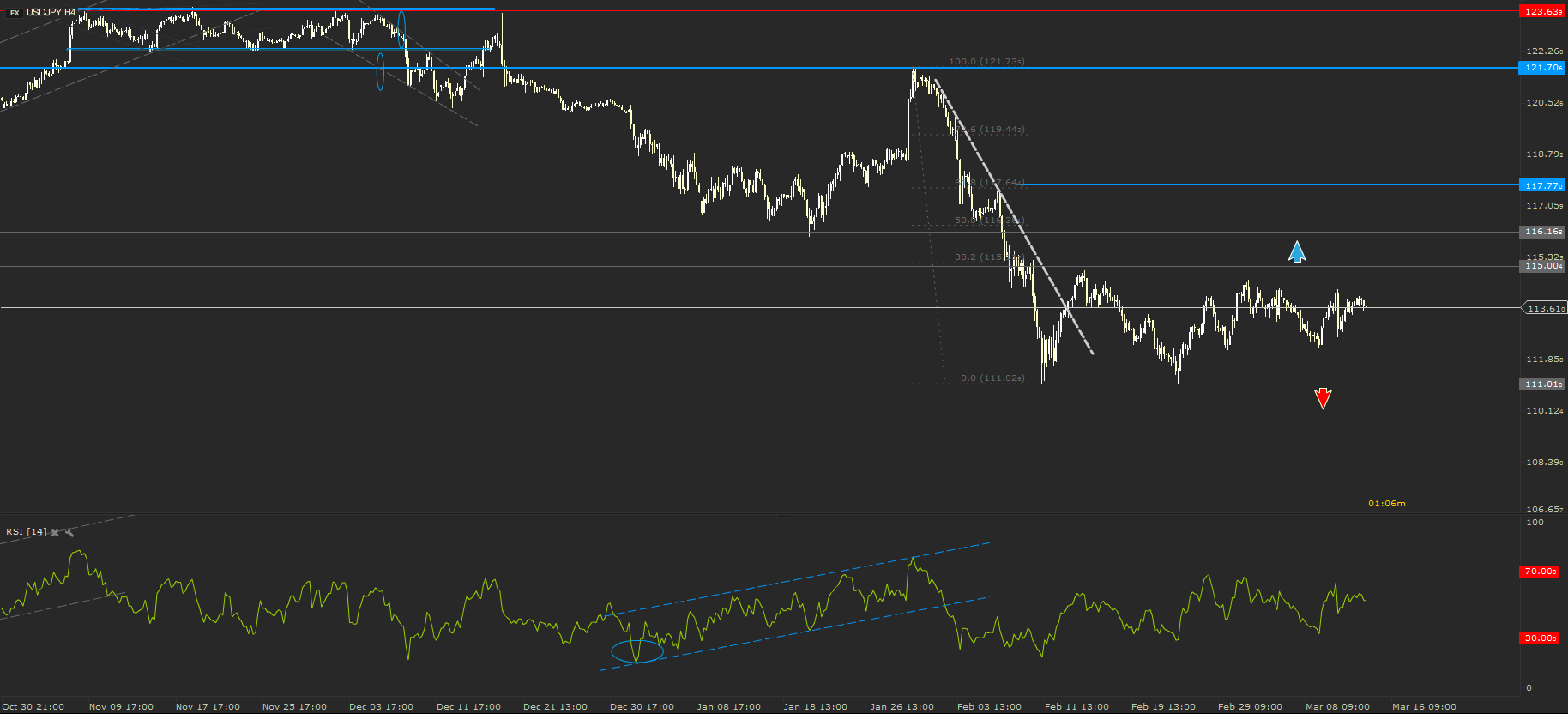

USDJPY – Continues Sideways

Seems like investors doesn’t really care about USDJPY this month. Half of March already gone and the price of this currency pair did not exit the range with the limits set in February between 115.00 (resistance) and 111.00 (support.)

I am keeping an eye on this pair for a breakout. My favorite scenario in this situation would a break below the support.

NZDUSD – Stronger Bearish Signals

Last week I was expecting the NZDUSD to be rejected once more from 0.6746 support area. Expectations met, the price got back to the resistance to bounce back towards the support. In the first half of last week the support was broken and the price fell to the trend line. In the second part of the week, the price got back to retest the resistance area (ex-support 0.6746).

This week started with a plunge of the kiwi. NZDUSD currently trading below 0.6700. I am expecting the price to retest the trend line and maybe to break it. I would consider a close on a four hour time frame under the trend line, a strong bearish signal. In this scenario I will be expecting the price to get back to the key level support from 0.6558.I would believe in a comeback of the NZD only if the price will break again above 0.6750.

Risk Warning: Financial Derivative Instruments are complex instruments and leveraged products that involve a high level of risk which can result in high losses, including the risk of losing the entire capital invested by the Client. Such instruments might not be suitable for all Clients. The Client should not engage in transactions with such Financial Instruments unless he/she understands and accepts the risks involved by trading Financial Instruments, taking into account his/her investment objectives and level of experience. Forex Rally warns that the information published on this website shall not be considered as a recommendation to buy/sell/keep a certain financial instrument and that past performance of Financial Instruments is not a reliable indicator of future performances.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0750 to start the week

EUR/USD trades in positive territory above 1.0750 in the European session on Monday. The US Dollar struggles to find demand following Friday's disappointing labor market data and helps the pair hold its ground.

GBP/USD clings to small gains above 1.2550

Following Friday's volatile action, GBP/USD edges highs and trades in the green above 1.2550. Soft April jobs report from the US and the modest improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold price rebounds on downbeat NFP data, eyes on Fedspeak

Gold price (XAU/USD) snaps the two-day losing streak during the European session on Monday. The weaker-than-expected US employment reports have boosted the odds of a September rate cut from the US Fed.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.