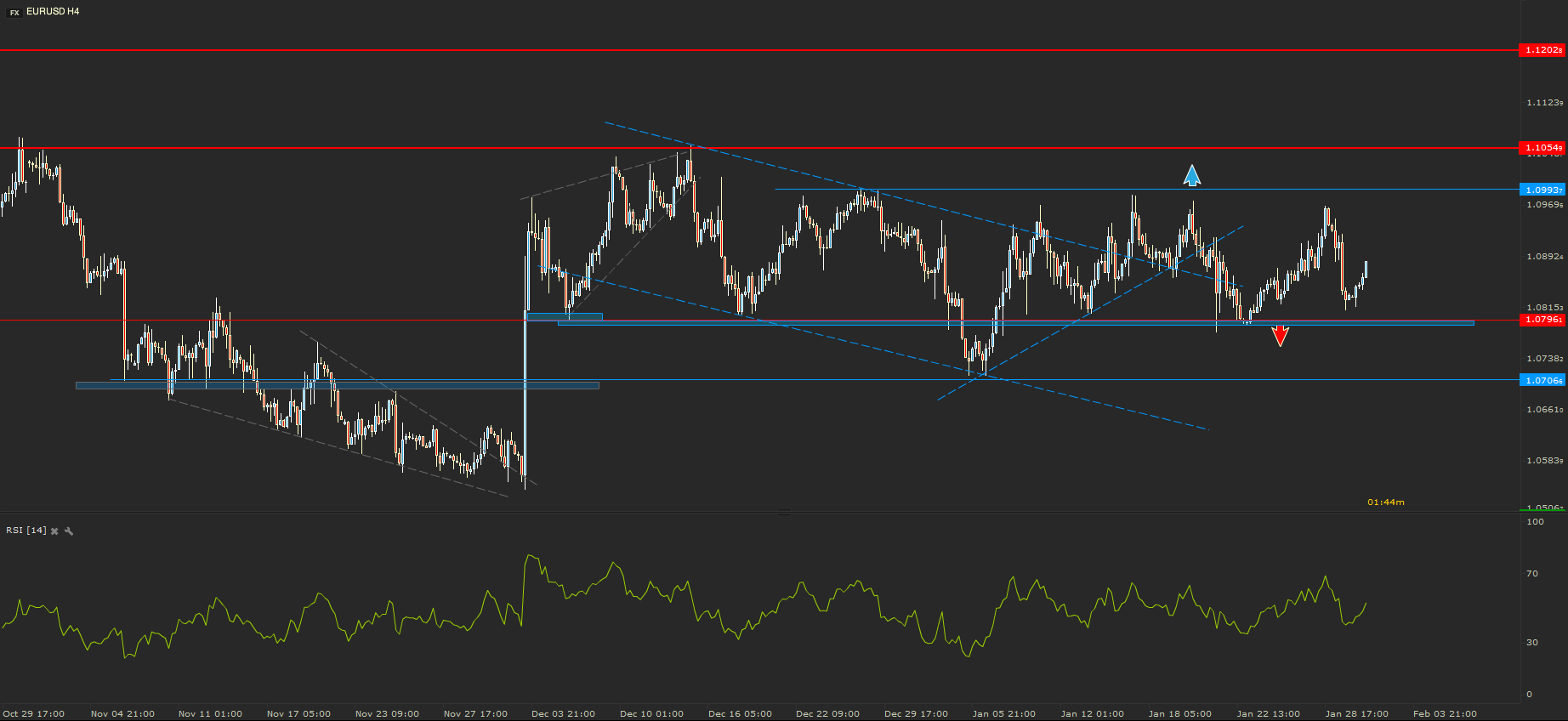

EURUSD - Continuing the sideways

From the beginning of this year the price of EURUSD has been trading between two strong boundaries. The resistance is found at 1.0993, while the support is found at 1.0796. Nothing up until today manage to get the price out of this range.

Giving the current price action, a strong signal for future movement I would consider to be a break out of this sideways move. A break below the support would signal a drop back towards 1.0700, while a break above 1.0993 could signal a rally to wards 1.1055.

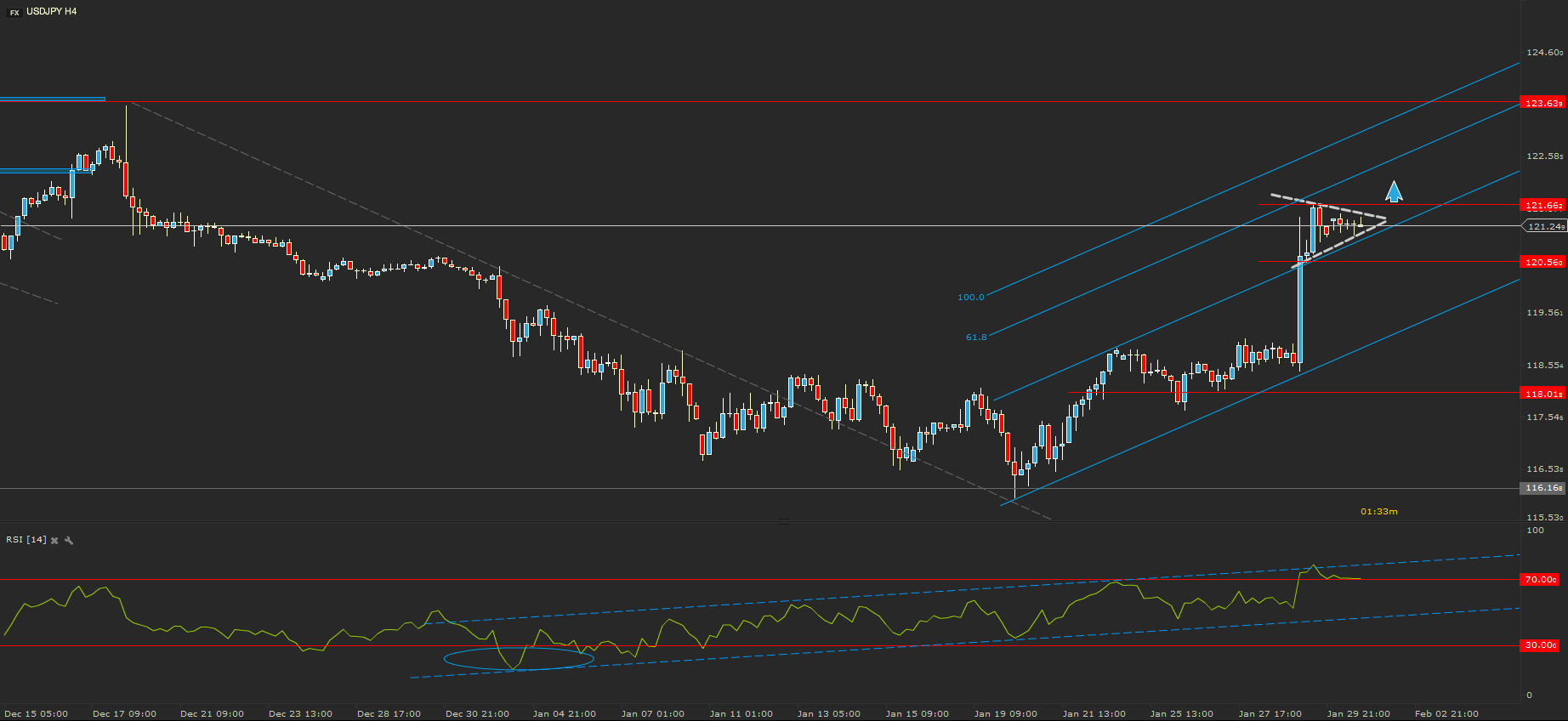

USDJPY - Pennant

Bouncing off the key support level was signaled by the positive divergence drawn on the 14 periods RSI. The price of USDJPY continues to rally based on the fundamentals. The up move stopped at 121.66 for the moment and the corrective moment seems to be a Pennant.

The Pennant is a continuation price pattern. Usually these kind of patterns, signals the continuation of the previous move. In this case a break above 121.66 would be considered a strong positive signal. While a drop below 120.56 would signal a drop back towards 119.50.

NZDUSD - Playing Boring

The price of NZDUSD has broken the inferior line of the Rising Wedge. But the drop did not even manage to hit the support from 0.6383. The price action of this pair has drawn a range between the mentioned support and the resistance from 0.6545.

In the current conditions, a break below the local support from 0.6424 would signal a drop back towards 0.6383, while a break above the resistance would signal a rally towards the key resistance level of 0.6600

Risk Warning: Financial Derivative Instruments are complex instruments and leveraged products that involve a high level of risk which can result in high losses, including the risk of losing the entire capital invested by the Client. Such instruments might not be suitable for all Clients. The Client should not engage in transactions with such Financial Instruments unless he/she understands and accepts the risks involved by trading Financial Instruments, taking into account his/her investment objectives and level of experience. Forex Rally warns that the information published on this website shall not be considered as a recommendation to buy/sell/keep a certain financial instrument and that past performance of Financial Instruments is not a reliable indicator of future performances.

Recommended Content

Editors’ Picks

EUR/USD rises toward 1.0800 on USD weakness

EUR/USD trades in positive territory above 1.0750 in the second half of the day on Monday. The US Dollar struggles to find demand as investors reassess the Fed's rate outlook following Friday's disappointing labor market data.

GBP/USD closes in on 1.2600 as risk mood improves

Following Friday's volatile action, GBP/USD pushes higher toward 1.2600 on Monday. Soft April jobs report from the US and the improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold holds on to modest gains around $2,320

Gold trades decisively higher on the day above $2,320 in the American session. Retreating US Treasury bond yields after weaker-than-expected US employment data and escalating geopolitical tensions help XAU/USD stretch higher.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Three fundamentals for the week: Two central bank decisions and one sensitive US Premium

The Reserve Bank of Australia is set to strike a more hawkish tone, reversing its dovish shift. Policymakers at the Bank of England may open the door to a rate cut in June.