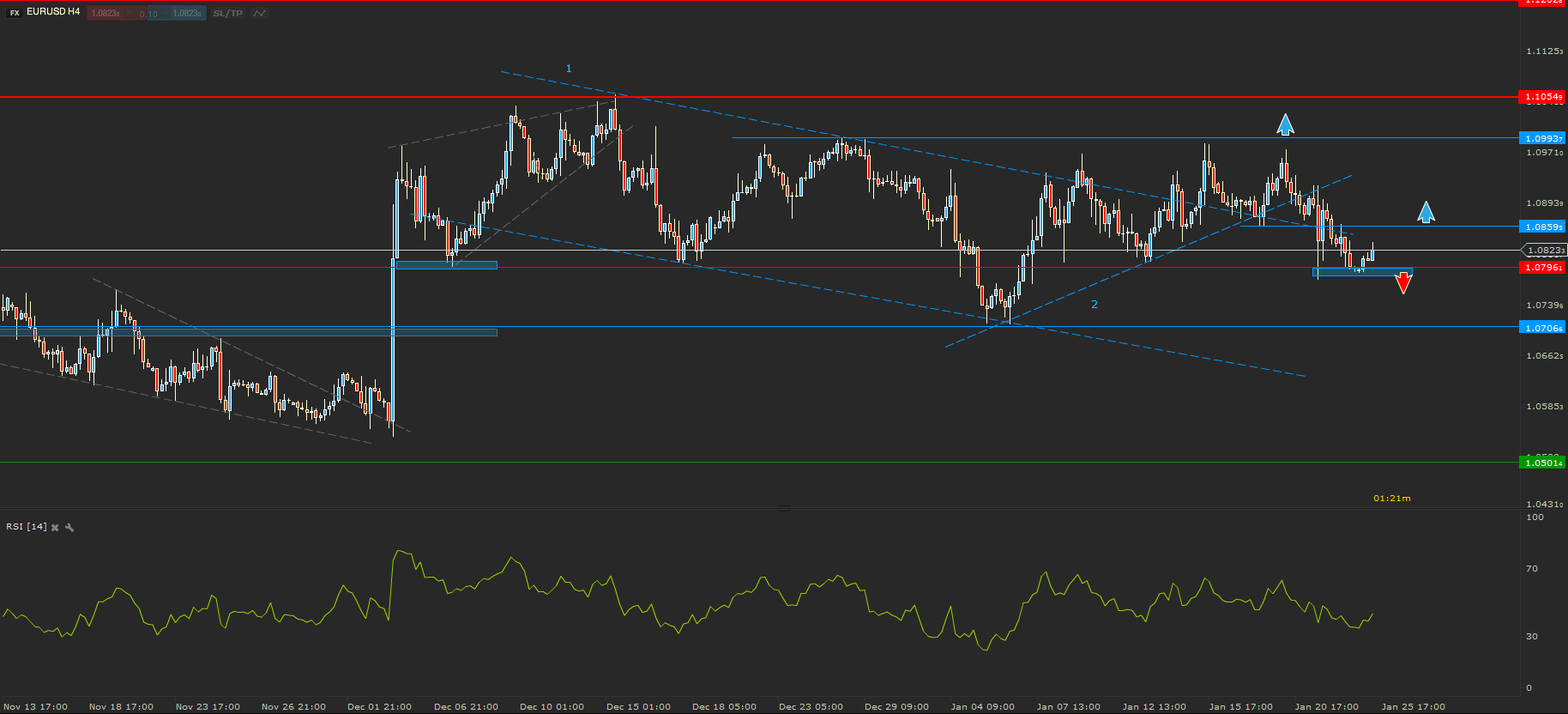

EURUSD - Wandering around 1.0800

Bears proved to be once again stronger than bulls. The price of EURUSD bounced third time from the trend lined (marked with 2 on my chart), but it did not manage to break above 1.1000. The resistance proved to be stronger than buyers expected.The price dropped below 1.0900 and only found support at 1.0800.

Currently EURUSD is wandering around this support level. 1.0800 was tested before, but it still is strong enough. A break and close below this support, on a 4 hour chart would signal adrop move towards 1.0700. On the other hand a break and close above 1.0860 would be a strong bullish signal. An up move could send the price back towards 1.1000.

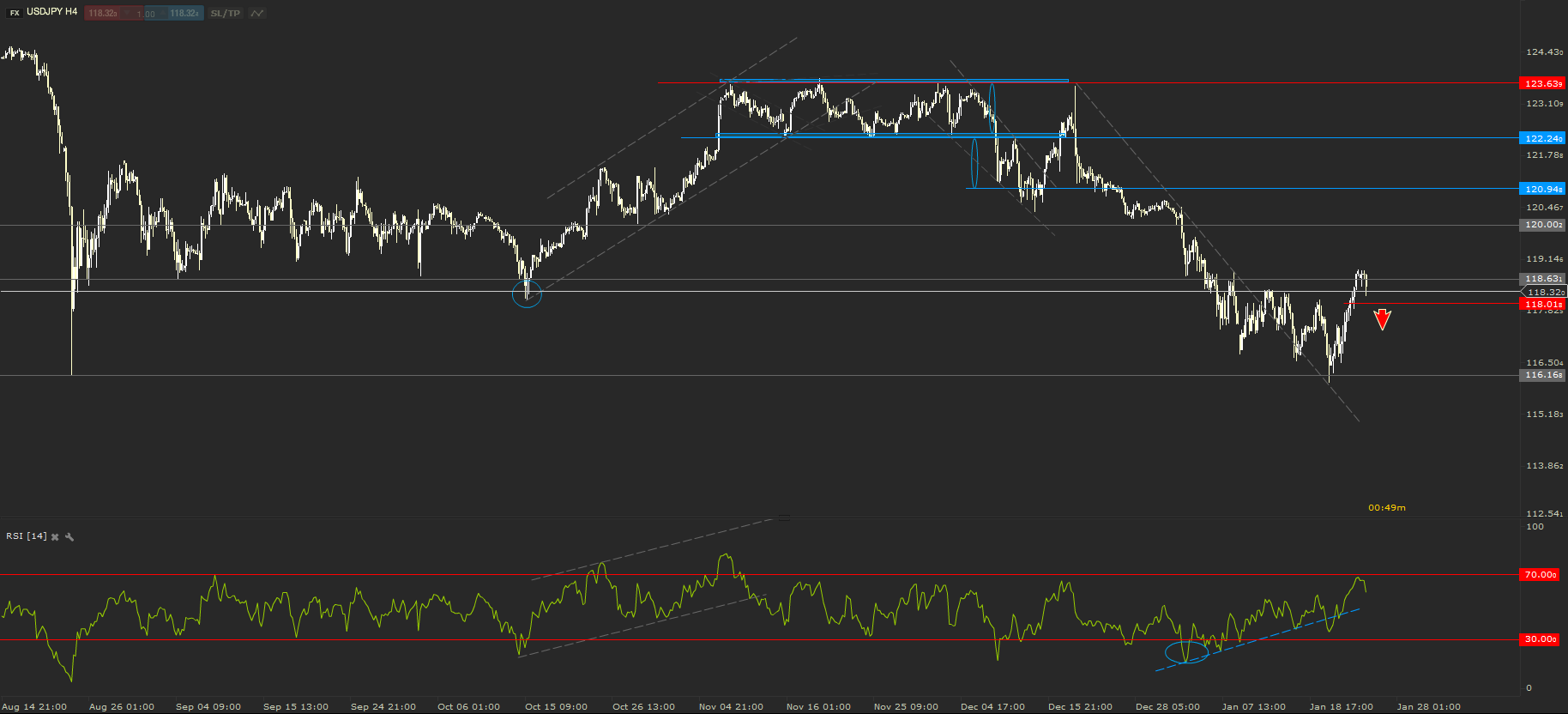

USDJPY – Bullish move confirmed

For the past 2 weeks I was highlighting the positive divergence drawn on the 14 periods RSI. The signal became a very strong last week, when the price hit the key level support and the divergence got even more significant. USDJPY jumped more than 200 pips in the second part of last week, hitting the resistance from 118.60.

I am expecting the resistance to be strong enough to reject the price. If the price will break below 118.00 I am expecting it to continue the down move towards 117.00 or even back to the key level support from 116.16.

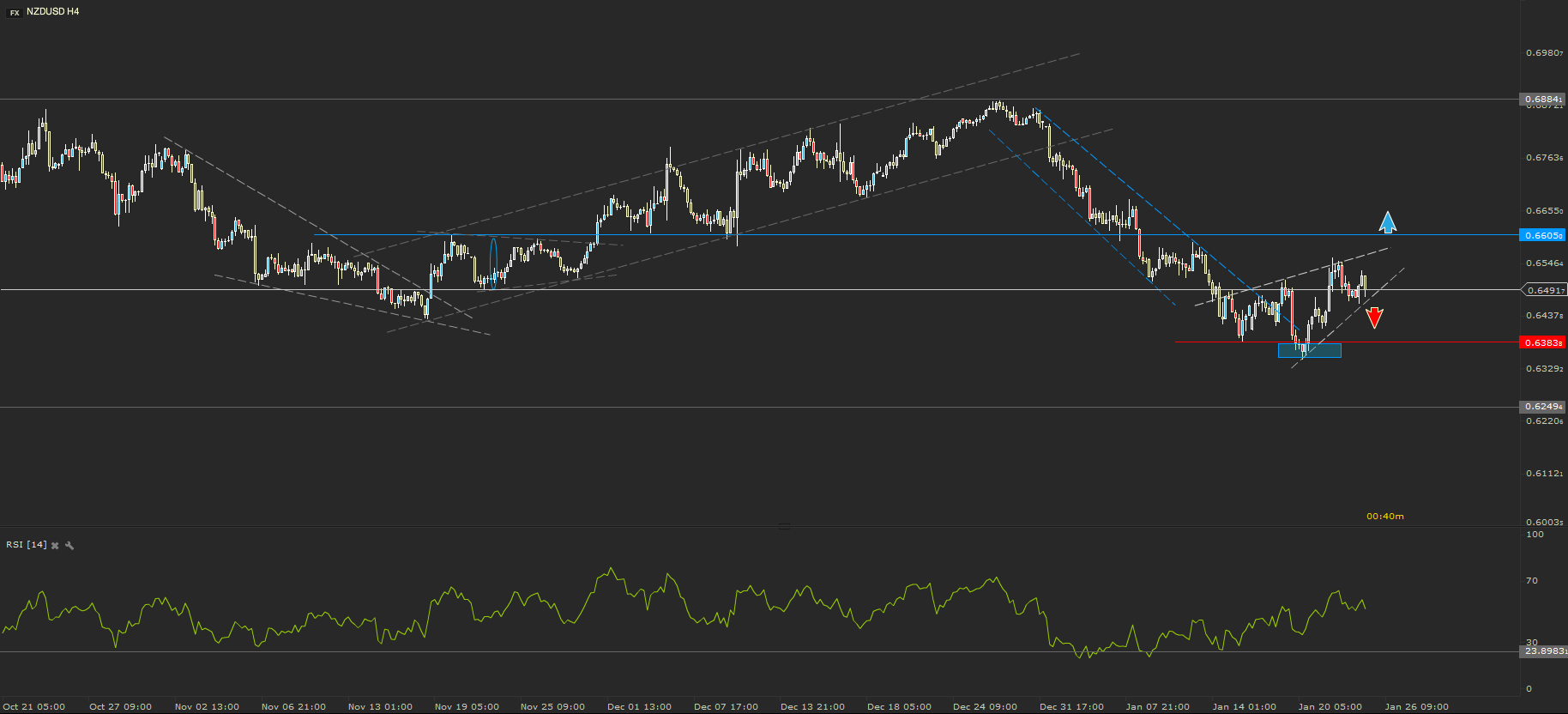

NZDUSD – Rising Wedge

I was expecting NZDUSD to continue the fall after a close below 0.63833, but it did not happen. After the close of a four hour candle below this support level the NZD started a strong comeback and managed to rally all the way above 0.6500.

The up move has drawn a Rising Wedge. This price pattern usually shows a continuation of the downtrend. If the lower line of the Wedge will be broken, I am expecting for the price to aim for the support level mentioned earlier. On the other hand, if the NZD will continue to gain against the greenback, I will be expecting for the up move to find a resistance at 0.6600

Risk Warning: Financial Derivative Instruments are complex instruments and leveraged products that involve a high level of risk which can result in high losses, including the risk of losing the entire capital invested by the Client. Such instruments might not be suitable for all Clients. The Client should not engage in transactions with such Financial Instruments unless he/she understands and accepts the risks involved by trading Financial Instruments, taking into account his/her investment objectives and level of experience. Forex Rally warns that the information published on this website shall not be considered as a recommendation to buy/sell/keep a certain financial instrument and that past performance of Financial Instruments is not a reliable indicator of future performances.

Recommended Content

Editors’ Picks

AUD/USD gains ground on hawkish RBA, Nonfarm Payrolls awaited

The Australian Dollar continues its winning streak for the third successive session on Friday. The hawkish sentiment surrounding the Reserve Bank of Australia bolsters the strength of the Aussie Dollar, consequently, underpinning the AUD/USD pair.

USD/JPY: Japanese Yen advances to nearly three-week high against USD ahead of US NFP

The Japanese Yen continues to draw support from speculated government intervention. The post-FOMC USD selling turns out to be another factor weighing on the USD/JPY pair. Investors now look forward to the crucial US NFP report for a fresh directional impetus.

Gold recoils on hawkish Fed moves, unfazed by dropping yields and softer US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s Federal Reserve decision to hold rates unchanged.

Solana price pumps 7% as SOL-based POPCAT hits new ATH

Solana price is the biggest gainer among the crypto top 10, with nearly 10% in gains. The surge is ascribed to the growing popularity of projects launched atop the SOL blockchain, which have overtime posted remarkable success.

NFP: The ultimate litmus test for doves vs. hawks

US Nonfarm Payrolls will undoubtedly be the focal point of upcoming data releases. The estimated figure stands at 241k, notably lower than the robust 303k reported in the previous release and below all other readings recorded this year.