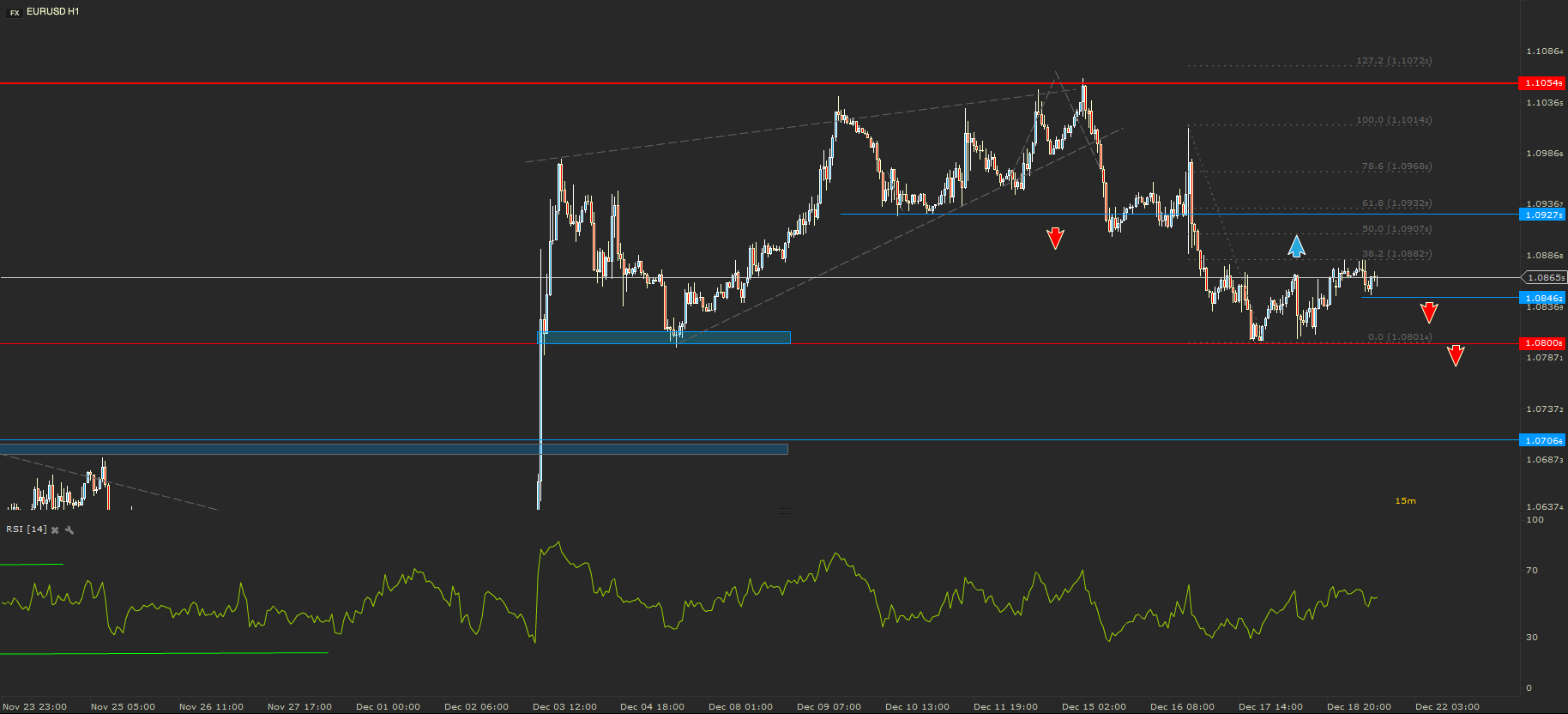

EURUSD - Back to 1.0800

Last week the EURUSD had another push to 1.1054, as expected, before dropping below the lower line of the Rising Wedge. The drop stopped at 1.0930 and jumped once more above 1.1000 before breaking below 1.0900 and plunging to 1.0800. The interest rate hike brought in USD buyers, but the move was not as impressive as it was two weeks ago.

For the moment, 1.0800 is a very good support, which managed to hold the price above in the last couple of trading days. The current price actions shows a local support at 1.0846. A drop below this level would signal a continuation of the down move, probably below the key level support. On the other had, a break above 1.0882 could signal a continuation of the short term rally, towards 1.0927.

USDJPY - Wider Sideways Move

After breaking out of the Falling Wedge, the price of USDJPY has rallied towards the key resistance level, from 123.63. But the rally did not last for long, because on Friday the Japanese Yen won back everything it lost after the rate hike. The drop stopped at an older support from 120.94.

Momentarily the price is trading sideways right above the support. If the bears will start putting pressure again on the price we might see a drop to 120.00. A second scenario, which I find more appropriate, would be a break above the local resistance from 122.24 and a rally towards 123.63.

USDCHF - Short Term Rally

Another very good example of perfect signal given by a Wedge pattern. After the price of USDCHF broke the upper line of the Falling Wedge, it rallied towards 1.000, but stopped several pips below it, at 0.9993. Here it found a resistance which might be strong enough to hold on against bulls pressure.

A break above this resistance could trigger another rally for the US dollar, which might get the price of this pair back to 1.0136. Though, a drop below the local support from 0.9905 would signal a drop back towards the latest lows from 0.9786.

NZDUSD - Higher Highs

The kiwi dollar continued to reach new higher highs inside of the ascending channel. Both trend line and rejection line were respected by the latest price action. The price rallied and reached a new higher high close to the key resistance level of 0.6863, but fell fast after that, to the trend line and the local support from 0.6685.

I would say that for the moment the NZDUSD is trading sideways in a 180 pips range. If the price will break above the last high, and especially above the key resistance, we might witness a rally towards the 0.7000. On the other hand a break below the trend line and the local support, confirmed by a close on the 4 hour chart, I will expect the price to continue the down move towards 0.6605.

Risk Warning: Financial Derivative Instruments are complex instruments and leveraged products that involve a high level of risk which can result in high losses, including the risk of losing the entire capital invested by the Client. Such instruments might not be suitable for all Clients. The Client should not engage in transactions with such Financial Instruments unless he/she understands and accepts the risks involved by trading Financial Instruments, taking into account his/her investment objectives and level of experience. Forex Rally warns that the information published on this website shall not be considered as a recommendation to buy/sell/keep a certain financial instrument and that past performance of Financial Instruments is not a reliable indicator of future performances.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 as USD rebounds

EUR/USD lost its traction and retreated slightly below 1.0700 in the American session, erasing its daily gains in the process. Following a bearish opening, the US Dollar holds its ground and limits the pair's upside ahead of the Fed policy meeting later this week.

USD/JPY recovers toward 157.00 following suspected intervention

USD/JPY recovers ground and trades above 156.50 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, the Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.