EURUSD - Continuing the Downtrend

EURUSD broke the support area I drew last week on my chart and dropped close to 1.0620. From this level bounced back up towards the first line of this down trend, where it found agood resistance before 1.0800. The next drop in price brought EURUSD to 1.0600,where it found another support.Currently the price is trading between the two most important trend lines of this trend.

I am expecting for the down pressure to continue because of fundamental reasons. In this case a break below 1.0600 round number support level, could trigger another 100 pips fall to the next support, I consider to be at 1.0500. My second scenario would be activated by a break above the area between the first trend line and 1.0700 resistance. The bullish divergence on the 14 periods RSI is signaling a possible up move. I believe that the breakout could trigger a rally of the European single currency, targeting 1.0800.

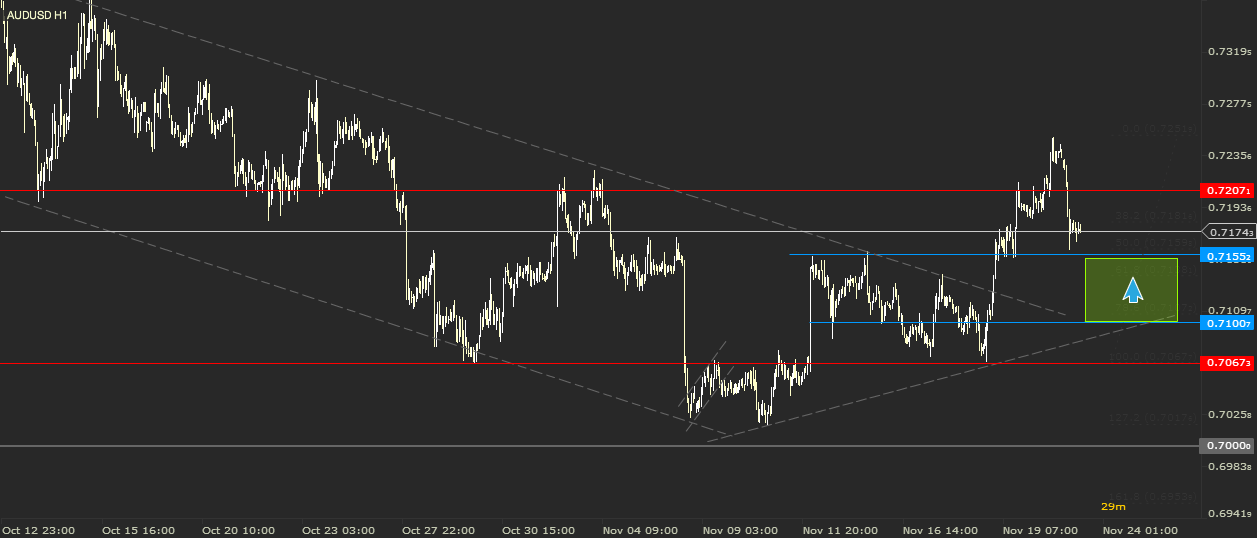

AUDUSD - Broke the Channel

During the first half of last week, bulls pushed the price of AUDUSD below 0.7100. The down move stopped at the local support from 0.7067 twice. After the second hit of the support area, a rally started. The rally Aussie had in the second part of the week stopped after almost 200 pips, at 0.7250.

This week, the price opened with a negative gap. The greenback managed to gain 50% of what it had lost last week. The fall stopped for the moment at the previous resistance,0.7155. I believe that AUDUSD has started a new uptrend, because it reached new higher highs. A bounce from the area between 0.7155 and 0.7100 could finalize with a new higher high. On the other hand a break below the round number level could announce a continuation of the fall below 0.7067.

USDJPY - First Bearish Signals

The price of USDJPY broke the upper line of the Bullish Flag last week. Bulls managed to push the dollar to reach a new higher high for this trend, but the rally stopped before hitting the next round number level. The drop, brought the price of this pair below the main trend line. This can be a strong bearish signal, but it is not enough to consider that the uptrend is finished.

This morning the price rallied towards 123.20, where it found a good resistance. A close on a 4 hour chart above this level could signal a continuation of the uptrend and confirm that this breakout below the trend line is a false one. On the other hand a drop under the local support of 122.71 would tell us that the bears are still in control, and the drop could aim for 122.00.

NZDUSD - Broke out of the Falling Wedge

On 15th of October NZDUSD started a down trend. From the first of November the price action outlined a Falling Wedge. The divergence on the 14 periods RSI was confirming the bullish signal. The price broke from under the Wedge on 19th of November and reached a new high on last week’s Friday.

Like on AUDUSD, this week’s trading session opened with a negative gap which was not yet covered.The drop continued all the way to 0.6500. Where it found a strong support and the 61.8 Fibonacci retrace. A break and close on the 4 hour chart, below this support area would signal a continuation of the drop towards the next Fibonacci retrace, at 78.6 (0.6468). A bounce from the current support could signal another rally, which could retest the previous highs around 0.6600.

Risk Warning: Financial Derivative Instruments are complex instruments and leveraged products that involve a high level of risk which can result in high losses, including the risk of losing the entire capital invested by the Client. Such instruments might not be suitable for all Clients. The Client should not engage in transactions with such Financial Instruments unless he/she understands and accepts the risks involved by trading Financial Instruments, taking into account his/her investment objectives and level of experience. Forex Rally warns that the information published on this website shall not be considered as a recommendation to buy/sell/keep a certain financial instrument and that past performance of Financial Instruments is not a reliable indicator of future performances.

Recommended Content

Editors’ Picks

RBA keeps interest rate steady at 4.35%, as expected

The Reserve Bank of Australia board members decided to keep the Official Cash Rate unchanged at 4.35% after its May monetary policy meeting on Tuesday. The policy announcement was widely expected by the markets. The RBA extended its pause for the fourth meeting in a row.

USD/JPY extends recovery above 154.00, focus on Fedspeak

The USD/JPY pair trades on a stronger note around 154.10 on Tuesday during the Asian trading hours. The recovery of the pair is supported by the modest rebound of US Dollar to 105.10 after bouncing off three-week lows.

Gold price extends its upside as markets react to downbeat jobs data

Gold price extends its recovery on Tuesday. The uptick of the yellow metal is bolstered by the weaker US dollar after recent US Nonfarm Payrolls (NFP) data boosted bets that the Federal Reserve would cut interest rates later this year.

Bitcoin miner Marathon Digital stock gains ground after listing by S&P Global

Following Bitcoin miner Marathon Digital's inclusion as an upcoming member of the S&P SmallCap 600, the company's stock received an 18% boost, accompanied by an $800 million rise in market cap.

The impact of economic indicators and global dynamics on the US Dollar

Recent labor market data suggest a cooling economy. The disappointing job creation and rising unemployment hint at a slackening demand for labor, which, coupled with subdued wage growth, could signal a slower economic trajectory.