Fundamental Forecast for Dollar: Bearish

US Dollar breaks key volume-based support levels, watch for further weakness These are the conditions needed to call for an important US Dollar bottom See the 2Q forecast for the US Dollar and other key currencies in the DailyFX Trading Guides

The US Dollar fell against all major FX counterparts and the DJ FXCM Dollar Index (ticker: USDOLLAR) matched its worst weekly losing streak in over five years despite a relative lack of major news. Why might the Greenback hit further lows in the days and weeks ahead?

Traders sent the previously high-flying US currency sharply lower yet again in what can best be described as a “pain trade”; the strongest currencies in Q1 have quickly become the worst performers in Q2 and vice versa. And indeed these major corrections have coincided with similarly sharp moves in commodities markets and especially crude oil prices, while global bond markets likewise have seen a large correction. The key question is simple: is there more “pain” left and will the US Dollar continue lower?

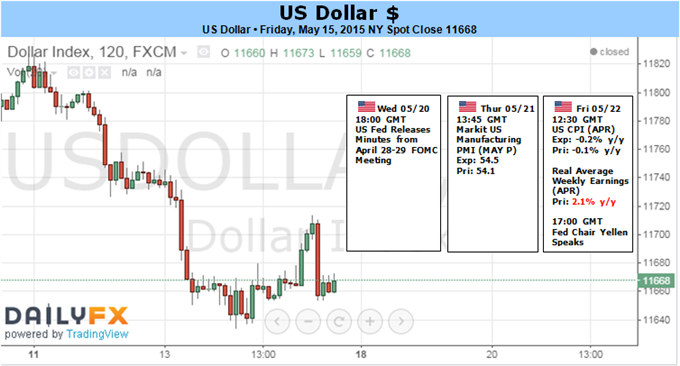

We’ll pay close attention to upcoming US Federal Open Market Committee (FOMC) Meeting Minutes as well as a key US Consumer Price Index (CPI) inflation report for the next clues on interest rates and the USD itself. FOMC Minutes should shed further light on whether officials have scaled back plans to raise interest rates given clear weakness in Q1 GDP growth figures and consumption data. April CPI inflation numbers could likewise shift market sentiment on rate hikes—particularly as current consensus forecasts call for the second-consecutive month of a year-over-year declines in nationwide prices. Major surprises in either the FOMC or CPI events would likely drive significant US Dollar volatility.

Whether or not the Dollar continues lower may ultimately depend on whether the current wave of position-covering is over. Recent CFTC Commitment of Traders data shows that large speculative traders decreased their Euro-short positions for the third-consecutive week, and the same data shows that speculators were still very heavily short. In other words: positioning figures suggest that there is certainly scope for continued US Dollar weakness. And indeed a break of critical volume-based support levels leaves us watching for further Euro and Sterling gains.

It will likely take important positive surprises out of FOMC Minutes and/or CPI results to force a meaningful US Dollar bounce. Until then, we’re keeping a close eye on key technical levels as the Greenback quickly goes from FX market leader to laggard.

FXCM, L.L.C.® assumes no responsibility for errors, inaccuracies or omissions in these materials. FXCM, L.L.C.® does not warrant the accuracy or completeness of the information, text, graphics, links or other items contained within these materials. FXCM, L.L.C.® shall not be liable for any special, indirect, incidental, or consequential damages, including without limitation losses, lost revenues, or lost profits that may result from these materials. Opinions and estimates constitute our judgment and are subject to change without notice. Past performance is not indicative of future results.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 as USD rebounds

EUR/USD lost its traction and retreated slightly below 1.0700 in the American session, erasing its daily gains in the process. Following a bearish opening, the US Dollar holds its ground and limits the pair's upside ahead of the Fed policy meeting later this week.

USD/JPY recovers toward 157.00 following suspected intervention

USD/JPY recovers ground and trades above 156.50 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, the Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.