Fundamental Forecast for Dollar:Neutral

Though the FOMC removed its ‘patient’ term – interrupted as a cue for a possible June hike – the Dollar slipped Fed

Fund futures now see the first rate hike not until November (there are meetings on Oct 28 and Dec 16)

Sign up for a free trial of DailyFX-Plus to have access to Trading Q&A's, trading signals and much more!

The Federal Open Market Committee (FOMC) meeting this past week certainly set off fireworks in the financial market. Yet, the outcome didn’t follow the simple path rate watchers would have expected. Now, with volatility further magnified; we find the Dollar wavering on its record-breaking, eight-month bull trend. Did the market overshoot on its speculative forecast for the Greenback before the central bank clarified its position – either pricing in a faster pace than was reasonable or perhaps pushing more premium than just the monetary policy differential would confer? Have the speculative ‘weak hands’ already been flushed from the system? And, will risk trends start to contribute to the curerncy’s fundamental picture in the near future?

Looking back at the Fed meet this past week, there weren’t many ‘surprises’. The headlines were focusing in particularly on whether the group would include or strike the term ‘patient’ in reference to their timing for normalizing monetary policy. It was popularly understood that the word was equivalent to a more than three-month time frame before the central bank would consider a rate hike. Having been removed, the ‘mid-2015’ (some say June) first rate hike is more probable.

Another meaningful change was the downgrade in growth, inflation and interest rate forecasts. In their updated forecasts, the Committee lowered a the 2015 GDP view to 2.3 – 2.7 percent (from 2.6 – 3.0), the 2015 inflation range to 0.6 – 0.8 percent (from 1.0 to 1.6) and December’s expected benchmark rate level to 0.625 percent (from 1.125). These are significant changes that could lower the ‘curve’ (or projected pace of tightening), but there was limited speculation of a swift pace to begin with. Furthermore, the moderation in this data does little to offset the communication effort by the Fed to acclimatize the market to an approaching hike. And yet, timing of the first hike assessed by Fed Funds futures was pushed even further back, to November.

The Dollar’s waffle after the policy update is likely a flush of an excessive market exposure. We’ve seen the currency far outpace other markets that are theoretically connected to rate forecasts (Treasury yields, Fed Fund futures, monetary markets). Having established such a remarkable and obvious trend, it is likely speculative interests that fell outside of the fundamental rational were drawn in. With the policy update, those focused on short-term momentum were easily shaken. The question is whether the excess has been worked from the market. Wednesday’s tumble was severe in both price and volume, but it didn’t even break the USDollar’s 8-month trend.

There is likely a large pocket of tactical traders who would quickly abandon the Dollar long view should it slip further or even stall for an extended period. Yet, despite the risk of a short-term long squeeze, the fundamental backdrop would still support the medium-term bullish lean for the currency. Whether the Fed realizes a hike in June or October, its hawkish view – much less its timing – is far more incisive than its counterparts.

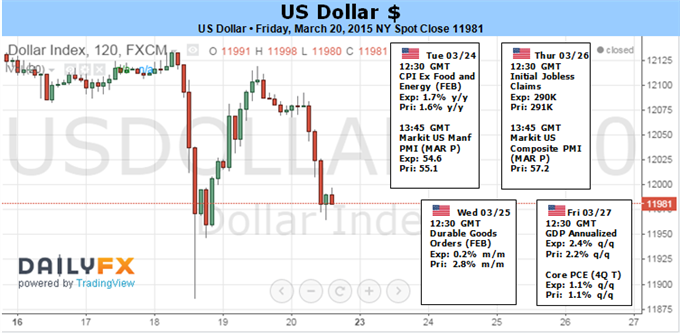

What is perhaps even more remarkable from this past week, was the swell in risk appetite following the Fed decision. Even a delay to the start of a tightening regime still clarifies the central bank’s ability and intention to raise rates. That reverses a course of years of increasing accommodation to draw risk out of the market and encourage investing. Yet, to a market with an increasingly shorter time frame for positioning, it offers a quick opportunity. The trouble is, what will the mentality be after that speculative swing is over? For milestones to gauge policy and risk trends moving forward; watch event risk such as the CPI data, the laundry list of Fed Speeches (including Yellen’s address on Friday) as well as international topics – like Greece’s financial problems.

FXCM, L.L.C.® assumes no responsibility for errors, inaccuracies or omissions in these materials. FXCM, L.L.C.® does not warrant the accuracy or completeness of the information, text, graphics, links or other items contained within these materials. FXCM, L.L.C.® shall not be liable for any special, indirect, incidental, or consequential damages, including without limitation losses, lost revenues, or lost profits that may result from these materials. Opinions and estimates constitute our judgment and are subject to change without notice. Past performance is not indicative of future results.

Recommended Content

Editors’ Picks

EUR/USD hold comfortably above 1.0750 as USD recovery loses steam

EUR/USD clings to small daily gains above 1.0750 in the early American session on Monday. In the absence of high-tier data releases, the US Dollar finds it difficult to gather recovery momentum and helps the pair hold its ground.

GBP/USD struggles to find direction, holds near 1.2550

GBP/USD stays under modest bearish pressure and trades near 1.2550 on Tuesday. The neutral risk mood, as reflected by the mixed action seen in US stocks, doesn't allow the pair to make a decisive move in either direction. The Bank of England will announce policy decisions on Thursday.

Gold rebounds to $2,320 as US yields edge lower

After falling to $2,310 in the early European session, Gold recovered to the $2,310 area in the second half of the day. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.5% and helps XAU/USD find support.

Ripple lawsuit develops with SEC reply under seal, XRP holders await public redacted versions

Ripple lawsuit’s latest development is SEC filing, under seal. The regulator has filed its reply brief and supporting exhibits and the documents will be made public on Wednesday, May 8.

The impact of economic indicators and global dynamics on the US Dollar

Recent labor market data suggest a cooling economy. The disappointing job creation and rising unemployment hint at a slackening demand for labor, which, coupled with subdued wage growth, could signal a slower economic trajectory.