Fundamental Forecast for Yen: Neutral

One-sided crowd sentiment gives us a modestly bearish USD/JPY trading bias

USD/JPY nonetheless likely to stick to recent trading ranges given Bank of Japan inaction

For Real-Time SSI Updates and Potential Trade Setups on the Japanese Yen, sign up for DailyFX on Demand

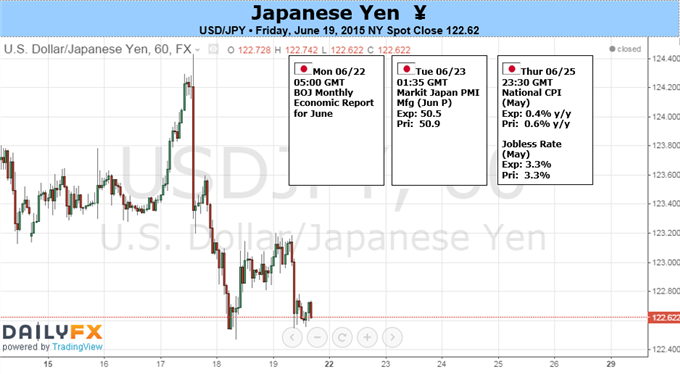

The Japanese Yen finished the week modestly higher versus the recently-downtrodden US Dollar, but the lack of a clear breakthrough from a highly-anticipated US Federal Reserve meeting and a lackluster Bank of Japan decision give few clues on next steps for the USD/JPY.

All eyes were on the US Federal Open Market Committee (FOMC) as investors looked to Fed guidance on its next interest rate moves, and relatively dovish official rhetoric and forecasts sparked a modest US Dollar sell-off across the board. Officials stopped short of giving clear indication on whether the FOMC would raise interest rates at its much-anticipated September meeting, however; the ambiguity gives relatively little reason to expect the US Dollar will continue sharply lower through the foreseeable future.

A mostly uneventful policy meeting from the Bank of Japan likewise gives little reason to believe that the USD/JPY will see major moves through the foreseeable future. The BoJ did announce it would improve the way in which it communicates policy decisions and economic forecasts in the future. At this stage there is little reason to believe the changes will have a meaningful impact on the Japanese Yen through the near-term.

A noteworthy drop in FX volatility prices suggests that the USD/JPY may continue to trade within its recent ¥122.50-124.50 range. The most important caveat is that a continued lack of progress in ongoing negotiations between Greece and its creditors raises the risks of significant market volatility. If Greece is unable to seek funding ahead of a key June 30 deadline it may in effect be forced out of the Euro Zone—an event that would likely send significant shockwaves through broader financial markets.

In times of market turmoil we have most often seen the Japanese Yen outperform its major counterparts, and we believe that similar episodes in the future would push the JPY higher across the board (USDJPY lower). Barring such an outcome, however, we see little reason to believe that the US Dollar will break substantially in either direction versus the recently slow-moving Japanese Yen.

FXCM, L.L.C.® assumes no responsibility for errors, inaccuracies or omissions in these materials. FXCM, L.L.C.® does not warrant the accuracy or completeness of the information, text, graphics, links or other items contained within these materials. FXCM, L.L.C.® shall not be liable for any special, indirect, incidental, or consequential damages, including without limitation losses, lost revenues, or lost profits that may result from these materials. Opinions and estimates constitute our judgment and are subject to change without notice. Past performance is not indicative of future results.

Recommended Content

Editors’ Picks

AUD/USD: Extra gains in the pipeline above 0.6520

AUD/USD partially reversed Tuesday’s strong pullback and regained the 0.6500 barrier and beyond in response to the sharp post-FOMC pullback in the Greenback on Wednesday.

EUR/USD jitters post-Fed with NFP Friday over the horizon

EUR/USD cycled familiar territory on Wednesday after the US Federal Reserve held rates as many investors had expected. However, market participants were hoping for further signs of impending rate cuts from the US central bank.

Gold prices skyrocketed as Powell’s words boosted the yellow metal

Gold prices rallied sharply above the $2,300 milestone on Wednesday after the Federal Reserve kept rates unchanged while announcing that it would diminish the pace of the balance sheet reduction.

Ethereum plunges outside key range briefly as US Dollar Index gains strength

Institutional whales appear to be dumping Ethereum after recent dip. Fed’s decision to leave rates unchanged appears to have helped ETH's price recover slightly. SEC Chair Gensler has misled Congress, considering recent revelations from Consensys suit, says Congressman McHenry.

The FOMC whipsaw and more Yen intervention in focus

Market participants clung to every word uttered by Chair Powell as risk assets whipped around in a frenetic fashion during the afternoon US trading session.