Fundamental Forecast for Yen: Neutral

US Dollar/Japanese Yen exchange rate very sensitive to US Treasury Yields

Weekly Volume Report: USDJPY volume profile looks encouraging for bulls

For Real-Time SSI Updates and Potential Trade Setups on the Japanese Yen, sign up for DailyFX on Demand

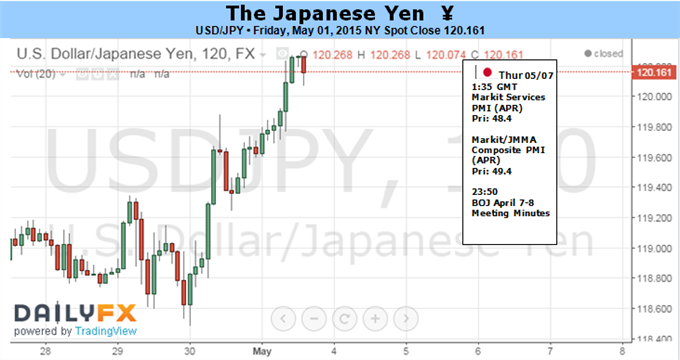

The Japanese Yen finished the week notably lower versus the US Dollar but stuck to its long-standing trading range. A big week for FX markets ahead might be enough to finally force a break in the slow-moving US Dollar/Japanese Yen exchange rate.

A sharp US Dollar rally pushed the USD/JPY to fresh 8-year highs through March and yet the pair has consolidated ever since. It has been a virtual stalemate for the Dollar and the Yen as both the US Federal Reserve and Bank of Japan have given relatively little reason to force a fundamental shift for either currency. And indeed this past week’s uneventful monetary policy decisions from both the Fed and BoJ maintained the status quo.

Any surprises in the upcoming US Nonfarm Payrolls report could nonetheless tip the scales and force major US Dollar volatility, while monetary policy meeting minutes from the Bank of Japan might spark noteworthy moves in the Yen. The US labor market report is often one of the biggest market-movers not only for the US Dollar and domestic financial markets but global counterparts as well. The interest rate-sensitive Japanese Yen will almost certainly react to any surprises.

Current consensus forecasts predict that the US economy added 225k jobs in April after a disappointing March result. Recent US Dollar weakness suggests few expect a material improvement in US economic data, and a worse-than-expected print could force the Greenback even lower.

The Bank of Japan Meeting Minutes due just a day before are less likely to force major moves in the Yen. Yet it remains important to monitor the central bank’s rhetoric in regards to future monetary policy moves. BoJ Governoor Kuroda sounded a surprisingly neutral tone at a recent press conference as officials show no real willingness to ease monetary policy despite notable disappointments in economic data. Pressure is building on the BoJ to ease further as recent inflation figures showed a sharp pullback in year-over-year Tokyo CPI growth. And though this may not be enough to force the Bank of Japan’s hand in itself, it remains of clear interest to monitor officials’ next moves.

It’s shaping up to be a fairly important week for the Dollar versus the Yen, and any major surprises could finally be enough to force the USD/JPY out of its narrow trading range.

FXCM, L.L.C.® assumes no responsibility for errors, inaccuracies or omissions in these materials. FXCM, L.L.C.® does not warrant the accuracy or completeness of the information, text, graphics, links or other items contained within these materials. FXCM, L.L.C.® shall not be liable for any special, indirect, incidental, or consequential damages, including without limitation losses, lost revenues, or lost profits that may result from these materials. Opinions and estimates constitute our judgment and are subject to change without notice. Past performance is not indicative of future results.

Recommended Content

Editors’ Picks

AUD/USD holds positive ground above 0.6500 on weaker US Dollar

The AUD/USD pair extends recovery around 0.6525 during the early Asian session on Thursday. The Federal Reserve held its interest rates steady at 5.25–5.50% at its meeting on Wednesday, citing a “lack of further progress” in getting inflation back down to its 2% target.

EUR/USD jitters post-Fed with NFP Friday over the horizon

EUR/USD cycled familiar territory on Wednesday after the US Federal Reserve held rates as many investors had expected. However, market participants were hoping for further signs of impending rate cuts from the US central bank.

Gold prices skyrocketed as Powell’s words boosted the yellow metal

Gold prices rallied sharply above the $2,300 milestone on Wednesday after the Federal Reserve kept rates unchanged while announcing that it would diminish the pace of the balance sheet reduction.

Solana price dumps 21% on week as round three of FTX estate sale of SOL commences

Solana price is down almost 5% in the past 24 hours and over 20% in the last seven days. The dump comes as the broader crypto market contracts with Bitcoin price leading the pack as it slides below the $58,000 threshold to test the Bull Market Support Band Indicator.

The FOMC whipsaw and more Yen intervention in focus

Market participants clung to every word uttered by Chair Powell as risk assets whipped around in a frenetic fashion during the afternoon US trading session.