Fundamental Forecast for British Pound:Neutral

Price & Time: GBP/USD Bucking the Trend?

Pound May Overlook UK GDP Upgrade, Aussie Dollar Drops on Capex Data

For Real-Time SSI Updates and Potential Trade Setups on the British Pound, sign up for DailyFX on Demand

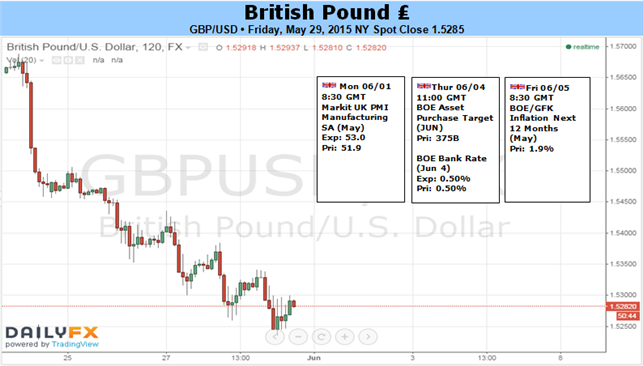

GBP/USD remainsat risk of facing a further decline in the week ahead should the fundamental developments coming out of the U.K. & U.S. heighten bets of seeing the Federal Reserve normalize monetary policy ahead of the Bank of England (BoE).

The BoE’s June 4 meeting may spur a limited market reaction as the central bank is widely expected to retain its current policy, and the lack of fresh central bank rhetoric may put greater emphasis on the U.S. data prints as Fed officials continue to see a rate hike in 2015. As a result, major economic developments coming out ahead of the Federal Open Market Committee’s (FOMC) June 17 interest rate decision may play an increased role in driving market volatility as BoE members show a greater willingness to normalize monetary policy in 2016.

However, the ongoing slack in the U.S. economy may continue to produce a mixed batch of data prints, and the Fed may largely discuss a further delay in liftoff as disinflationary environment undermines the central bank’s scope to achieve the 2% target for price growth. At the same time, positive developments coming out of the U.K. could highlight a tightening race between the Fed & BoE as Governor Mark Carney sees the spare capacity being fully-absorbed over the next 12-months, and we may see a growing dissent within the Monetary Policy Committee (MPC) in the coming months as a growing number of central bank officials prepare households and businesses for higher borrowing-costs.

Nevertheless, the recent string of lower highs & lows in GBP/USD raises the risk for a further decline in the exchange rate, and the pair may continue to give back the rebound from 1.4564 (April low) as it fails to retain the bullish formations carried over from the previous month. In turn, the next downside region of interest comes in around 1.5190, the 50% Fibonacci retracement from the April advance.

FXCM, L.L.C.® assumes no responsibility for errors, inaccuracies or omissions in these materials. FXCM, L.L.C.® does not warrant the accuracy or completeness of the information, text, graphics, links or other items contained within these materials. FXCM, L.L.C.® shall not be liable for any special, indirect, incidental, or consequential damages, including without limitation losses, lost revenues, or lost profits that may result from these materials. Opinions and estimates constitute our judgment and are subject to change without notice. Past performance is not indicative of future results.

Recommended Content

Editors’ Picks

EUR/USD rises toward 1.0800 on USD weakness

EUR/USD trades in positive territory above 1.0750 in the second half of the day on Monday. The US Dollar struggles to find demand as investors reassess the Fed's rate outlook following Friday's disappointing labor market data.

GBP/USD closes in on 1.2600 as risk mood improves

Following Friday's volatile action, GBP/USD pushes higher toward 1.2600 on Monday. Soft April jobs report from the US and the improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold holds on to modest gains around $2,320

Gold trades decisively higher on the day above $2,320 in the American session. Retreating US Treasury bond yields after weaker-than-expected US employment data and escalating geopolitical tensions help XAU/USD stretch higher.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Three fundamentals for the week: Two central bank decisions and one sensitive US Premium

The Reserve Bank of Australia is set to strike a more hawkish tone, reversing its dovish shift. Policymakers at the Bank of England may open the door to a rate cut in June.