Fundamental Forecast for British Pound: Neutral

GBP/USD Continues to Carve Bullish Series as Retail FX Remains Short

GBP/USD First 6 Day Rally Since December 2013

For Real-Time SSI Updates and Potential Trade Setups on the Japanese Yen, sign up for DailyFX on Demand

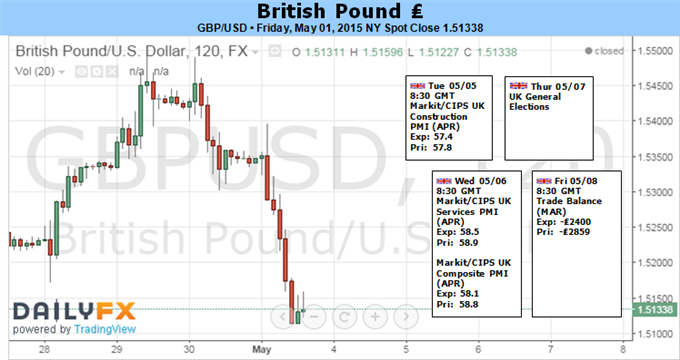

Headlines surrounding the U.K. election are likely produce increased volatility for GBP/USD, but the uncertainties clouding the fiscal outlook may only act as a near-term driver for the British Pound as the Bank of England (BoE) remains on course to normalize monetary policy.

A hung parliament is likely to produce near-term headwinds for the British Pound, and the GBP/USD may continue to give back the rebound from April (1.4564) as the pair struggles to retain the series of higher highs & lows ahead of the election. On the other hand, the formation of a coalition government may largely undermine the bearish sentiment surrounding the sterling, and market participants may put increase emphasis on the BoE’s quarterly inflation report due out on May 13 as Governor Mark Carney continues to prepare U.K. households and businesses for higher borrowing-costs.

Despite the weaker-than-expected 1Q Gross Domestic Product (GDP) report, the BoE may strike a more hawkish tone this time around as the sterling effect raises the risk for ‘a faster pickup in inflation,’ and an upward revision in the central bank’s price growth forecast may boost the appeal of the sterling as market participants ramp up interest rate expectations. With that said, the monetary policy outlook may continue to act as the biggest fundamental driver as market participants speculate on the BoE’s normalization cycle, and a material shift in the forward-guidance may generate a more bullish course for GBP/USD as the central bank reiterates that the next policy move will most likely be a rate-hike.

Nevertheless, the failed attempt to test the February high (1.5551) may keep GBP/USD capped going into the first full-week of May, and the failure to retain the bullish structure from April certainly raises the risk of seeing a further decline going into the election. In turn, former resistance around the 1.5000 handle will come on the radar as the pound-dollar searches for near-term support.

FXCM, L.L.C.® assumes no responsibility for errors, inaccuracies or omissions in these materials. FXCM, L.L.C.® does not warrant the accuracy or completeness of the information, text, graphics, links or other items contained within these materials. FXCM, L.L.C.® shall not be liable for any special, indirect, incidental, or consequential damages, including without limitation losses, lost revenues, or lost profits that may result from these materials. Opinions and estimates constitute our judgment and are subject to change without notice. Past performance is not indicative of future results.

Recommended Content

Editors’ Picks

EUR/USD: Federal Reserve and Nonfarm Payrolls spell action this week

The EUR/USD pair temporarily reconquered the 1.0700 threshold last week, settling at around that round level. The US Dollar lost its appeal following discouraging United States macroeconomic data indicating tepid growth and persistent inflationary pressures.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold: Strength of $2,300 support is an encouraging sign for bulls

Gold price started last week under heavy bearish pressure and registered its largest one-day loss of the year on Monday. The pair managed to stage a rebound in the second half of the week but closed in negative territory.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.