Fundamental Forecast for Euro: Neutral

- EURUSD took a spill post-FOMC, and the USDOLLAR Index has remained in its consolidation state ever since.

- Speculation around the timing of the Fed’s first rate hike is proving to be a persistent, significant catalyst for EURUSD.

- Have a bullish (or bearish) bias on the Euro, but don’t know which pair to use? Use a Euro currency basket.

Despite all of the intraweek volatility, when the chips settled, the Euro ended the week lower against most of its major counterparts. Depreciating by just under one-half of one percent against the US Dollar, EURUSD saw price oscillate between $1.0892 and $1.1128 amid a flurry of headlines around Greece, whether or not the Federal Reserve would raise rates in September 2015, and further signs of volatility in Chinese financial markets.

While each of these factors may have played some part in getting EURUSD to trade back under $1.1000 by week’s close, it’s evident that the market right now is highly sensitive to specuatlion unfolding around the timing of the Fed’s first rate hike more than anything. Ahead of the Fed last week, markets were pricing in January 2016 as the most likely period for the first rate hike. After the Fed, markets began aggressively pricing in December and even October 2015 as the most likely periods.

Traders saw just how tightly wound the market is right now with respect to the Fed raising rates, given the reaction in EURUSD to a typically-low level economic report – the US Employment Cost Index on Friday. With Fed officials saying that, despite low levels inflation, hopes for sustained higher consumption on the back of rising wages should pave the way for action later this year. As the US ECI showed the slowed wage growth since 1982, markets quickly took it was a sign that the Fed’s prognosis was misguided: per the fed funds futures contracts derived implied probabilities, there was a 48% chance of a rate hike in September ahead of the US ECI release; afterwards the probability dropped to 40%. Around the data, EURUSD jumped over 1% before fading back throughout the day on Friday.

Friday’s violent topside price action in EURUSD is indicative of a market that has too many chips on the table: the market was too aggressive in pulling forward expectations of a Fed rate hike; and there were still too many traders short Euro in the market. Indeed, per the CFTC’s COT report, there were still 104.0K net-short Euro positions held by speculators for the week ended July 28, 2015; likewise, FXCM’s SSI has indicated that the retail crowd has been net-short EURUSD since the end of March. Both of these conditions may have fed into the short covering move amid unwinding rate hike expectations on Friday.

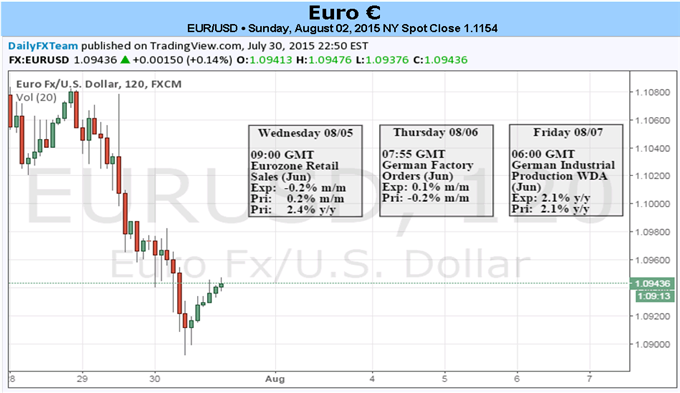

With several significant Euro-Zone and US economic data release due over the coming days – the calendar is quite saturated with central bank activity between Tuesday and Thursday, and the July US Nonfarm Payrolls report will be released on Friday – it’s very likely that the coming five days bring about the same burst of volatility that the past week wrought.

FXCM, L.L.C.® assumes no responsibility for errors, inaccuracies or omissions in these materials. FXCM, L.L.C.® does not warrant the accuracy or completeness of the information, text, graphics, links or other items contained within these materials. FXCM, L.L.C.® shall not be liable for any special, indirect, incidental, or consequential damages, including without limitation losses, lost revenues, or lost profits that may result from these materials. Opinions and estimates constitute our judgment and are subject to change without notice. Past performance is not indicative of future results.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 as USD rebounds

EUR/USD lost its traction and retreated slightly below 1.0700 in the American session, erasing its daily gains in the process. Following a bearish opening, the US Dollar holds its ground and limits the pair's upside ahead of the Fed policy meeting later this week.

USD/JPY recovers toward 157.00 following suspected intervention

USD/JPY recovers ground and trades above 156.50 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, the Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.