Fundamental Forecast for Euro: Neutral

- Expectations for the ECB’s QE program were established on Wednesday after a ‘leak’…

- …but ECB President Draghi delivered, and the new QE program lived up to thepre-announcement hype.

- Have a bullish (or bearish) bias on the Euro, but don’t know which pair to use? Use a Euro currency basket.

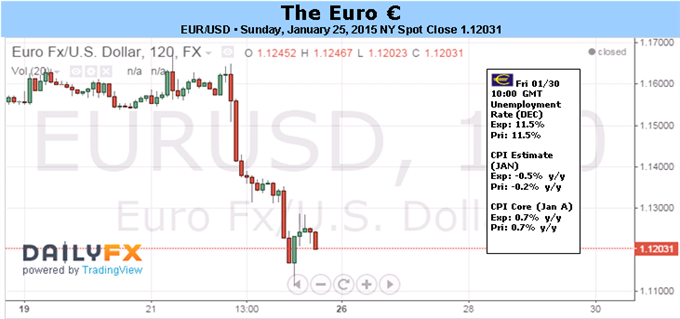

The Euro’s beating continued last week, with fresh 11-year lows coming against the US Dollar after the European Central Bank unveiled its much-anticipated QE program. EURUSD closed the week down a whopping -3.24% at $1.1203 while EURJPY closed down by -3.01% at ¥131.95. Volatility measures have swelled the past few days, and there is little indication that sharp price swings will abate anytime soon: the Euro has three very strong influences driving price right now.

The first component of the risk triumvirate would of course be the ECB’s historical decision to open up its balance in order to attempt to buoy inflation expectations. Since early-November, we’ve heard ECB President Mario Draghi discuss the desire to boost the ECB’s balance sheet back to its early-2012 levels. At €2.16 trillion for the week ended January 16, the balance sheet is still roughly €1 trillion short of its peak in the first half of 2012. The ECB’s QE program at €60bn/month will accomplish this by Q3’16. But this is not the main takeaway from the ECB’s monumental decision; rather, the fact that the program is open-ended means it is significantly more aggressive than the assumed ‘through the end of 2016’ that was first floated the day before the ECB’s meeting this week.

Market participants have priced in a good deal of the easing expectations; but with real yields low, the Euro is essentially a funding currency at this point in time, not a growth currency. Inflation expectations continue to tumble, as measured by the 5Y5Y inflation breakevens, but this is not a great indicator anymore: the ECB’s new program will include purchases of inflation linkers. So, falling expectations are a component of market participants front-running the commencement of the QE program in mid-March.

Sliding bond yields and elevated equity indices serve as a good indication of the ECB’s dovish move. The question henceforth is: how optimistic are market participants that the aforementioned measures will revive the region’s flagging growth and disinflationary spiral? When the Fed implemented its QE programs, the US Dollar slid rapidly into the announcements, but bottomed quickly thereafter as traders began pricing in the impact of QE: an improved economic environment.

For the Euro, finding a bottom might not be so easy to achieve in the near-term. The second member of the risk triumvirate, the Greek elections, have brought a new element into the equation: the far-left, anti-bailout Syriza party in as the custodians of the Greek government. Syriza leader and likely Greek Prime Minister Alexis Tsipras has voiced his desire to renegotiate Greece’s debt burden, and German officials have been more open than in the past to a potential debt restructuring deal. The rise of an anti-bailout party poses a real threat to the current construct of the Euro-Zone: will Greece leave and reintroduce the Drachma?; or will Germany say ‘enough is enough’ and call it quits amid the rising cost of saving the Euro-Zone? Neither is a palatable outcome for the Euro.

Between the ECB’s QE program and the Syriza victory, there is good reason why traders may treat the Euro with hostility in the coming weeks. But a third wrinkle emerges this week: the Federal Reserve’s own policy meeting. This may be the best opportunity for the Euro to rebound. Market measures (the Fed funds rate and overnight index swaps (OIS)) now point to a Q4’15 rate hike from the Fed, far more dovish than what the Fed’s dot plot suggested just last month.

With a large Euro short position in the futures market – speculators currently hold 180.7K net-short contracts, the most since the week ended June 5, 2012 (195.2K) – and a five-year higher in long-end (10Y+) US Treasury shorts, there is a powder keg mid-week in the FOMC meeting that offers a ray of hope for Euro bulls. Without a dovish Fed, however, hope for the Euro rests solely on incoming data, evidence that growth is returning and no more QE is down the road. There are few guarantees in life; but the Euro’s risk triumvirate of the ECB’s QE program, the Greek elections, and the FOMC meeting should keep volatility elevated for the foreseeable future.

FXCM, L.L.C.® assumes no responsibility for errors, inaccuracies or omissions in these materials. FXCM, L.L.C.® does not warrant the accuracy or completeness of the information, text, graphics, links or other items contained within these materials. FXCM, L.L.C.® shall not be liable for any special, indirect, incidental, or consequential damages, including without limitation losses, lost revenues, or lost profits that may result from these materials. Opinions and estimates constitute our judgment and are subject to change without notice. Past performance is not indicative of future results.

Recommended Content

Editors’ Picks

AUD/USD gains momentum above 0.6500 ahead of Australian Retail Sales data

AUD/USD trades in positive territory for six consecutive days around 0.6535 during the early Asian session on Monday. The upward momentum of the pair is bolstered by the hawkish stance from the Reserve Bank of Australia after the recent release of Consumer Price Index inflation data last week.

EUR/USD holds positive ground above 1.0700, eyes on German CPI data

EUR/USD trades on a stronger note around 1.0710 during the early Asian trading hours on Monday. The weaker US Dollar below the 106.00 mark provides some support to the major pair.

Gold trades on a softer note below $2,350 on hotter-than-expected US inflation data

Gold price trades on a softer note near $2,335 on Monday during the early Asian session. The recent US economic data showed that US inflationary pressures staying firm, which has added further to market doubts about near-term US Federal Reserve rate cuts.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.