Fundamental Forecast for Pound:Neutral

- The Euro may have its own problems, but it may be able to lever the US Dollar’s moment of vulnerability.

- The retail crowd’s shift in the US Dollar is led by what could be a bottom forming in EURUSD led by sentiment.

- Have a bullish (or bearish) bias on the Euro, but don’t know which pair to use? Use a Euro currency basket.

The Euro broadly stabilized for the second straight week, posting a +1.09% gain against the US Dollar, with the EURUSD exchange rate closing at $1.2761 on Friday. The 18-member currency gained against all but two of the other seven major currencies, with minor gains rewarded to the Swiss Franc (EURCHF -0.09%) and the New Zealand Dollar (EURNZD -0.31%). Concerns over the region’s growth prospects continue to linger, but they haven’t produced further downside yet in the Euro.

Although economic conditions have moved off the low, the Euro-Zone remains in an economic state on the verge of its third recession since the financial crisis began in 2008. The Citi Economic Surprise Index closed the week at -54.1, barely off the yearly low established on October 14 at -57.3.

The big concern levied by market participants that’s holding back the Euro is the ongoing pressure in medium-term inflation expectations. The 5Y5Y breakeven inflation swap, the European Central Bank’s preferred market measure of medium-term inflation expectations, slumped to a new yearly low this week before rebounding sharply. The gauge fell as low as 1.541% on Wednesday but closed the week at 1.779%.

What’s particularly interesting about this recent mix of financial and economic conditions is that the Euro hasn’t been depreciating. EURUSD is nearly 300-pips off of its early-October low, and the futures market remains saturated with aggressively short speculators. Non-commercials/specs held 155.3K net-short contracts for the week ended October 14, an increase from the 146.2K net-short contracts held a week earlier. Still, market positioning is off its extreme seen in early-September, when specs held 161.4K net-short contracts.

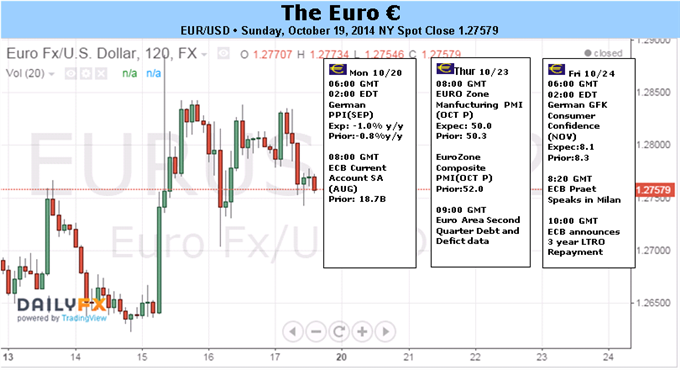

There is latent potential, then, if the Euro is braving weakening conditions and a buildup of short positions, for a short covering rally. One could develop as the US Dollar faces its own moment of vulnerability, or if incoming economic data doesn’t disappoint market expectations too greatly. The week is packed with typically market-moving PMI releases. Overall, further weakness is anticipated in the broader Euro-Zone indicators due to drag originating out of France and Germany.

The scope of the incoming recession to the Euro-Zone’s largest economy will be in particular focus, as the preliminary October German Manufacturing PMI is expected to decrease further to 49.6, indicating a heightened pace of contraction. The weak reading should reflect not only weakening domestic demand but also softer foreign demand, from Euro-Zone and emerging market partners alike. This means that any economic weakness forthcoming may be beyond the current scope of the ECB’s measures.

If the table is getting set for a Fed-styled, sovereign QE program to bolster the ECB’s easing stance, then that too will have to wait: the market is eagerly awaiting the ECB to release the results of the asset quality review (AQR) on Sunday. –CV

FXCM, L.L.C.® assumes no responsibility for errors, inaccuracies or omissions in these materials. FXCM, L.L.C.® does not warrant the accuracy or completeness of the information, text, graphics, links or other items contained within these materials. FXCM, L.L.C.® shall not be liable for any special, indirect, incidental, or consequential damages, including without limitation losses, lost revenues, or lost profits that may result from these materials. Opinions and estimates constitute our judgment and are subject to change without notice. Past performance is not indicative of future results.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of US jobs report

EUR/USD stays in a consolidation phase above 1.0700 after closing the previous two days in positive territory. Investors eagerly await April jobs report from the US, which will include Nonfarm Payrolls and Unemployment Rate readings.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2550 amid the softer US Dollar on Friday. Market participants refrain from taking large positions as focus shifts to April Nonfarm Payrolls and ISM Services PMI data from the US.

Gold remains stuck near $2,300 ahead of US NFP

Gold price struggles to gain any meaningful traction and trades in a tight channel near $2,300. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support to XAU/USD ahead of the key US NFP data.

Solana price pumps 7% as SOL-based POPCAT hits new ATH

Solana price is the biggest gainer among the crypto top 10, with nearly 10% in gains. The surge is ascribed to the growing popularity of projects launched atop the SOL blockchain, which have overtime posted remarkable success.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.