GBP: Jan 27, 10:30 Gross Domestic Product (QoQ)

GBP: Jan 27, 10:30 Gross Domestic Product (YoY)

USD: Jan 27, 14:30 Durable Goods Orders

USD: Jan 27, 14:30 Durable Goods Orders ex Transportation

USD: Jan 27, 16:00 New Home Sales (MoM)

USD: Jan 27, 16:00 Consumer Confidence

USD: Jan 28, 20:00 Fed Interest Rate DecisionUSD: Jan 28, 20:00 Fed's Monetary Policy StatementUSD: Jan 29, 14:30 Initial Jobless ClaimsJPY: Jan 30, 00:30 National Consumer Price Index (YoY)EUR: Jan 30, 11:00 Consumer Price Index - Core (YoY)EUR: Jan 30, 11:00 Consumer Price Index (YoY)USD: Jan 30, 14:30 Gross Domestic Product AnnualizedUSD: Jan 30, 16:00 Reuters/Michigan Consumer Sentiment Index

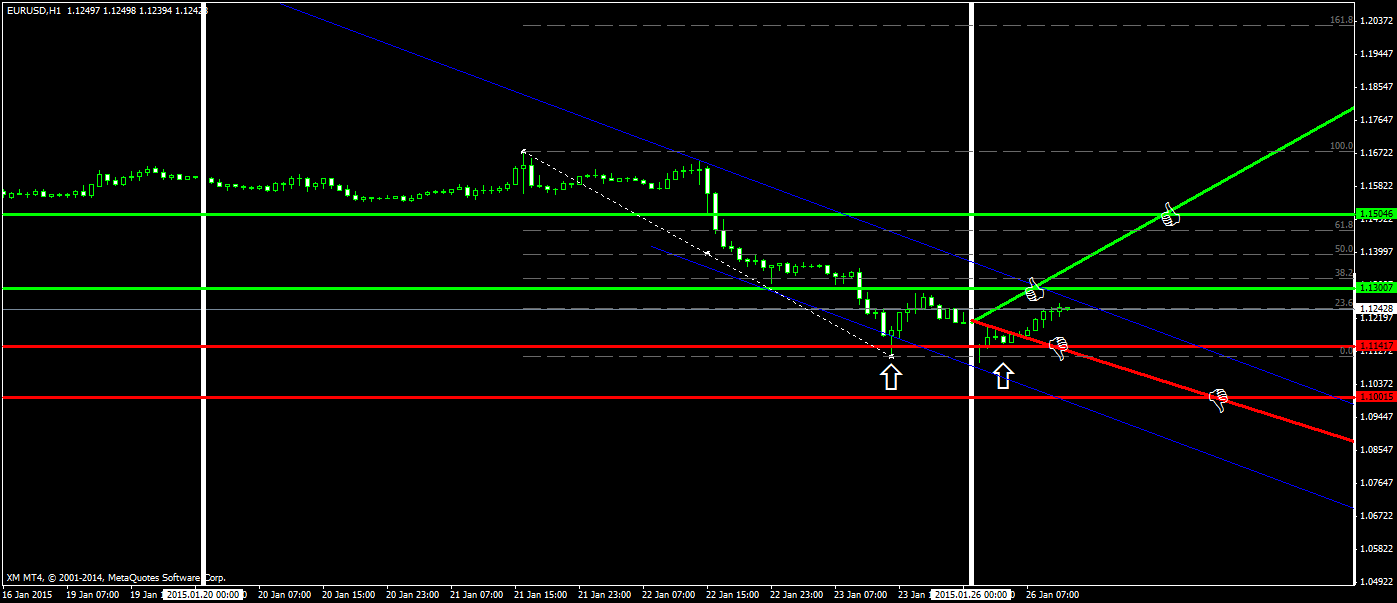

EUR/USD

Last week the EUR/USD has oscillated around 1.1679.-1.1203. Towards the end of the week, the USD has strengthened against the EUR and finished the week at 1.1204. The closest support for this week is found at 1.1141. If this support is overcome, we can expect a decline down to 1.1000. The closest resistance for this week is found at 1.1328. If this resistance is overcome we can expect a growth up to 1.1460. This week we expect a bearish trend.

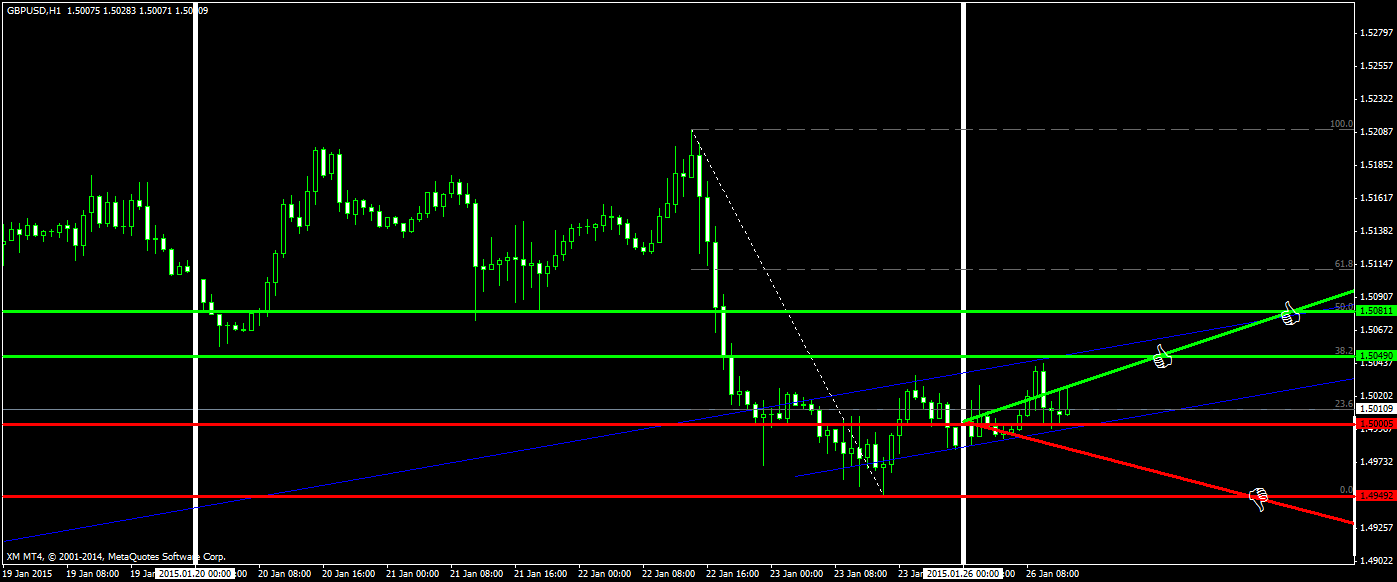

GBP/USD

Last week the GPB/USD has oscillated around 1.5211-1.4949. Towards the end of the week, the USD has strengthened against the GBP and finished the week at 1.5000. The closest support for this week is found at 1.5000. If this support is overcome, we can expect a decline down to 1.4949. The closest resistance for this week is found at 1.5050. If this resistance is overcome we can expect a growth up to 1.5080. This week we expect a bearish trend.

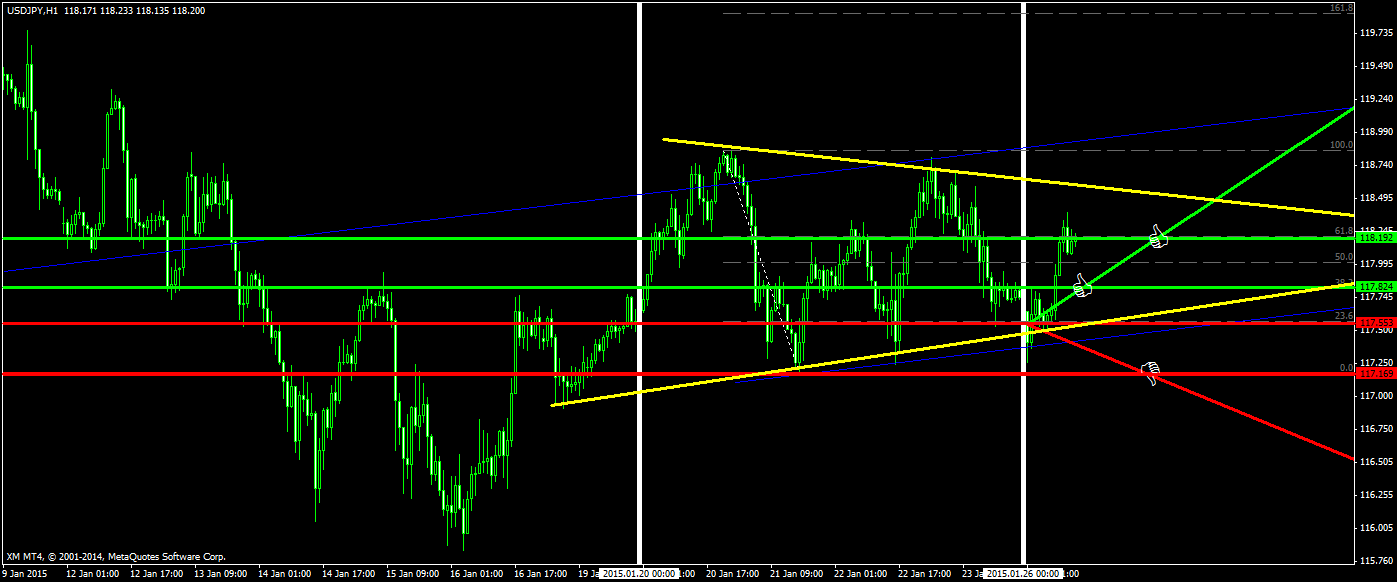

USD/JPY

Last week the USD/JPY has oscillated around 118.86-117.17. Towards the end of the week, USD has strengthened against the JPY and finished the week at 117.70. The closest support for this week is found at 117.55. If this support is overcome, we can expect a decline down to 117.17. The closest resistance for this week is found at 117.82. If this resistance is overcome we can expect a growth up to 118.19. This week we expect a bullish trend.

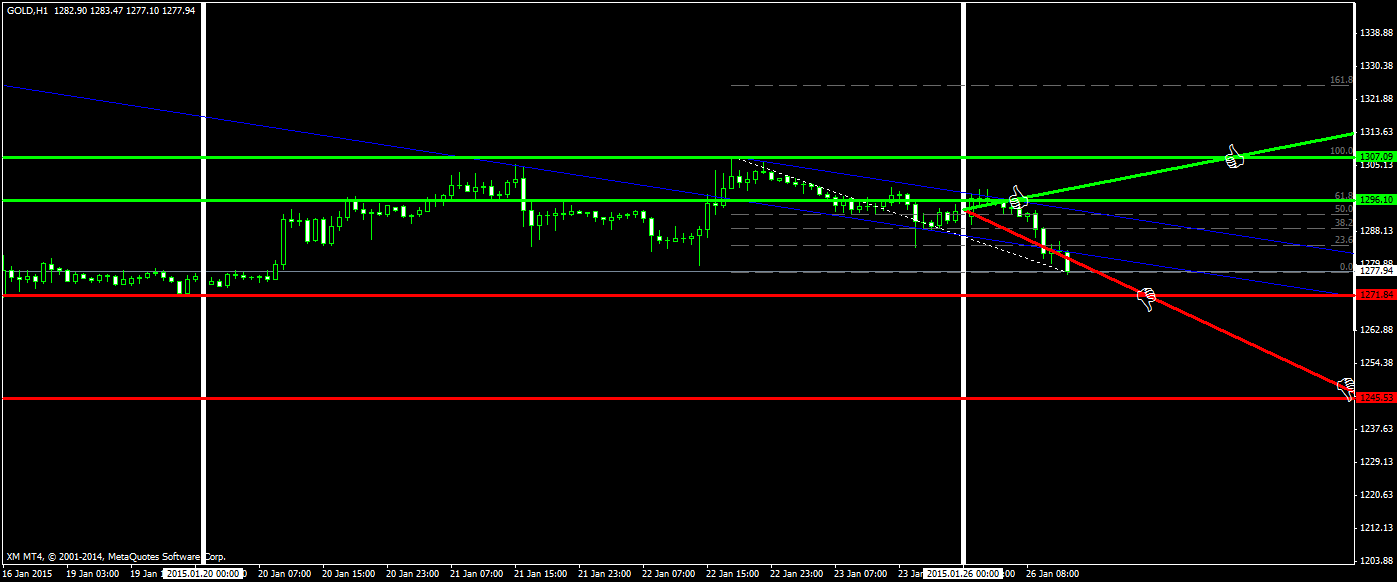

GOLD

Last week Gold has oscillated around 1271-1307. Towards the end of the week, Gold has strengthened and finished the week at 1290. The closest support for this week is found at 1271. If this support is overcome, we can expect a decline down to 1245. The closest resistance for this week is found at 1296. If this resistance is overcome we can expect a growth up to 1307. This week we expect a bearish trend.

By utilizing this website, you agree to be bound by these terms and conditions. This is a legal agreement (“Agreement”) between you and Leconte, sro.. (“Gurulines”) for use of the website, data, Gurulines electronic trading platform, and products and services which you selected or initiated, which may include the Gurulines trading platform and third party signal providers (“Products and Services”). If you do not agree with the terms of this Agreement, do not use this website or any of the Products and Services.

Recommended Content

Editors’ Picks

EUR/USD holds firm above 1.0700 ahead of German inflation data

EUR/USD trades on a firm footing above 1.0700 early Monday. The pair stays underpinned by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 155.00 on likely Japanese intervention

USD/JPY is recovering ground after crashing to 155.00 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

Gold price bulls move to the sidelines as focus shifts to the crucial FOMC policy meeting

Gold price (XAU/USD) struggles to capitalize on its modest gains registered over the past two trading days and edges lower on the first day of a new week, albeit the downside remains cushioned.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.