Weekly outlook

This week on the Markets

1. U.K. December Nationwide Housing Prices, Mon., 30th December, 7:00 a.m.

U.K. November house prices rose 0.6 percent, compared to 1 percent rise in October, Nationwide building society reported in Swindon. Forecast of the economists was ranging from 0.2 percent to 1 percent. On year to year comparison house prices rose 6.5 percent, compared to October’s 6.2 percent. In November, the average house price in U.K. cost 174,566 British Pounds. Rising home prices may contradict to the slow pay rises in U.K. and endanger the ability to buy for the first time buyers. Economy in U.K. continues to recover, although house prices rise at the current pace may not seem justified to keep up with the pace of the total whole picture of economic recovery. Henyep expects that December house prices will keep rising to 0.7 percent from previous month and yearly lift will stand at a 7.1 percent price jump.

2. U.S. November Pending Home Sales, Mon., 30th December, 3:00 p.m.

The number of contract Americans signed to buy previously-owned homes unexpectedly fell in October for a fifth consecutive month amid higher borrowing costs that are denting the real-estate recovery. It decreased 0.6 percent after a 4.6 percent drop in December according to National Association of Realtors said in Washington. The median projection in a survey of economists called for a 1 percent gain in the index from a month before. Higher mortgage rated and price increases driven by a tighter supply of homes for sale may be keeping some prospective buyers out of the real-estate arena. Further gains in hiring and confidence would help boost the housing-market recovery as well as the U.S. economic expansion. The pending sales index was 102.1 on a seasonally-adjusted basis, the lowest this year. A reading of 100 corresponds to the average level of contract activity in 2001, or “historically healthy’ home buying traffic, according to NAR. We expect that November Pending Home Sales will be at 1 percent rise, with yearly minus 0.2 percent decrease.

3. U.S. December Consumer Confidence, Tue., 31st December, 3:00 p.m.

Confidence among U.S. consumers unexpectedly declined in November to a seven-month low as Americans grew more pessimistic about the labor-market outlook. The Conference Board’s Index fell to 70.4 from a revised 72.4 a month earlier that was stronger than initially estimated, the New-York based private research group reported. The median forecast of the economists was calling from a reading of 72.6. The drop in sentiment helps explain why some retailers such as Best Buy Co see a need to match competitors’ discounts this holiday-shopping season. More employment opportunities and wage gains would help lay the groundwork for a pickup in household purchases that make up about 70 percent of the U.S. economy. We expect that December confidence in U.S. will jump up to 76.3

4. European Union December Markit Manufacturing PMI, Thurs., 2nd January, 8:58 a.m.

Euro-area factory output grew at a faster pace than economists forecast in December, led by Germany, as the currency bloc continued its gradual recovery from a record-low recession. An index based on a survey of purchasing managers in the manufacturing industry increased to 52.7, a 31-month high, from 51.6 in November, London-based Markit Economics said in its statement. That is above the estimate of 51.9 in a previous survey of the economists. In comparison, China’s manufacturing output fell to three-month low. Euro growth predominantly weighed in manufacturing, where rising exports have helped push growth of the sector to the fastest in two and a half years. ECB President Mario Draghi said output growth should continue “in particular owing to some improvement in domestic demand supported by the accommodative monetary policy stance” Expansion “should, in addition, benefit from gradual strengthening of demand for exports” he said. Henyep expects that the data will officially get confirmed on a date of release as the growth progresses.

5. U.S. Jobless Claims, Thurs., 2nd January, 1:30 p.m.

Below is the chart of the U.S. initial jobless claims for the last two years. No doubt economic conditions and job market has improved in U.S. as it may be seen. Jobless claims falling below 300K in September was the strongest ever in the period. For the week ended December 21st, jobless claims declined by 42,000, more than forecast, to 338,000, Labor Department reported in Washington.Continuing claims rose by 46,000 to 2.92 million in the week ended Dec 14, the highest since August. Those who’ve used up their traditional benefits and are now collecting emergency and extended payments decreased about 40,7000 to 1.33 million in a week ended Dec 7. The year-end holidays make it difficult to adjust for fluctuations in applications for jobless benefits, a Labor Department official said as the figures were released. Another report showed that pickup in employment is helping boost personal spending. The unemployment rate among people eligible for benefits held at 2.2 percent in the week ended Dec 14th. We expect that this year last full week’s initial claims among Americans will be at 345,000

6. U.S. December ISM manufacturing and November construction spending, Thurs., 2nd January, 3:00 p.m.

Manufacturing in the U.S. unexpectedly accelerated in November at the fastest pace in more than two years, indicating factories will be a source of strength for the economy heading into 2014. The Institute for Supply Management’s index rose to 57.3, the highest since April 2011, from 56.4 a month earlier, the Tempe, Arizona-based group’s report showed. The median forecast in a survey called to 55.1 reading. Export orders climbed, reflecting a rebound in the world economy that’s translating into more production and hiring. Construction increased to 0.8 percent in October as well that is when it slid to minus 0.3 percent in September, and the rebound is obvious. The main propeller was in non-residential contracts, including commercial and educational areas. We expect that Manufacturing for December will be insignificantly cooler at 57.0 on a scale, while November construction spend will stand at 0.6 percent from previous month.

7. U.K. November Mortgage Approvals, Fri., 3rd January, 9:30 a.m.

Back to U.K., mortgage approvals in October on the island rose to the highest in almost six years and business lending fell, highlighting an imbalance in credit that Bank of England Governor Mark Carney is trying to address. Lenders granted 67,700 mortgages, the most since February 2008, compared with 66,891 in September, the central bank said in a report in London. The median earlier forecast called for 68,500 approvals. Business lending fell 1.1 billion pounds. The BoE’s Financial Policy Committee said that it will end incentives for mortgages in its Funding for Lending credit-boosting program and focus the initiative on corporate loans. The change is aimed at both helping companies get access to credit and heading off any potential risks for financial stability from Britain’s strengthening housing market.Net mortgage lending rose by 1.2 billion pounds in October from September, the central bank said. Consumer credit increased by 457 million pounds. We expect that November mortgage approvals will continue rising and will be at 69,700

8. U.K. December PMI construction, Fri., 3rd January, 9:30 a.m.

U.K. Construction expanded at the fastest pace in more than six years in November, driven by a surge in housebuilding. AN index of construction activity rose to 62.6 from 59.4 in October, Markit Economics said in London. The median forecast of the economists called for 59. The gauge have been above 50 level that divided expansion from contraction since May. Residential construction growth was the strongest in a decade. The report adds to signs the recovery is maintaining the momentum, after Markit’s report showed manufacturing growing the most in almost three years. Bank of England policy makers meeting later next year will probably leave the base lending rate unchanged at a record low, in line with guidance set out in August, to cement the recovery. We see still big loss in output before U.K. can reach its pre-recession peak. WE expect that December PMI construction will be at 62.0 level, steady and strong

9. European Union Inflation Data, Fri., 3rd January, 10:00 a.m.

Euro-area inflation stayed below 1 percent for a second month, less than half the European Central Bank’s ceiling, underscoring the weakness in parts of the euro region’s economy. The annual rate rose to 0.9 percent from 0.7 percent in October, the European Union’s statistics office said in Luxembourg. The median forecast in earlier survey called for 0.8 percent. Separately, unemployment unexpectedly dropped to 12.1 percent. The increasing inflation rate is mostly portraying itself via higher energy prices. Once those start settling down, early next year we may witness that inflation will weaken again. November’s data mark 10th consecutive month that the rate has been less than ECB’s 2 percent goal. The central bank unexpectedly cut its key refinancing rate by a quarter point to 0.25 percent on Nov 7 to prevent slowing inflation from taking hold in a still-fragile euro-area economy. Mario Draghi, ECB’s President, has commented, that the region needs record-low borrowing costs to combat a “prolonged” period of weak consumer-price growth and “very high” unemployment. Henyep expects that December inflation will stay unchanged at 0.9 percent from a year ago

Chart of the week

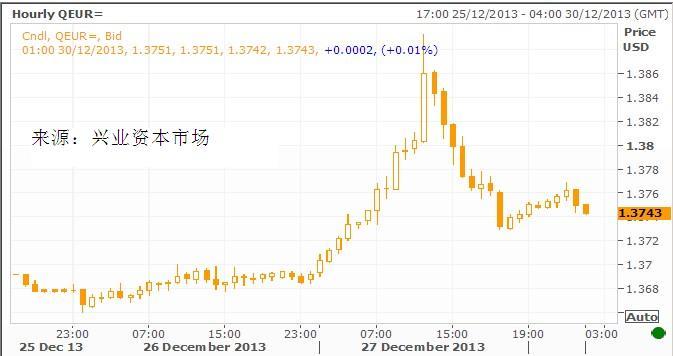

Euro rises to more than 2-year high vs dollar

The euro jumped to its strongest level against the dollar in more than two years on Friday as banks adjusted positions for the year end, while the yen hit five-year lows for a second straight session.

The European Central Bank will take a snapshot of the capital positions of the region's banks at the end of 2013 for an asset-quality review (AQR) next year to work out which of them will need fresh funds. The upcoming review has created some demand for euros to help shore up banks' balance sheets, traders said.

The currency has risen more than 10 cents from a low hit in July below $1.28, as the euro zone economy came out of a recession triggered by its debt crisis.

Moves were exaggerated because liquidity was thin, traders said, but analysts said the euro was likely to hold its strength into 2014.

COT Weekly Report

HY Markets commitment of traders (COT) weekly report is based on the data published every Friday by the U.S. Commodity Futures Trading Commission (CFTC). It seeks to provide investors with up-to-date information on futures market operations. It contains reportable (commercial and non-commercial holdings) and non-reportable positions. However, the non-commercial holding is an important signal of the futures traders’ sentiment that can be a very powerful trading tool to help anticipate market direction. Therefore, by looking at the net position changes, it will help determine the likelihood of a trend continuing or coming to an end in the near future.

How do I read the Non-commercial net position changes?

Positive means a net long position, and negative means a net short position. When the net position changes show that the net long position is decreasing, this indicates the market sentiment is down and vice verse, when the net long position is increasing, it indicates the market is optimistic.

How to read the open interest net changes?

The information set forth herein was obtained from sources which we believe to be reliable, but its accuracy cannot be guaranteed. It is not intended to be an offer, or the solicitation of any offer, to buy or sell the products or instruments referred herein. Any person placing reliance on this commentary to undertake trading does so entirely at their own risk.

Recommended Content

Editors’ Picks

AUD/USD gains momentum above 0.6500 ahead of Australian Retail Sales data

AUD/USD trades in positive territory for six consecutive days around 0.6535 during the early Asian session on Monday. The upward momentum of the pair is bolstered by the hawkish stance from the Reserve Bank of Australia after the recent release of Consumer Price Index inflation data last week.

EUR/USD: Federal Reserve and Nonfarm Payrolls spell action this week

The EUR/USD pair temporarily reconquered the 1.0700 threshold last week, settling at around that round level. The US Dollar lost its appeal following discouraging United States macroeconomic data indicating tepid growth and persistent inflationary pressures.

Gold: Strength of $2,300 support is an encouraging sign for bulls

Gold price started last week under heavy bearish pressure and registered its largest one-day loss of the year on Monday. The pair managed to stage a rebound in the second half of the week but closed in negative territory.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.