- The fight over Ukraine is an unwelcome source of uncertainty

- Hiring in the U.S. improves in February

- American businesses have lots of cash to invest

When the 2014 winter Olympics were awarded to Sochi, there was considerable surprise. The city rests on the Black Sea and is known more as a summer resort than a winter wonderland. Russia’s southwest is not the most stable of regions, resting in a pocket of countries and ethnicities that have produced considerable unrest over many centuries (including this one).

At a cost of $51 billion, however, Russia was able to build venues and manufacture snow in sufficient amounts to give Olympic viewers the impression of Innsbruck, Austria. Investments in security created a sense of peace that has been essential to the Games since ancient times.

Sadly, once the cameras were off, the veneer of international harmony fell away in a flash. Just days after the closing ceremony and less than 300 miles from Sochi, Russian forces seized control of Crimea, a semi-autonomous region that is part of Ukraine. The goodwill garnered by the Olympics was quickly amortized, and the world now finds itself in a very tense situation.

While the origins of the crisis are political, economic considerations are playing a major role in the diplomatic chess game now underway. For now, markets seem to be taking the situation very much in stride, but an escalation of conflict could certainly test investor patience.

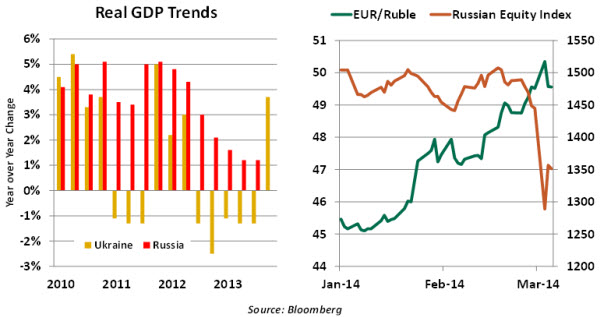

Ukraine is not a major player in the world economy. Its gross domestic product (GDP) ranked 53rd globally last year, and its GDP per capita didn’t make the top 100. By many accounts, it has struggled with poor policy, corruption and political conflict since earning independence in 1991.

The Ukrainian economy has faltered in the years since the 2008 financial crisis, bringing the country to the brink of default. The most recent round of tension arose over negotiations for aid, which was offered by both the European Union (EU) and Russia on the basis of Ukraine’s symbolic and strategic value.

While far larger and healthier, Russia’s economy has not been performing all that well of late. Soft commodity prices and the sluggish recovery in Europe have limited exports, which account for about a third of Russian GDP. The Bank of Russia implemented a large emergency rate hike at the beginning of March, which will not be helpful to growth.

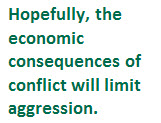

Economically, Russia has quite a bit to lose from escalating its aggression. Russia was the world’s third-largest recipient of foreign investment last year, with more than 60% of that coming from banks in the EU. Those flows may now be curtailed by apprehension, diplomatic pressure or outright sanctions.  The big entry on the other side of the threat ledger is Russian energy, which both Ukraine and the EU rely on heavily. Russia supplies about a third of Europe’s natural gas and crude oil and in the past has used these flows as weapons in diplomatic matters. Exports from the EU to Russia are substantial, so isolating Russia would put those flows in question.

The big entry on the other side of the threat ledger is Russian energy, which both Ukraine and the EU rely on heavily. Russia supplies about a third of Europe’s natural gas and crude oil and in the past has used these flows as weapons in diplomatic matters. Exports from the EU to Russia are substantial, so isolating Russia would put those flows in question.

With the notable exception of the United Kingdom, Europe’s economy has been struggling to separate itself from recession. A tough stand against Russia, while principled, would come at a delicate time in the business cycle. Exposures of EU banks could become problematic if negotiations fail and sanctions are enacted. With the European Central Bank’s asset quality review underway, there is no appetite for a new round of credit stress. For these reasons, Germany, in particular, seems very reluctant to pursue tough measures against Russia.

Any kind of military intervention would be expensive and unsettling. The U.S. defense budget is far larger than those found anywhere in Europe, so Washington would undoubtedly be asked for support. Yet recent American attempts at stabilization and nation-building in Europe, the Middle East and North Africa have not proven terribly successful. The administration and the Congress will understandably hesitate to commit troops or materials.

The sad fact is that the euphoria of overthrowing an unpopular regime gives way quickly to the hard business of restoring social, governmental and financial stability. On that last front, an aid package for Ukraine that was cobbled together should help a bit, but it is long on pledges and relatively short on cash. This is likely to be the first step in a long and expensive process.

Markets have weathered a long list of regional skirmishes over the past few years. This is not to minimize the awful human toll that can accumulate in these cases, but the cold calculus of asset prices looks a long way forward.

Unless the tone in Ukraine escalates to a much more dangerous pitch, the financial impact of recent events should eventually fade away. But this week reminds us of lingering fragilities in the global village, which can impede progress and increase risk premiums.

Skeptical Olympic observers referred to Sochi as a “Potemkin Village,” a façade with little behind it. Ironically, Grigory Potemkin built the original false frontage in Crimea in 1787 to impress Catherine the Great. With everything now out in the open over there, let’s hope that things settle down soon.

February Employment Report – Not So Chilly After All

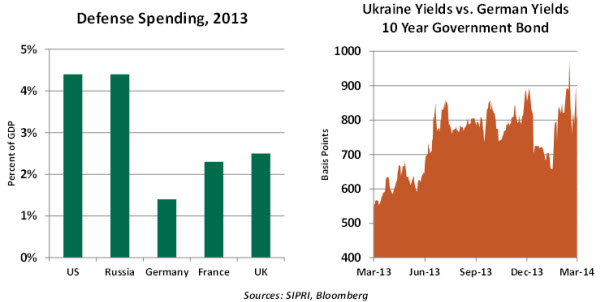

Winter chills did keep scores away from work in February, but the employment numbers were significantly better than estimates of December and January. Last month’s 175,000 gain in payroll employment suggests that despite poor weather, the underlying momentum in the labor market is not impaired.

The unemployment rate moved up one notch to 6.7% in February, reflecting a steady participation rate and a mild increase in employment as measured by the household survey (+42,000). The number of discouraged workers declined 130,000 from a year ago to 775,000 in February. Projected economic growth suggests that discouraged workers are likely to return to the work force and bring about a higher participation rate, which implies only a gradual improvement in the unemployment rate in the months ahead.

The latest monthly increase lifted the three-month moving average employment gain to 129,000. By comparison, the change in payroll employment averaged 204,000 in the first 11 months of 2013. Bone-chilling winter weather explains most of the difference.

The latest monthly increase lifted the three-month moving average employment gain to 129,000. By comparison, the change in payroll employment averaged 204,000 in the first 11 months of 2013. Bone-chilling winter weather explains most of the difference.

Construction employment (+15,000) was positive even in the face of bad weather. Hiring in the leisure and hospitality industry moved up 25,000, while heath care employment rose only 9,500, marking the third below-trend improvement in this sector.

A sharp drop in hours worked in the construction sector, largely due to weather, and a modest decline in the service sector led to a shorter workweek in February (34.2 hours versus 34.5 hours in the first nine months of the year). A resumption of a longer week is nearly certain as weather conditions improve. Hourly earnings moved up 0.4% to $24.31, the largest increase in eight months. This puts the year-to-year gain at 2.2%, the best reading since October.  The latest employment report and other incoming economic data do not stand in the way of the current tapering program. The March 18-19 Federal Open Market Committee (FOMC) policy statement should include the announcement of another $10 billion in reduction of asset purchases, bringing the total monthly purchase to $55 billion. At this pace, the asset purchase program should conclude by October 2014.

The latest employment report and other incoming economic data do not stand in the way of the current tapering program. The March 18-19 Federal Open Market Committee (FOMC) policy statement should include the announcement of another $10 billion in reduction of asset purchases, bringing the total monthly purchase to $55 billion. At this pace, the asset purchase program should conclude by October 2014.

The 6.5% threshold for the unemployment rate is obsolete and is up for modification at the March FOMC meeting. The minutes of the January and subsequent Fed rhetoric support this expectation. Modified forward guidance could encompass broad trends in demand and a collection of labor markets indicators that present a comprehensive picture of employment conditions, rather than tying the future path of monetary policy to a single indicator.

There remain a lot of seasonal issues with economic reports, so we would again caution against reading too much into today’s employment news. But spring starts in a week, and one can only hope that more-normal temperatures will clear the snowdrifts and clear up the data.

Too Much Cash, Too Little Investment

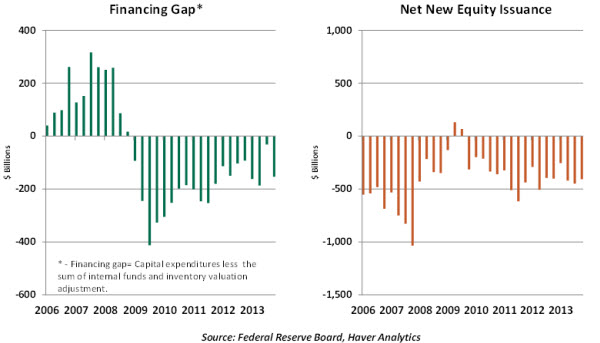

Capital expenditures of non-financial corporations were well below the sum of internal funds generated and inventory valuation adjustment during the last 20 straight quarters. This noticeable contrast between availability of funds and lack of investment spending raises an obvious question: What have firms done with excess cash?

Firms have three alternatives to put their excess cash to work – invest, pay dividends or buy back shares. U.S. non-financial firms have engaged in massive repurchases of equity and abstained from re-investing excess cash in their businesses during the last five years. Dividends as a percentage of GDP slowed in 2009 and 2010, moved up in 2011 but were nearly steady during the two years ended 2013.

Challenging global demand conditions, dysfunctional Congressional policy stances that increased fiscal policy uncertainty, and a 35% tax on profits held at foreign subsidiaries of American firms are factors mentioned as holding down business investment. Simply said, companies are apparently not seeing risk-adjusted rates of return that would lead them to initiate capital expenditures.

As a result, the capital stock of the United States increased a paltry 1.1% in 2012, marking the fifth straight year that the capital stock of the nation rose less than 2%. The United States invests about 15% of GDP, lower than any developed country except the United Kingdom. This may be one reason why productivity growth has been so sluggish in this country.  Policy must, therefore, focus on raising investment, as it is key to long-term growth. A couple of steps might help in this regard. First, investment tax credits or accelerated depreciation periods have been used successfully in the past and should be considered again. Second, offering U.S. multi-nationals preferred tax treatment if they repatriate capital is another option to encourage domestic investment.

Policy must, therefore, focus on raising investment, as it is key to long-term growth. A couple of steps might help in this regard. First, investment tax credits or accelerated depreciation periods have been used successfully in the past and should be considered again. Second, offering U.S. multi-nationals preferred tax treatment if they repatriate capital is another option to encourage domestic investment.

Some will certainly say that giving concessions could create issues of fairness or cause problems for the federal budget. But if corporate investment increases, economic returns in the forms of new hiring and increased competitiveness could certainly follow. The time to start preparing for the long-term is now.

Recommended Content

Editors’ Picks

AUD/USD remains firm above 0.6600 ahead of RBA

AUD/USD maintains its bullish bias well and sound on Monday, extending the multi-session recovery past the 0.6600 barrier ahead of the key interest rate decision by the RBA.

EUR/USD propped up near 1.0750 ahead of European Retail Sales

EUR/USD churned around 1.0770 to kick off the new trading week, with the pair rising after better-than-expected Purchasing Managers Index figures early Monday before settling into familiar chart territory above 1.0750 ahead of Tuesday’s pan-European Retail Sales figures.

Gold holds on to modest gains around $2,320

Gold trades decisively higher on the day above $2,320 in the American session. Retreating US Treasury bond yields after weaker-than-expected US employment data and escalating geopolitical tensions help XAU/USD stretch higher.

Bitcoin price holds above $63K as MicroStrategy tops BTC ownership list

Bitcoin (BTC) price recorded a rather bold two days this past weekend in a surge that saw millions in positions liquidated. However, the week is off to a calm start with altcoins sucking liquidity from the BTC market.

Stagflation warning: Service economy contracts as prices rise

In another stagflation warning sign, the U.S. service sector contracted in April even as service prices rose. The Institute for Supply Management's non-manufacturing PMI dropped to 49.4 in April, dipping from 51.4 in March.