This Week's Highlights

Sterling traders unnerved by weak inflation data

US Dollar strengthens on hawkish Fed tone

Australasian currencies weaker on Chinese data

FX Market Overview

Sterling strengthened after the UK inflation data showed a fall to1.6%; well below the BOE's target 2.0%. However, discounting pressure, the stronger Pound and falling energy prices were cited as the root causes of this dip and these are all highly variable. So Sterling ended the day stronger than it started but this morning's retail sales data put paid to that. The forecasts were for a small scale fall and that was right. It is in keeping with the last three months as well. We also got public sector borrowing data this morning and that showed an unwelcome rise in government borrowing.

Yesterday evening saw the release of the minutes from the last Federal Reserve Open Market Committee meeting and they reflected a move towards earlier interest rate rises as long as the flagging labour market growth picks up. Most members of the Open Market Committee saw little risk of falling inflation. So whilst inflation isn't at concerning levels yet, in their minds, there is scope for rate hikes in the medium term. The Dollar strengthened after the release of the minutes and remains at the stronger end of its ranges today.

The Euro had a less exciting day; meandering in the wake of the Pound and USD and sinking slowly in the East. There is a whiff of infighting amongst the member states. German, supported by a phalanx of Nobel Prize winning economists, is accursing other Eurozone members (Italy and France mainly) of breaking fiscal rules, running high deficits and jeopardising the Eurozone's recovery. Many of the economists note the austerity measures in Europe are entirely the wrong policy and a period of expansionist policies are called for. Prof Peter Diamond, described as the world's leading expert on unemployment, said, "Historians are going to tar and feather Europe's central bankers". These experts see the risk of depression in Europe as a real and present danger. This morning's purchasing managers indices are likely to pour more cold water on the recovery hopes and that whole negative scenario is weighing on the UK's recovery prospects because Europe is the UK's largest trading partner.

Manufacturing data from China hit a 3-month low last month and that has caused concerns for the economies of Australia and New Zealand; both heavily reliant on China for export sales. We have seen a little weakness in both the Aussie and Kiwi Dollars overnight.

As well as those mentioned above, today's data releases included US business and consumer confidence indices and the weekly jobless claims figures. The expectation wass that this data would be almost universally poorbut, in the end, the figures were mixed and that left the US Dollar treading water.

Away from the market, a robot, designed to study how robots can interact with humans, has hitchhiked its way across Canada and it has become an internet hit in the process. HitchBOT has been a lot more successful in hitchhiking than most but I wonder what it learned about human interaction and how did it not get stolen or bot-napped?

Currency - GBP/Australian Dollar

The Sterling – Australian Dollar exchange rate has broken below the support line I thought would contain it and found support at the same level it did in May and June. It is an interesting development because this A$1.78 level doesn't register as a technical level of any substance but it is clearly being seen as a support line. As such, it is vulnerable and we may well see a break below here to the Fibonacci support level at A$1.7350. Whatever the outcome on the short term movements, this currency pair is capped at A$1.8150 at the moment and that gives AUD buyers the target they need to make plans.

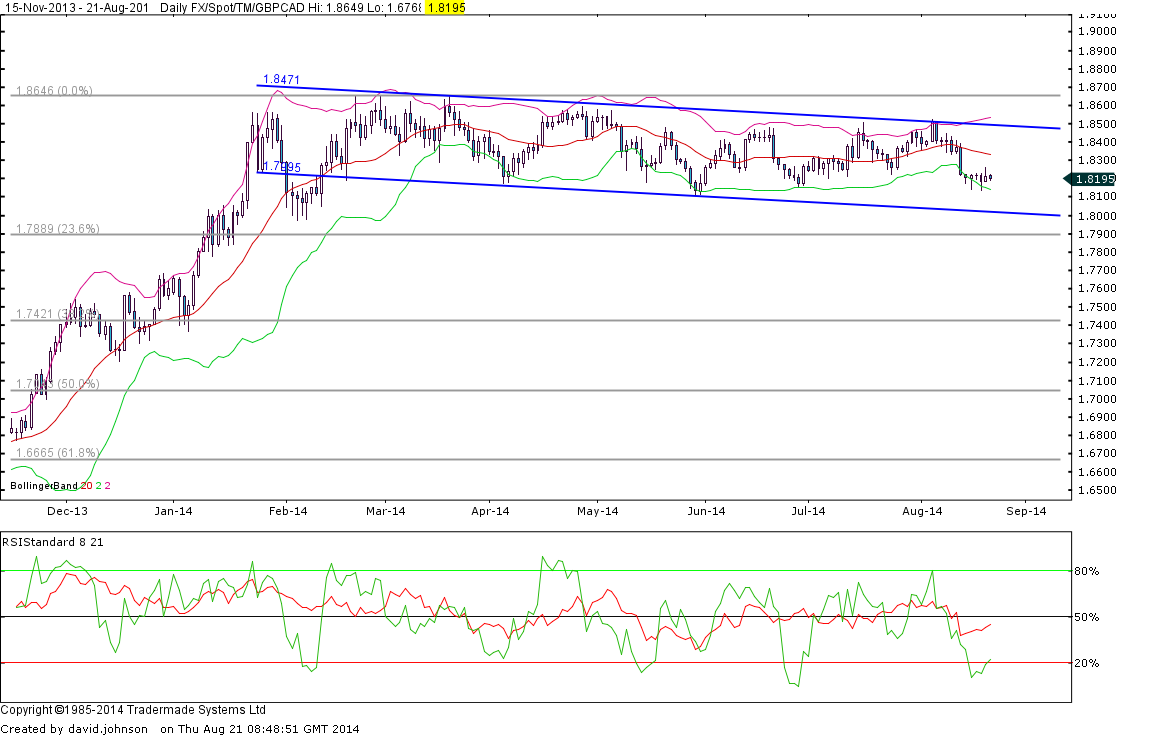

Currency - GBP/Canadian Dollar

Looking at this Sterling – Canadian Dollar chart is a bit of déjà vu. It is a channel that has been in place for the whole of 2014 and the top and bottom of that channel can be seen at C$1.85 and C$ 1.80 respectively. There isn't much more to be said about it really. CAD buyers should be leaping in with both feet at anything above the interbank level of C$1.83 and Cad sellers should be excited if they can sell at C$1.81 or better. It's not the most interesting report I have ever written but it is factually correct.

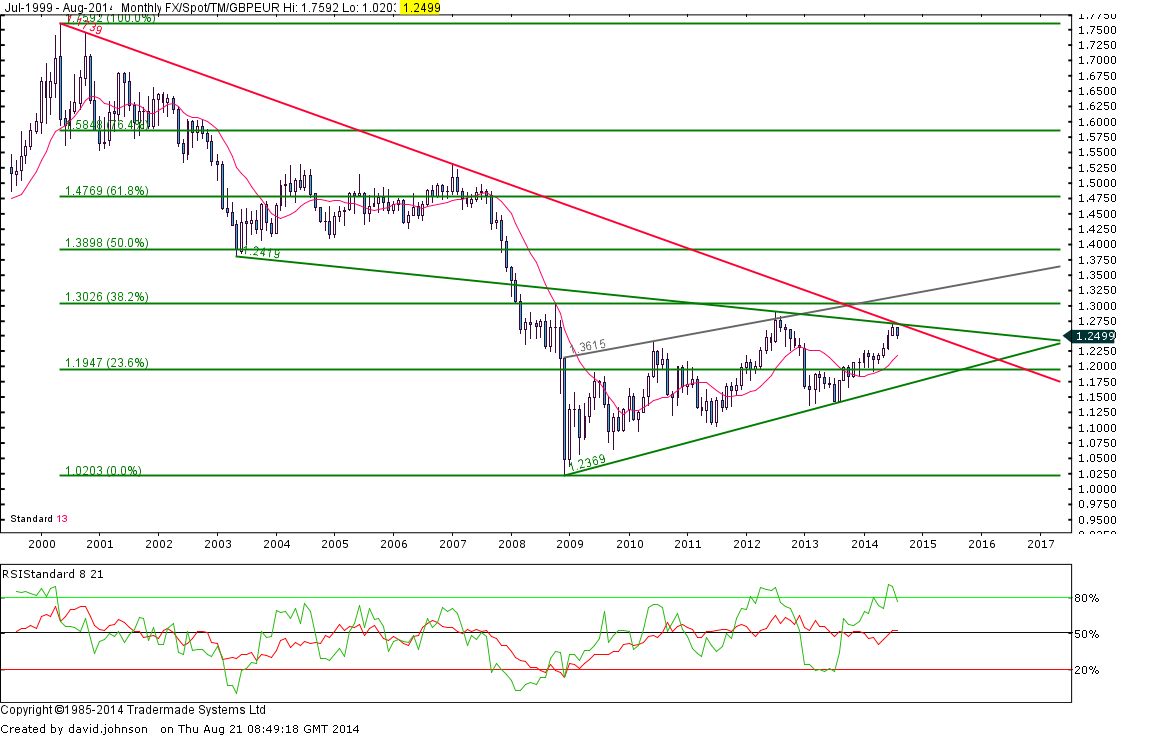

Currency - GBP/Euro

European economy is floundering, Germany is accusing France and Italy of breaking the fiscal rules, economists are battering the ECB and European union for their poor management of the Eurozone economy and unemployment remains grotesquely high across the region. However, the breadth of the liquidity in the euro is such that vast tranches of euro liquidity is wrapped up in central bank reserves; so there is comparatively little being traded. Hence the currency Sterling – Euro trading range is as tight as Maria Carey's vocal chords. €1.21 support and €1.2650 resistance mark the outer reaches of the current trading range. Use them to your advantage.

Currency - GBP/New Zealand Dollar

The Reserve Bank of New Zealand has stopped raising interest rates for now. That has weakened the Kiwi Dollar to some degree and yesterday's poor Chinese manufacturing data added to that weakness. However, the NZ base rate is still roughly 3% higher than most western economies; so the yield advantage ensures the NZD is in demand. That is what has kept the Sterling – NZD rate below NZ$2.00 to the pound. This pair is trading right in the centre of its range at the moment and seems unlikely to venture lower than NZ$1.9350 in the medium term.

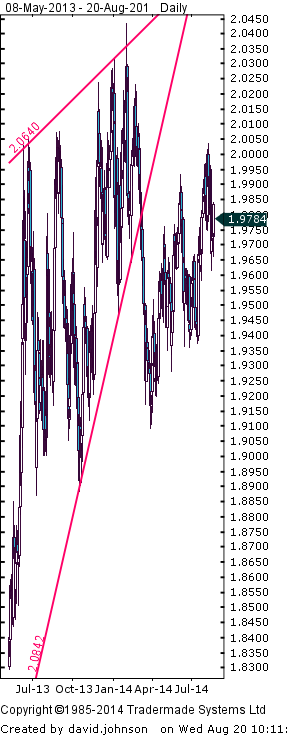

Currency - GBP/US Dollar

This long term chart shows the turnaround in the Pound’s fortunes and highlights the rally in Sterling that started in mid-2013. That rally ran out of steam in July 2014 after tensions in Ukraine and the Middle East started a flow of funds into the US Dollar for safe haven reasons. At the same time, Sterling started to lose its lustre as, amongst other things, inflation data softened and forecasts for the first interest rate hike from the Bank of England were pushed back to mid-2015. From a technical perspective, it appears highly likely we will see the correction in the GBP-USD rate continue and a drop to somewhere between $1.6325 and $1.6425 seems to be on the cards. The test for the pound will be whether it can stand up at that point or whether it falls below $1.63. The Pound will find trendline support at $1.62 and that should be strong enough to stop the rot but below there is a void which could see this pair drop to $1.58 in no time at all. With the general recovery in the UK economy still intact, such a collapse in the Pound is deemed unlikely at the moment and a recovery back to $1.70+ is the more likely scenario but protection against a fall of this kind is recommended for Sterling sellers.

Currency - Euro/USD

After rallying in a volatile pattern from July 2012 to the high in May 2014, the Euro-US Dollar exchange rate has retraced to some degree; hitting the technical level of a 38.2% Fibonacci retracement. That all sounds very complex but the key is that traders will all be aware of that and be ready to buy the Euro at this price-point. The improvement in US prospects, slightly better labour market data and an increased possibility of tighter money supply in the US are combining to strengthen the US Dollar but heightened tension in the Middle East and Ukraine are causing investor flight into the safe haven US Dollar. At the same time, infighting within the stagnating Eurozone is causing concern. France and Italy are being criticised by Germany and a group of eminent economists have cited the contractionist policies of the Eurozone as contributing to the lack of recovery in the region.

Nevertheless, we are highly likely to see some rebound in the EUR-USD rate after this recent fall and that could take us back to $1.3450 without disturbing the downward trend. Above $1.3450, we are likely to see a more substantial recovery but that is not envisaged unless US data plummets. If or when the Euro does break below $1.3250, the door is open to a test of $1.30 in the next few weeks.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 as USD rebounds

EUR/USD lost its traction and retreated slightly below 1.0700 in the American session, erasing its daily gains in the process. Following a bearish opening, the US Dollar holds its ground and limits the pair's upside ahead of the Fed policy meeting later this week.

USD/JPY recovers toward 157.00 following suspected intervention

USD/JPY recovers ground and trades above 156.50 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, the Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.