Recommendations:

Medium: Short the EURUSD at 1.3350, SL 1.3400, targets 1.330, 1.3150, 1.2800.

Risky: Short the USDJPY at 101.70, SL 102.50, targets 101.20, 100.50, 100.00.

Risky: Buy the USDJPY at 96.50, SL 95.70, targets 97.50, 99.00, 101.50.

Very Risky: Short the GPBUSD at 1.5450, SL 1.5510, targets 1.5400, 1.5200, 1.4850, 1.4250.

Analysis:

The giant money printing program unveiled by the Bank of Japan has been a major event last week, causing the USDJPY to fly swiftly +500 pips. The Euro also appreciated due to no interest rate cut by the ECB and some strong buying in EURJPY. We expect the USDJPY to continue to progress next week, however at a more moderate pace. The EURUSD should show some weakness in its upward march, and we would look for short entries. The US employment number have a mixed effect on the dollar: on one hand the unemployment figure went slightly down to 7.6% (a bit closer to the no-QE area of 6%) and on the other hand the job creation tumbled to 88k. If we have another month with NFP numbers below 50k, the chances of an increase in the QE flows of the fed become will become significant. The only significant event next is the FOMC meeting minutes which should be rather bullish for the USD since the meeting was held prior to the terrible NFP numbers of Friday. Finally, the SP500 remains silently stuck in the 1560 area

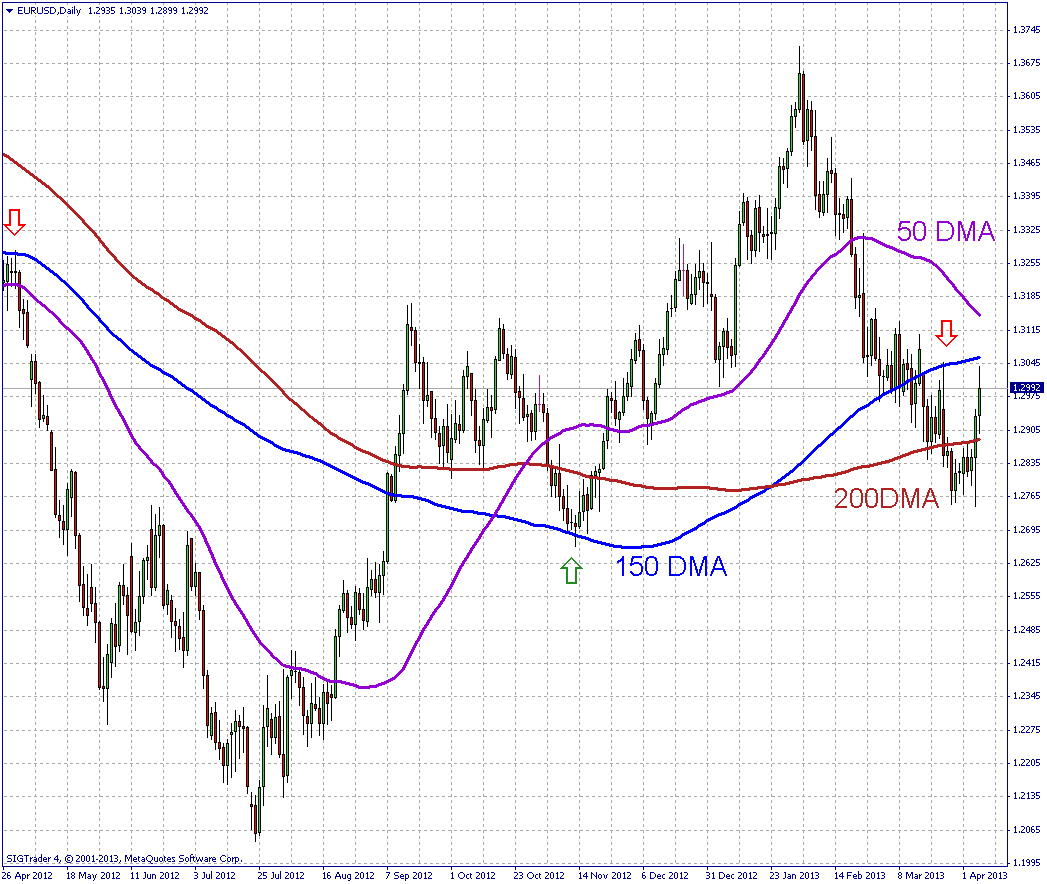

EURUSD: We doubt that the push higher in EURUSD will exceed 1.33, despite the uncertainty caused by low NFP numbers. We still think the trend is downside oriented in EURUSD, and we would look for a short entry around 1.3350 (61.8% Fibonacci retrace from 1.37 to 1.2750).

USDJPY: The massive money printing of the BOJ has taken the market by surprise. Next week we expect the USDJPY to test 100. A risky trade but possible would be to short the USDJPY above 101.50 next week, since this would be a very overbought level according to our mathematical models. Similarly risky and worth a try is to enter long at the previous highs around 96.50. With this BOJ easing, the trend for the yen is going to be more weakness in the coming weeks. The major trend line resistance comes now around 107.00

GBPUSD: The GBPUSD went up as we suggested last week and we are now very close to the decisive moment in this pair. Either we break above 1.54-1.55 and the trend becomes neutral. Or we fall heavily back below 1.50. A short entry is worth a try although we consider it very risky.

EURUSD Daily Chart

USDJPY Monthly Chart

Recommended Content

Editors’ Picks

AUD/USD gains momentum above 0.6500 ahead of Australian Retail Sales data

AUD/USD trades in positive territory for six consecutive days around 0.6535 during the early Asian session on Monday. The upward momentum of the pair is bolstered by the hawkish stance from the Reserve Bank of Australia after the recent release of Consumer Price Index inflation data last week.

EUR/USD holds positive ground above 1.0700, eyes on German CPI data

EUR/USD trades on a stronger note around 1.0710 during the early Asian trading hours on Monday. The weaker US Dollar below the 106.00 mark provides some support to the major pair.

Gold trades on a softer note below $2,350 on hotter-than-expected US inflation data

Gold price trades on a softer note near $2,335 on Monday during the early Asian session. The recent US economic data showed that US inflationary pressures staying firm, which has added further to market doubts about near-term US Federal Reserve rate cuts.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.