Draghi’s Dovish Remarks Suffocate EUR

Market expects ECB to announce new measures in December

Greater Euro/U.S rate divergence needs to be priced

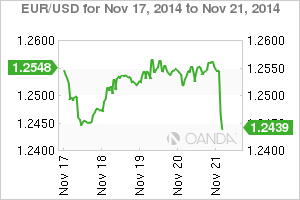

The Euro bear got a subtle hint yesterday to consider “not” booking any EUR profits just yet, all because the EUR bull happened to be blinded by PMI flash numbers. The ones that did nothing should be thanking Draghi this ‘frantic’ Friday morning as he has managed to again put the “boot-in” with another “whatever it takes” kind of moment.

EUR Plummets on Inflation Expectations

The EUR (€1.2438) has managed to take a sharp turn lower after his comments regarding inflation in Frankfurt – again indicating that Euro policy makers will do what it must to raise inflation back to its target. His assessment of growth and inflation is supporting market expectations that the ECB will need to adopt full-blown QE sooner rather than later.

His evaluation of the Eurozone in his speech would strongly suggest that the ECB is about to up the ante as early as the December meet in a few weeks. His ‘dovish’ comments (inflation situation more challenging, committed to recalibrating size, pace and composition of asset purchases and the potential broadening of channels through which the ECB intervenes) are currently suffocating the EUR outright and on the crosses (fresh day lows for EUR/JPY €146.46, EUR/GBP €0.7938).

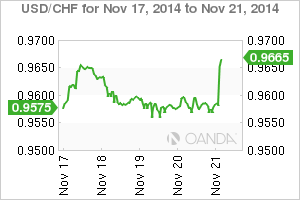

SNB can breath a little easier

Not surprisingly, EUR/CHF has managed to climb to a one-week high (€1.2032) on thoughts of lower ECB funding. Euro/U.S rate divergence is lending the SNB a helping hand ahead of the Swiss Gold Referendum on November 30. With the U.S dollar having a strong run this morning on the “what if” scenario has managed to push USD/CHF higher ($0.9670) and allows EUR/CHF to be supported and gradually move away from the SNB’s well publicized “floor.”

Draghi pointed to yesterday’s flash PMI results to indicate that a strong recovery is unlikely in the coming months. His sense of urgency, lift inflation expectations “as soon as possible,” has a percentage of the market already anticipating the ECB will sweeten the terms of the TLTRO in December, while leaving the debate over balance sheet expectations until January.

Draghi needs to get a “bang for his buck” as hot air will lose ECB street credibility. Euro policy makers will need to make sure that they have exhausted all existing balance sheet avenues before they begin down that route of no return – sovereign bond purchases. To date, the ECB has had the minimum of success in expanding its balance sheet. In fact, it has actually declined -€11B since the beginning of September. The EUR will remain very sensitive to short interest rate trends, with further downside very much on the cards. However, be mindful of the Swiss “floor.”

On tap for next week:

If you thought the FX market was slow this week, next week will be a challenging one for most, as both forex ranges and market volumes are expected to take a “big” step back due to the various bank holidays to be respected.

Japan will “not” be kicking things off in the Asian session as they celebrate their Labour day on Nov 23. Governor Kuroda from the BoJ will grab most of the attention from his planned speeches on Monday (due to speak at a meeting with business leaders, in Nagoya and at the Paris EUROPLACE International Financial Forum, in Tokyo); nevertheless, he is not expected to stray too far from the BoJ’s official copy/rhetoric from last weeks monetary policy meet. German Ifo business confidence on Nov 24 should be capable of keeping the EUR on its toes.

The market will try and engage with the minimum of interest in U.S preliminary GDP (Nov 25) and U.K q/q GDP on Wednesday, as no one wants to have too much strapped on as the U.S begins to celebrate thanksgiving, the largest and most travelled holiday period in the U.S calendar.

Historically, forex volumes plummet over the two-day festivities (its a financial half day, but most make it a long w/d). Be aware that OPEC happens to have an all day meeting scheduled for the same day – could the ministers surprise the crude market?

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD retargets the 0.6600 barrier and above

AUD/USD extended its positive streak for the sixth session in a row at the beginning of the week, managing to retest the transitory 100-day SMA near 0.6580 on the back of the solid performance of the commodity complex.

EUR/USD keeps the bullish bias above 1.0700

EUR/USD rapidly set aside Friday’s decline and regained strong upside traction in response to the marked retracement in the Greenback following the still-unconfirmed FX intervention by the Japanese MoF.

Gold advances for a third consecutive day

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Bitcoin price dips to $62K range despite growing international BTC validation via spot ETFs

Bitcoin (BTC) price closed down for four weeks in a row, based on the weekly chart, and could be on track for another red candle this week. The last time it did this was in the middle of the bear market when it fell by 42% within a span of nine weeks.

Japan intervention: Will it work?

Dear Japan Intervenes in the Yen for the first time since November 2022 Will it work? Have we seen a top in USDJPY? Let's go through the charts.