Aside from the ceremonial signing of “Phase One” of the US-China Trade Deal, this past week was seemingly uneventful. The US Senate passed the United State- Mexico-Canada Agreement (USMCA) and it is currently waiting President Trump’s signature. Things between the US and Iran in the Middle East have calmed down, and stocks have continued their climb to all time highs on the back of better bank earnings.

The World Economic Forum’s annual meeting will be held next week in Davos, beginning on Wednesday. Many world leaders and large companies attend this event, including large oil companies, and it may be good for some potentially market moving soundbites.

With many of the political and geo-political events on the sidelines (for now), the markets next week are likely to begin focusing once again on central banks, macro-economic data and earnings.

There are three Central Bank meetings next week, which include the Bank of Japan, the Bank of Canada, and the European Central Bank.

Earnings season kicks into high gear next week, with such notables reporting as HAL, NFLX, TXN, JNJ, and AXP.

In addition, macro-economic data highlights for next week are as follows:

Monday

- Martin Luther King Jr. Day – US Markets closed

- ECB President Lagarde Speech

Tuesday

- BOJ Interest Rate Decision and Quarterly Outlook Report

- UK Employment data (DEC) Claimant Count expecting +26,000 vs +28,800 last

- German and EU ZEW Economic Sentiment Index (JAN). Expectations are for 15 and 6, respectively.

Wednesday

- Canada Inflation Rate (YoY) (DEC) Expectations are for 2.2% vs 2.2% last

- (MoM) expectation is for 0% vs -0.1% last

- BOC Interest Rate Decision and Monetary Policy Report

Thursday

- Australian Consumer Inflation Expectations (JAN) Expecting 3.7% vs 4% last

- Australian Employment Change (DEC) Expecting +16,000 vs +39,900 last

- ECB Interest Rate Decision, Press Conference, and Strategic Review

- Crude Oil Inventories

Friday

- BOJ Monetary Policy Meeting Minutes

- Worldwide Flash PMIs – In particular, for the US this will be the first piece of manufacturing data since the US-China trade deal was agreed. Markets participants will look closed to watch for an uptick in US PMIs.

- ECB President Lagarde Speech

- Canadian Retail Sales (MoM) (NOV) Expecting 0.4% vs -1.2% last

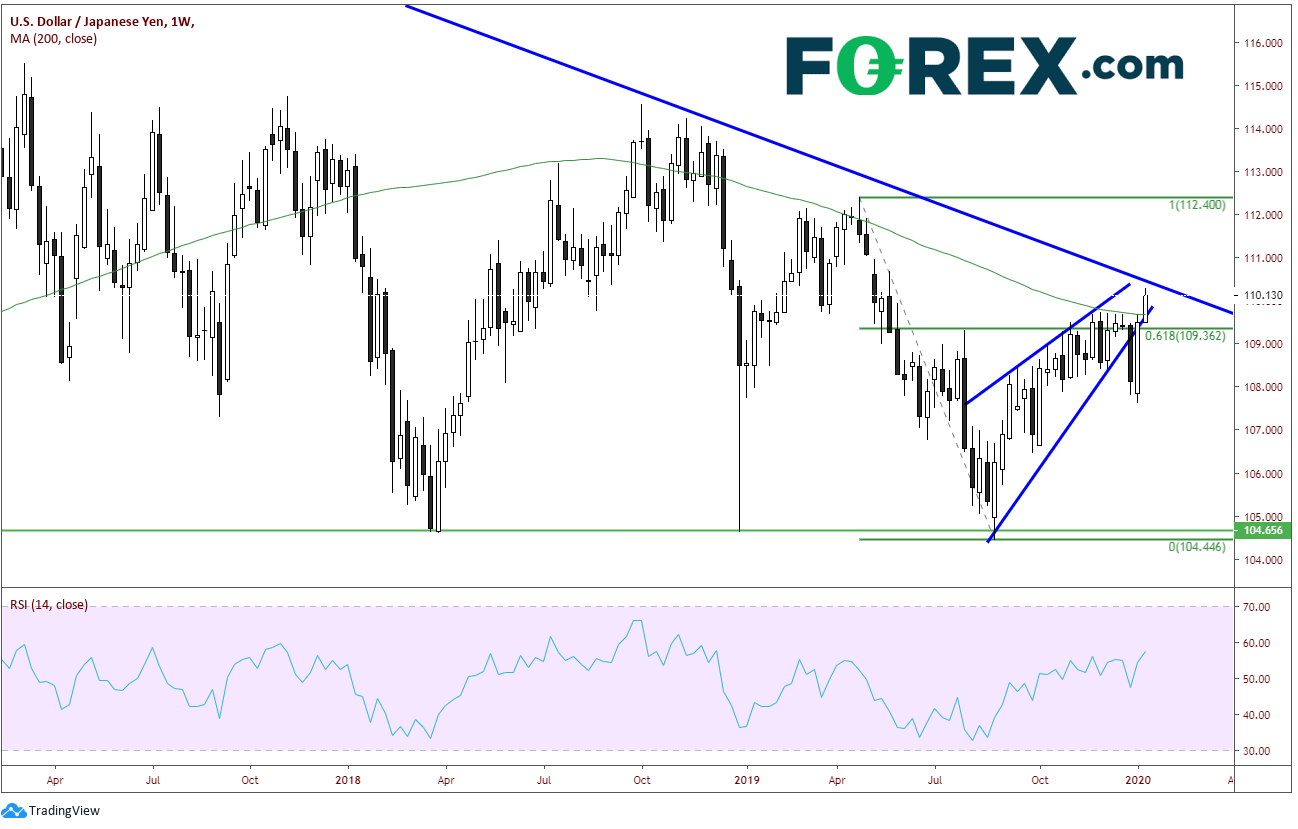

Chart to Watch: USD/JPY

Source: Tradingview, FOREX.COM

As stocks continue to put in new all-time highs, USD/JPY is moving right along with them. During the first week of the year, price put in a bullish engulfing candle after a false breakout out of the rising wedge. Last week, USD/JPY squeezed above strong horizontal resistance and the 200-week moving average near 109.70. The pair is currently approaching a long term downward sloping trending dating back to mid-2015. If price breaks above the trendline, it will look to fill the gap from the first week of May 2019 near 110.90/111.00.

Risk Warning Notice Foreign Exchange and CFD trading are high risk and not suitable for everyone. You should carefully consider your investment objectives, level of experience and risk appetite before making a decision to trade with us. Most importantly, do not invest money you cannot afford to lose. There is considerable exposure to risk in any off-exchange transaction, including, but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of the markets that you are trading. Margin and leverage To open a leveraged CFD or forex trade you will need to deposit money with us as margin. Margin is typically a relatively small proportion of the overall contract value. For example a contract trading on leverage of 100:1 will require margin of just 1% of the contract value. This means that a small price movement in the underlying will result in large movement in the value of your trade – this can work in your favour, or result in substantial losses. Your may lose your initial deposit and be required to deposit additional margin in order to maintain your position. If you fail to meet any margin requirement your position will be liquidated and you will be responsible for any resulting losses.

Recommended Content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays firm above 156.00 after BoJ Governor Ueda's comments

USD/JPY stays firm above 156.00 after surging above this level on the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.