Week Ahead – Georgia election and US jobs report kick off new year

The new year will start with a bang. A crucial runoff election in the state of Georgia will determine which party controls the US Senate, the latest US employment report will tell us how the recovery is progressing, and the minutes of the December Fed meeting will be eyed for clues around the next policy move. There is also a barrage of key data from the Eurozone and Canada. Overall, markets are searching for the next ‘big theme’, and for now, that could be the balance of power in the Senate.

US Senate control hangs on Georgia

Global markets got their holiday gifts right on time this year. The Brexit agreement and the US relief package were both wrapped up, the global vaccine rollout is going smoothly so far, and there is no sign that central banks will take their foot off the gas in the coming year. With everything progressing according to plan, investors seem to be looking for the next big narrative that will drive risk sentiment, and luckily, they may not have to wait long.

The US Senate is currently controlled by the Republicans, but that could change if the two Senate seats from the state of Georgia fall into Democratic hands this coming week. Since none of the candidates received a majority of the vote in the November election, the state will hold runoff elections on Tuesday. If the Democrats manage to win both seats, then the Senate would be tied at 50-50, giving incoming Vice President Kamala Harris the tiebreaker vote.

In theory, the Democrats having full control of Congress implies bigger relief packages in the future if the economic recovery hits any speed bumps. Some would argue this outcome also entails a higher risk of corporate tax increases going forward, but in reality, it would be almost impossible to raise taxes in any significant manner with such a razor-thin majority, especially with a recession raging.

As such, the risk for markets seems one-sided. If the Democrats flip both seats, the stock market could power even higher while the dollar sinks even lower on expectations of bigger government deficits. Otherwise, it would simply be a continuation of the current situation, so any stock market selloff or dollar rebound may be limited – if any. Opinion polls suggest both races are too close to call.

Nonfarm payrolls and FOMC minutes on the menu too

The US calendar is jam-packed with key events, as besides the Georgia runoffs, there is also a volley of crucial economic releases to kick off the new year. The show begins on Tuesday, when the ISM manufacturing PMI for December hits the markets. The non-manufacturing survey will follow on Thursday, but in the meantime, the minutes of the latest FOMC meeting will see the light on Wednesday.

The Fed ‘disappointed’ investors by not delivering any new liquidity measures back then, but Chairman Powell quickly rode to the rescue, reassuring markets that his central bank will stay tremendously accommodative for a long time and is willing to unleash more firepower if needed. The minutes are unlikely to reveal anything groundbreaking, but investors will be interested to find out exactly how much opposition there was to new stimulus measures.

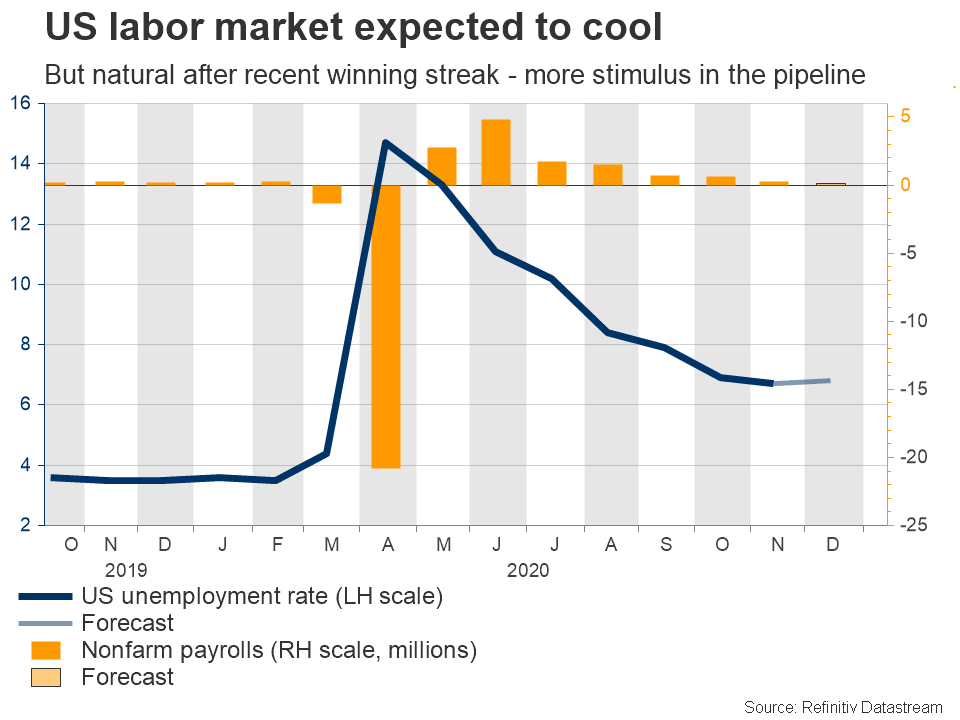

The week culminates with the all-important employment report on Friday. Nonfarm payrolls are forecast to have risen by 100k in December, much lower than the 245k registered in November and barely enough to keep up with US population growth. The unemployment rate is expected to tick higher for the first time since April. If so, this would confirm what the preliminary Markit PMIs suggested, namely that the labor market has started to cool. That said, it is quite natural to have a soft month following such a spectacular streak of gains.

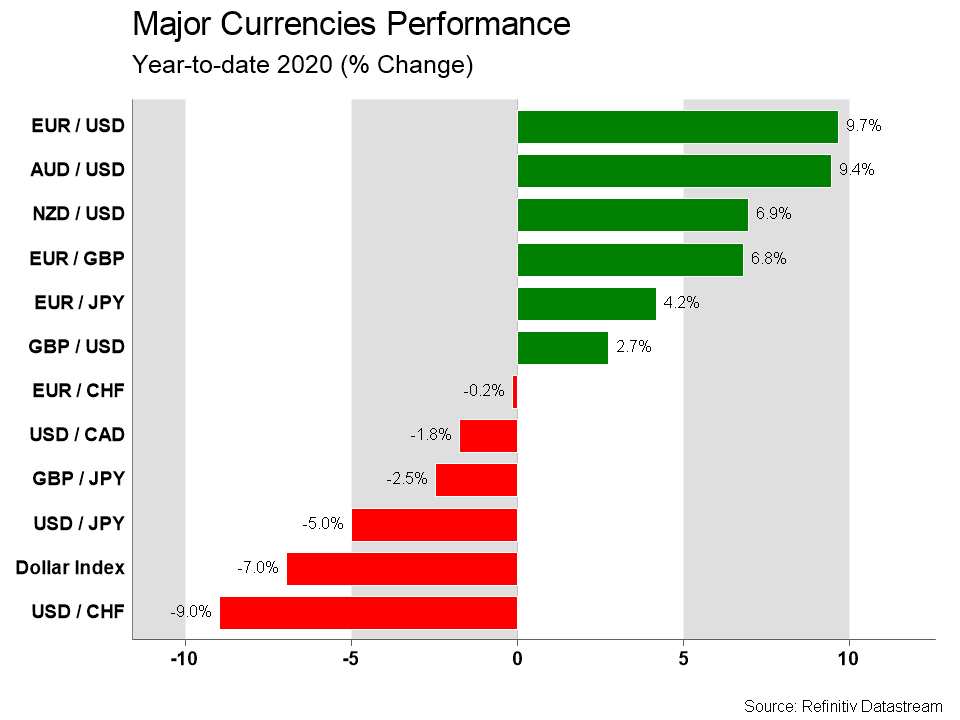

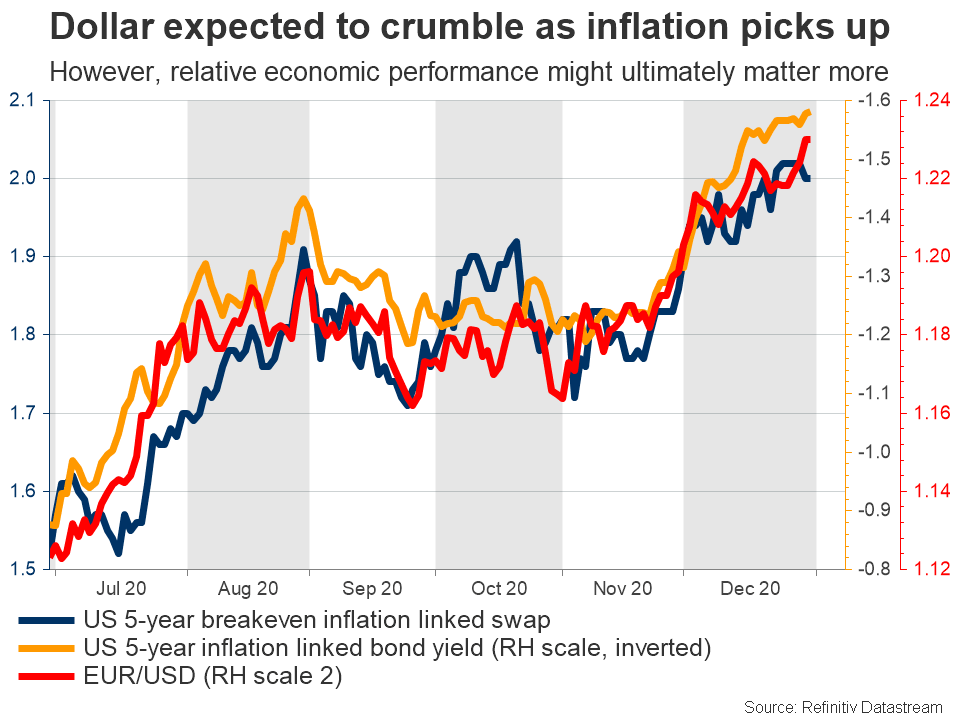

As for the dollar, the popular narrative for 2021 is that it will go further down the drain as US inflation accelerates faster than other economies, keeping real interest rates deeply negative. While it is true that fading safe-haven demand for the reserve currency coupled with deeply negative US rates seems like a recipe for disaster, the catch is that much of this has already played out and most other major economies are even weaker fundamentally.

In the classic way of thinking, interest rate differentials are the most crucial variable for the FX market. However, coming out of a crisis, perhaps relative economic performance will matter even more. The US economy is much stronger than the euro area, is ahead in the vaccination race, and more stimulus is already in the pipeline. Capital is ultimately attracted to growth, not deflation.

Canadian and European data on the docket too

Staying in North America, Canada will see the release of its own employment data for December on Friday as well. Expectations are equally pessimistic, with the net change in employment forecast to turn negative and the unemployment rate projected to rise a touch. While a soft set of data may trigger a brief pullback in the loonie, the numbers are unlikely to be weak enough to spark expectations for further action by the BoC. The currency’s broader path hinges mainly on stock market performance and oil prices.

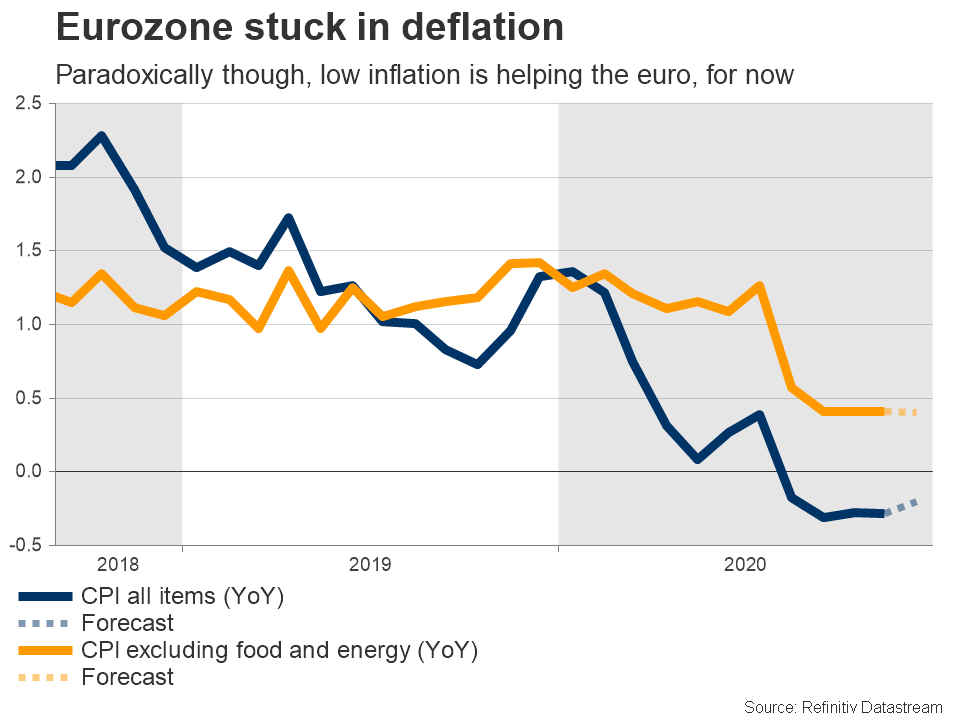

Over in Europe, the main release will be the Eurozone’s preliminary inflation data for December on Thursday. Forecasts suggest the bloc remained trapped in deflation for a fourth month in a row. It is paradoxical, but deflation has been helping the euro lately by pushing real interest rates higher. The calculation for real rates is nominal bond yields minus inflation, so the lower inflation falls, the more real rates rise.

For now, this could keep the single currency supported, as it remains attractive from a rate differential perspective. However, economic performance is bound to come into play at some point, and on that front, there isn’t much to be cheerful about. If America proves to be a fundamentally stronger and more productive region once again, then euro/dollar may even reverse course in 2021.

Have a great new year!

Author

Marios graduated from the University of Reading in 2015 with a BSc in Economics and Econometrics. Prior to joining XM as an Investment Analyst in December 2017, he was providing financial analysis, reporting and consulting service