USD/JPY soars to 20-year high amid Fed and BOJ divergence

The Australian dollar moved sideways on Tuesday even after the Reserve Bank of Australia (RBA) caught investors off-guard with a bigger hike than expected. The bank hiked interest rates by 50 basis points (bps) to 0.85%. This was a higher increase than the median estimate of 25-bps increase. It was also the bank’s first back-to-back rate hike since 2010 and the first time it has hiked rates by 50 bps since 2000. It now expects inflation to keep rising in the coming months and then retreat to the target range of 2% and 3% in 2023. Analysts anticipate several more rate hikes this year.

The Japanese yen crashed to the lowest level in over 20 years due to the monetary policy divergence between the Bank of Japan (BOJ) and other central banks. While the Fed, RBA, BOE, and ECB have started tightening, the BOJ is still committed to maintaining low interest rates and easy-money policies. On Monday, the bank vowed to stick with this policy in a bid to boost the economy even as inflation keeps rising. Most of these inflationary pressures are because of rising energy prices. While the weaker yen helps many Japanese exporters, smaller firms are being hit hard.

Global stocks declined sharply on Tuesday on concerns over soaring inflation and interest rates. In the United States, futures tied to the Dow Jones, S&P 500, and Nasdaq 100 indices declined by more than 1%. In Europe, key benchmarks like CAC 40, Stoxx 50, and DAX declined by almost 1%. Investors are also pricing in margin pressure from leading companies. For example, Target said that its profit will likely drop because of rising inventories. The company expects its profit to decline faster than it noted in its recent quarterly results.

USD/JPY

The USDJPY pair continued its bullish trend as the Japanese yen continued weakening. The pair rose to a high of 132.80, which was the highest level in over 20 years. As it rose, it managed to move above the important resistance at 131.37, which was the previous YTD high. It has moved above the 25-day and 50-day moving averages while the Relative Strength Index (RSI) has moved above the overbought level. The pair’s uptrend will likely continue in the coming months.

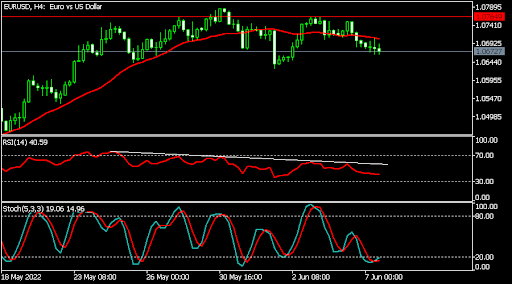

EUR/USD

The EURUSD pair declined to a low of 1.0672, which was the lowest level since June 6. On the four-hour chart, the pair remains below the important resistance level at 1.0765. It also crossed the important 25-day moving average while the RSI and Stochastic have been rising. Most importantly, it has formed what looks like a head and shoulders pattern. Therefore, the pair will likely keep falling ahead of the ECB decision.

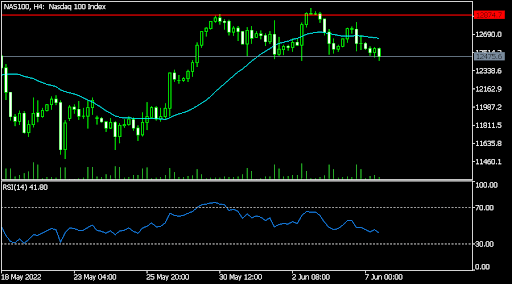

NAS100

The Nasdaq 100 index continued its bearish trend as margin concerns continued. It fell to a low of $12,470, which was slightly below last week’s high of $12,945. On the four-hour chart, the pair moved below the 25-day and 50-day moving averages while the Relative Strength Index (RSI) has been in a downward trend. It has also formed a small head and shoulders pattern. Therefore, the index will likely continue falling as bears target the key support at $12,200.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.