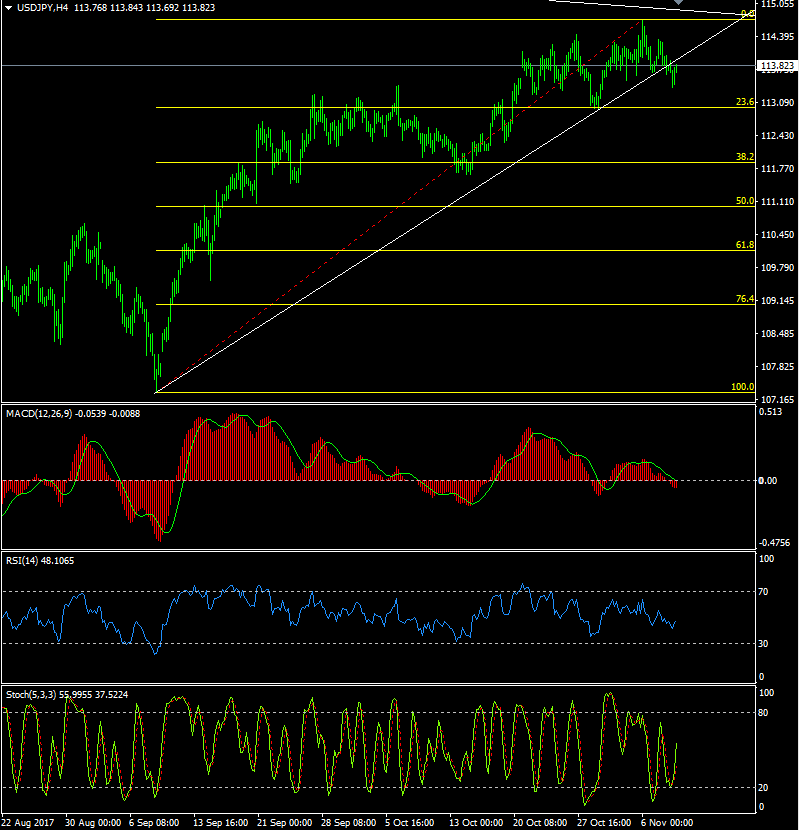

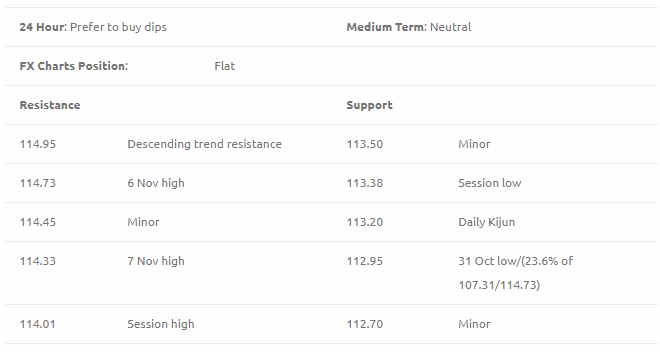

Preferred Strategy: US$Jpy slipped to a low of 113.38 on Wednesday before a recovery to sit at 113.85 into the NY close, leaving the bigger picture outlook unchanged.

The short term technical outlook also remains unchanged, and the charts look mixed/flat so a fairly nimble stance is required, with further choppy trade either side of 114.00 looking possible over the next couple of days.

On the downside, support will be seen at 113.50, below which could then head back to the session low, to the daily Kijun at 113.20 and then at the Fibo level at 112.95 although this seems unlikely today. If wrong, a sustained break of 113.00 would see us back in the previous 112/113 range, where 112.75 would be the first level of support ahead of 112.30.

On the topside, minor resistance now lies at 114.00, above which could return to 114.35/45 and above, towards the 114.73, 6th Nov high, but above which could see a test of the descending trend resistance, currently at around 114.90. A break of 115.00 would then see little resistance until 115.20 and then 115.50.

I remain fairly neutral, although I still like the dollar in the medium term and prefer to buy dips.

Economic data highlights will include:

Trade Balance, Current Account, Tertiary Industry Index, Eco Watchers Survey, Machine Tool Orders

All content on this website, www.fxcharts.com.au (FX Charts PL) is a personal view only and offers absolutely no guarantee as to the correctness or otherwise of that opinion. The content here is of a “general nature” only and does not constitute personal or investment advice. The FX Charts website is not an inducement to trade Foreign Exchange (FX). No liability whatsoever is accepted for any loss or damage that may result, directly or indirectly, from any , comment, opinion, information or omission, whether negligent or otherwise, within the FX Charts Website. The information and any opinion or outlook expressed in this commentary may be based on assumptions or market conditions and may be liable change at any time, without notice.

Recommended Content

Editors’ Picks

EUR/USD advances toward 1.1200 on renewed US Dollar weakness

EUR/USD is extending gains toward 1.1200 on Friday, finding fresh demand near 1.1150. Risk sentiment improves and weighs on the US Dollar, allowing the pair to regain traction. The Greenback also reels from the pain of the dovish Fed outlook, with Fedspeak back on tap.

Gold price advances further beyond $2,600 mark, fresh record high

Gold price (XAU/USD) gains positive traction for the second successive day on Friday and advances to a fresh record high, beyond the $2,600 mark during the early European session.

USD/JPY recovers to 143.00 area during BoJ Governor Ueda's presser

USD/JPY stages a recovery toward 143.00 in the European morning following the initial pullback seen after the BoJ's decision to maintain status quo. In the post-meeting press conference, Governor Ueda reiterated that they will adjust the degree of easing if needed.

Shiba Inu is poised for a rally as price action and on-chain metrics signal bullish momentum

Shiba Inu remains strong on Friday after breaking above a symmetrical triangle pattern on Thursday. This breakout signals bullish momentum, further bolstered by a rise in daily new transactions that suggests a potential rally in the coming days.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.