USDJPY, H1 and Daily

The Yen has traded moderately firmer, underpinned by a resumption of risk aversion in Asian equity markets. USDJPY has drifted below Friday’s 111.82 low, while it is showing a 0.7% loss to Pound and 0.4% loss to the Dollar, Euro and Canadian Dollar. This is now the third consecutive session the pairing has hovered around the 112.0 mark. It has been a negative session for Asian stock markets so far, though there has been limited safe haven demand for the Yen as yet. Japan’s Nikkei 225 is down 1.8% heading into the Tokyo close, breaching last week’s low, while China’s SSE index is 0.6% for the worse, so far remaining above last week’s lows.

The usual suspects have been weighing on Equities, as relayed in circulating market narratives — US-China trade war and higher US and global yields (although softer today). In data, Japan’s August industrial production was revised to 0.2% m/m growth, down from the preliminarily estimated 0.7% m/m and decelerating from 0.6% growth in the month prior. Overall, for USDJPY, the directional risks remains to the downside without looking overextended yet.

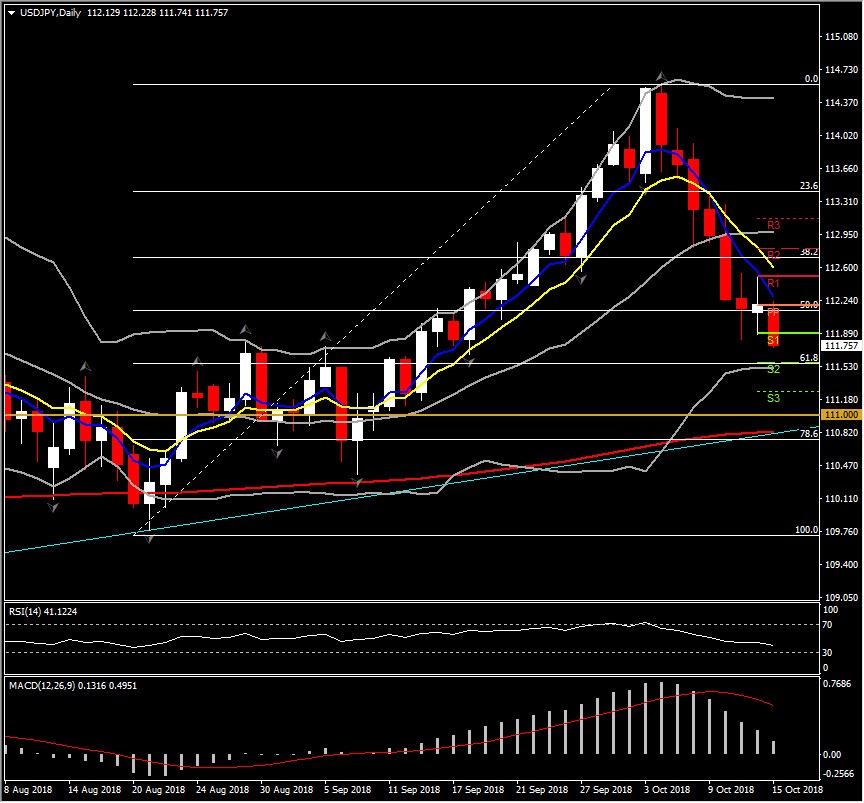

The asset has been sharply driven by the bears for the last 6 consecutive hours, with the latest candle formed below the S1 and below the lower Bollinger Bands pattern, which is extended to the downside. The price is also moving below all EMAs, i.e. 10- , 20-, 50- and 200-period EMAs. The sellers are also gathering momentum once more with MACD oscillator accelerating lower below its signal line within the negative area. RSI is slightly above the 30 barrier, but its slope is looking downward.

Subsequently, the downwards momentum has not run out of steam yet, since we have not identified any significant reversal indication. Only an upwards correction above 50-period EMA could provide an indication for a possible retest of 112.50 level. However in the medium term only a break above 112.54-112.60 area, which was the upper area of 2-day range and 10-days EMA, could strengthen the possibility for the asset to reverse to the upside after October’s sharp decline.

Intraday Support levels: 111.57 ( Strong Support as it coincides with S2, 61.8% Fib. level and lower daily BB) and 111.25, 111.00

Intraday Resistance levels: 112.20, 112.50, 112.80

In general, the outlook remains bearish since October 4, given the risk for a sustained period of risk aversion in global markets, which could in turn generate safe haven demand for the Yen and offset otherwise bullish USDJPY fundamentals.

Disclaimer: Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of purchase or sale of any financial instrument.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.