A weaker JPY and stronger USD somehow forces us to look at the situation on the USDJPY, which in these conditions should be one of the rising pairs on the markets and frankly speaking, it is.

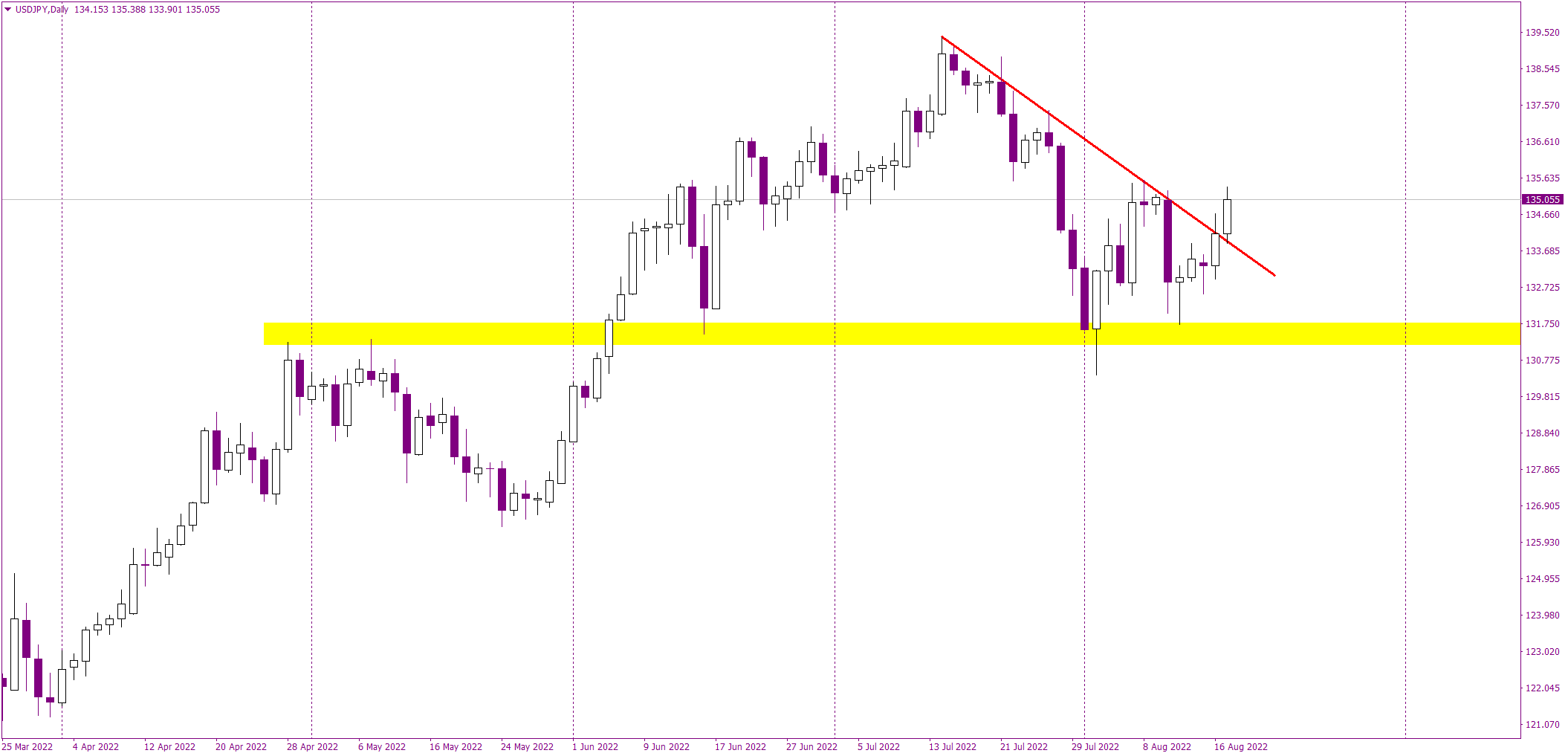

Actually, yesterday and today, the USDJPY created a major, long-term buy signal. This optimism is coming from the fact that the price bounced off a crucial horizontal support at 131.5 (yellow). That area was a top in April and May and already served as a support in June and July. The price staying above that level was a key to hold the positive sentiment alive and buyers passed this test.

Another thing is the breakout of the mid-term down trendline (red), which means the end of the bearish correction that started from mid-July. Both those things are very bullish, so a current rise should not be a big surprise.

Not so long ago, we got to know the retail sales data from the US. Core Retail Sales were better than expectation but the headline Retail Sales was slightly worse than anticipation. In both cases, we also got a negative revision of the data from last month. The initial reaction was a slightly stronger USD but let’s say that the data failed to significantly increase volatility. Now, half an hour after the data, the USDJPY is slightly lower than before the data release.

To wrap things up: sentiment on the USDJPY is positive and can stay this way as long as the price remains above 131.5. In a few hours, we will get the minutes from the last Federal Open Market Committee (FOMC) meeting and that can of course influence the USDJPY stay sharp.

Trading FX/CFDs on margin bears a high level of risk, and may not be suitable for all investors. Before deciding to trade FX/CFDs you should carefully consider your investment objectives, level of experience, and risk appetite. You can sustain significant loss.

Recommended Content

Editors’ Picks

AUD/USD: Extra gains in the pipeline above 0.6520

AUD/USD partially reversed Tuesday’s strong pullback and regained the 0.6500 barrier and beyond in response to the sharp post-FOMC pullback in the Greenback on Wednesday.

EUR/USD meets support around 1.0650

EUR/USD managed to surpass the key 1.0700 barrier in response to the intense retracement in the US Dollar in the wake of the Fed’s interest rate decision and Chair Powell’s press conference.

Gold surpasses $2,300 as Dollar tumbles

The precious metal maintains its constructive stance and trespasses the $2,300 region on Wednesday after the Federal Reserve left its FFTR intact, matching market expectations.

Bitcoin price reclaims $59K as Fed leaves rates unchanged

The market was at the edge of its seat on Wednesday to see whether the US Federal Reserve (Fed) would cut interest rates during the Federal Open Market Committee (FOMC) meeting.

The market welcomes the Fed's statement

The market has welcomed the Fed statement, and the S&P 500 is higher in its aftermath, the dollar is lower and Treasury yields are falling. There is still only one cut priced in by the Fed.