The Canadian dollar surged last week, gaining close to 200 points against the US dollar. USD/CAD closed the week just above the 1.35 line, its lowest level in 11 weeks. This week’s highlights are GDP and Trade Balance. Here is an outlook on the major market-movers and an updated technical analysis for USD/CAD.

The US had a mixed week, as employment and housing reports missed expectations, but there was some positive news from the manufacturing sector, as durable goods sparkled. There were no major Canadian releases last week.

Updates:

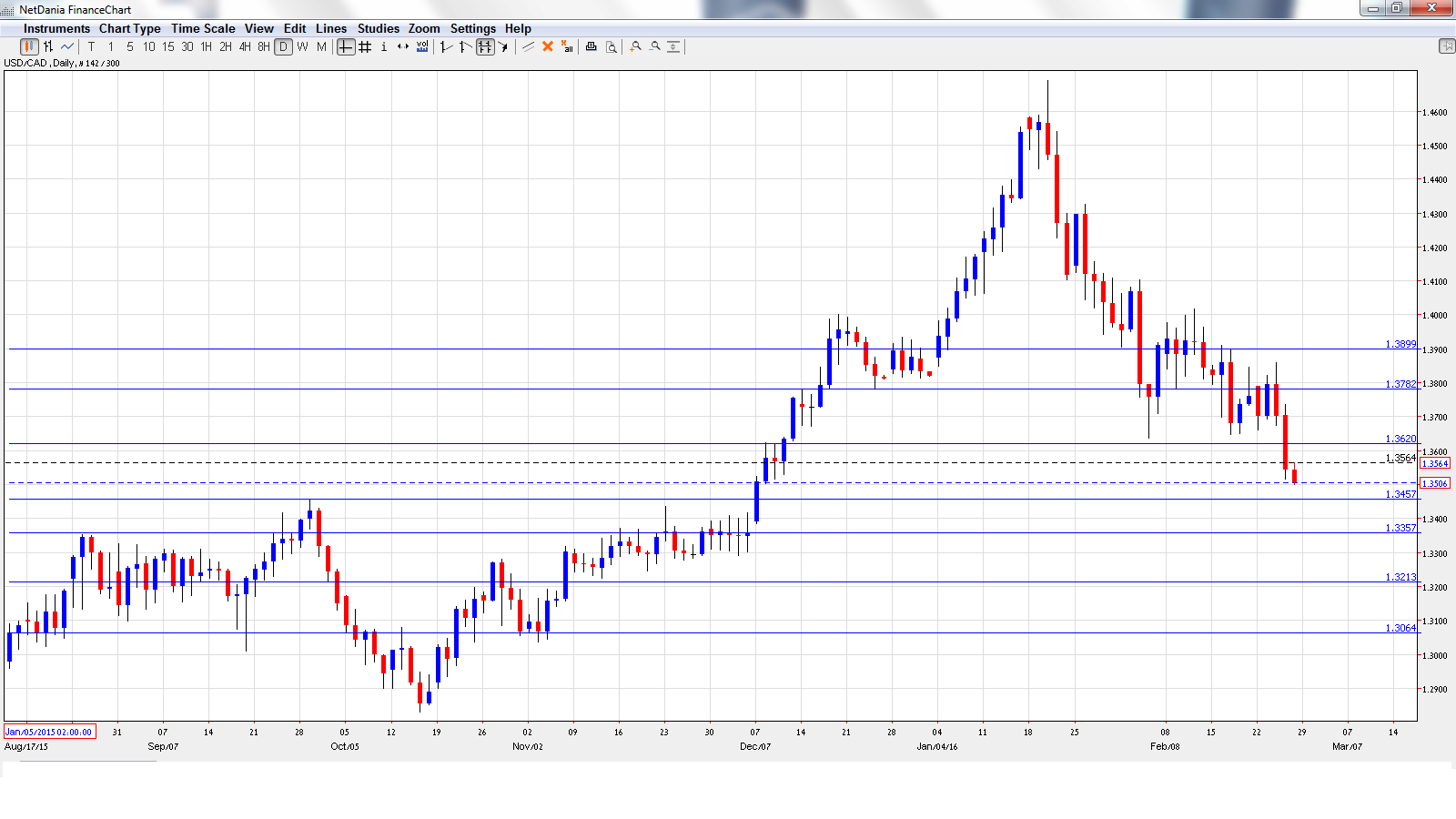

USD/CAD daily graph with support and resistance lines on it.

Current Account: Monday, 13:30. Current Account is closely linked to currency demand, as foreigners must purchase Canadian dollars in order to buy Canadian goods and services. The current account deficit narrowed in Q3 to C$16.2 billion, but this was higher than the estimate of C$15.2 billion. The deficit is expected to widen in Q4, with a forecast of C$16.8 billion.

RMPI: Monday, 13:30. This indicator is a key gauge of inflation in the manufacturing sector. The index has struggled, with two straight declines. The January release came in at -5.0%, its sharpest drop in four months. This was much higher than the estimate of -3.8%.

GDP: Tuesday, 13:30. Canada releases GDP on a monthly basis. The January reading improved to 0.3%, matching the forecast. GDP is expected to soften in February, with an estimate of 0.1%.

RBC Manufacturing PMI: Tuesday, 14:30. This PMI has not cracked above the 50-point line since July 2015, indicative of ongoing contraction in the manufacturing sector. In the January release, the index improved to 49.3 points.

Trade Balance: Friday, 13:30. Canada continues to posts trade deficits, but the indicator improved in December to C$-0.6 billion, much lower than the estimate of C$-2.2 billion. The estimate for the January report stands at C$-1.0 billion.

Labor Productivity: Friday, 13:30. Labor productivity is an important indicator, as it is directly linked to labor-related inflation. The indicator improved to 0.1% in Q3, compared to -0.6% in Q2. The upswing is expected to continue in the fourth quarter, with an estimate of 0.2%.

Ivey PMI: Friday, 15:00. The week wraps up with Ivey PMI, a survey of purchasing managers. The index surged to 66.0 points in January, crushing the estimate of 50.3 points. Will the indicator post another strong reading in February?

USD/CAD Technical Analysis

USD/CAD opened the week at 1.3789 and climbed to a high of 1.3859, as resistance held firm at 1.3900 (discussed last week). The pair then reversed directions and dropped all the way to 1.3501. USD/CAD closed the week at 1.3506.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

USD/JPY briefly recaptures 160.00, then pulls back sharply

Having briefly recaptured 160.00, USD/JPY pulls back sharply toward 159.00 on potential Japanese FX intervention risks. The Yen tumbles amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

AUD/USD extends gains above 0.6550 on risk flows, hawkish RBA expectations

AUD/USD extends gains above 0.6550 in the Asian session on Monday. The Aussie pair is underpinned by increased bets of an RBA rate hike at its May policy meeting after the previous week's hot Australian CPI data. Risk flows also power the pair's upside.

Gold stays weak below $2,350 amid risk-on mood, firmer USD

Gold price trades on a softer note below $2,350 early Monday. The recent US economic data showed that US inflationary pressures stayed firm, supporting the US Dollar at the expense of Gold price. The upbeat mood also adds to the weight on the bright metal.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.