USD/JPY Price Forecast: 100-day SMA pivotal support holds the key for bulls ahead of US NFP

- USD/JPY attracts fresh sellers amid bets that BoJ will hike interest rates again in December.

- A softer USD contributes to the slide, though rebounding US bond yields help limit losses.

- Traders might also refrain from placing aggressive bets ahead of the US NFP report on Friday.

The USD/JPY pair comes under some renewed selling pressure on Thursday and reverses a major part of the overnight gains to the weekly top. That said, wavering expectations that the Bank of Japan (BoJ) will deliver an interest rate hike in December might hold back traders from placing aggressive bearish bets and help limit deeper losses. BoJ Governor Kazuo Ueda said last week that rate hikes were nearing as inflation and economic trends develop in line with the forecasts. That said, a Jiji Press report on Wednesday indicated growing hesitation within BoJ regarding a premature rate increase.

Adding to this, BoJ's more dovish board member Toyoaki Nakamura said that the central bank must move cautiously in raising interest rates. This adds to a layer of uncertainty around the chances of a hike this month and keeps a lid on any further gains for the JPY. Meanwhile, the Federal Reserve's (Fed) Beige Book showed on Wednesday that US economic activity expanded slightly in most regions since early October. Moreover, hawkish remarks from several FOMC members, including Fed Chair Jerome Powell, suggested that the US central bank will adopt a cautious stance on cutting rates.

In fact, St. Louis Fed President Alberto Musalem said that the risks of lowering borrowing costs too quickly are greater than those of easing too little and that it may be appropriate to pause interest-rate cuts as soon as the December policy meeting. Meanwhile, Powell acknowledged that the US economy is in very good shape and is definitely stronger than expected, and said that the central bank can take a little more cautious approach while cutting interest rates toward neutral. Separately, San Francisco Fed President Mary Daly said there is no sense of urgency to lower interest rates.

This comes on top of speculations that US President-elect Donald Trump's policies will reignite inflation, which might force the Fed to stop cutting rates or possibly raise them again. This, in turn, triggers a modest bounce in the US Treasury bond yields, after their lowest closing levels in more than a month on Wednesday, which further contributes to capping the lower-yielding JPY. However, the US Dollar (USD), so far, has been struggling to gain any meaningful traction, which could limit any recovery in the USD/JPY pair ahead of the US Nonfarm Payrolls (NFP) report on Friday.

Technical Outlook

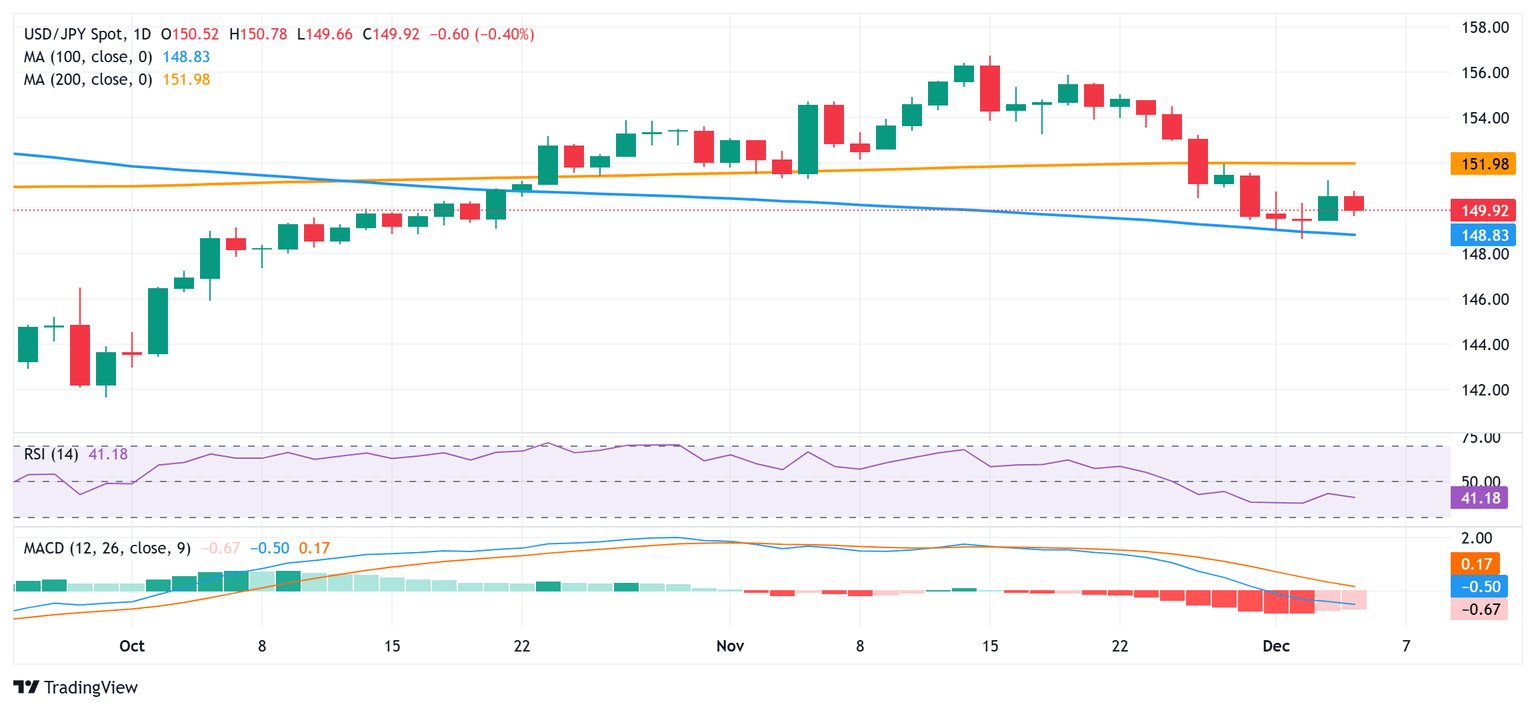

From a technical perspective, any subsequent fall is to find decent support near the 149.55-149.50 horizontal zone ahead of the 149.00 mark and the 100-day SMA, currently around the 148.80 region. The latter should act as a key pivotal point, which if broken decisively will be seen as a fresh trigger for bearish traders. Given that oscillators on the daily chart are holding in negative territory, the USD/JPY pair might then slide to the 148.10-148.00 region en route to the 147.35-147.30 zone and the 147.00 round figure.

On the flip side, any recovery back above the 150.00 psychological mark is likely to confront some resistance near the 150.55 region. This is followed by the 150.70 hurdle ahead of the 151.00 round figure and the weekly high, around the 151.20-151.25 zone touched on Wednesday. A sustained strength beyond could lift the USD/JPY pair to the 152.00 mark, or the very important 200-day SMA. Some follow-through buying will suggest that the recent corrective decline from a multi-month high touched in November has run its course and shift the bias in favor of bullish traders.

USD/JPY daily chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.