At a Financial Crossroads: Will Japan Reshape Global Markets? The Japanese yen, a cornerstone of the carry trade and global finance, stands at a historic juncture. With the Bank of Japan (BOJ) poised for potential intervention, the ramifications could be profound for the yen and ripple effects through global markets. As the yen drops to the lowest in 34 years despite the BOJ rate hike, the world watches eagerly for the BOJ’s next move. How will these strategies alter the course of the global economy? This momentous period beckons a deeper dive into the BOJ’s tactics and their far-reaching impacts.

Assessing the imminence of BoJ’s intervention

Finance Minister Shunichi Suzuki has declared the government’s readiness to battle exchange rate volatility head-on, signaling a clear intent for “decisive action” against erratic market movements—a move financial observers see as a precursor to imminent currency intervention. Amidst this backdrop, Bank of Japan Governor Kazuo Ueda pledges to monitor currency trends vigilantly, underscoring a unified front to stabilize the yen.

Echoing this sentiment, US Treasury Secretary Janet Yellen deemed Japan’s potential measures to tame yen volatility entirely justified in September 2023, essentially green-lighting Tokyo’s approach to market intervention. This international vote of confidence may be the catalyst Japan needs to forge ahead with its plans, promising a strategic pivot that could reshape market dynamics.

How intervention carried out

In Japan, foreign exchange intervention is to be carried out under the authority of the Minister of Finance. As stipulated in the Act on Special Accounts and the Bank of Japan Act, the Bank conducts foreign exchange interventions on behalf of and at the minister’s instruction.

Current market dynamics: A surge in Yen short-selling

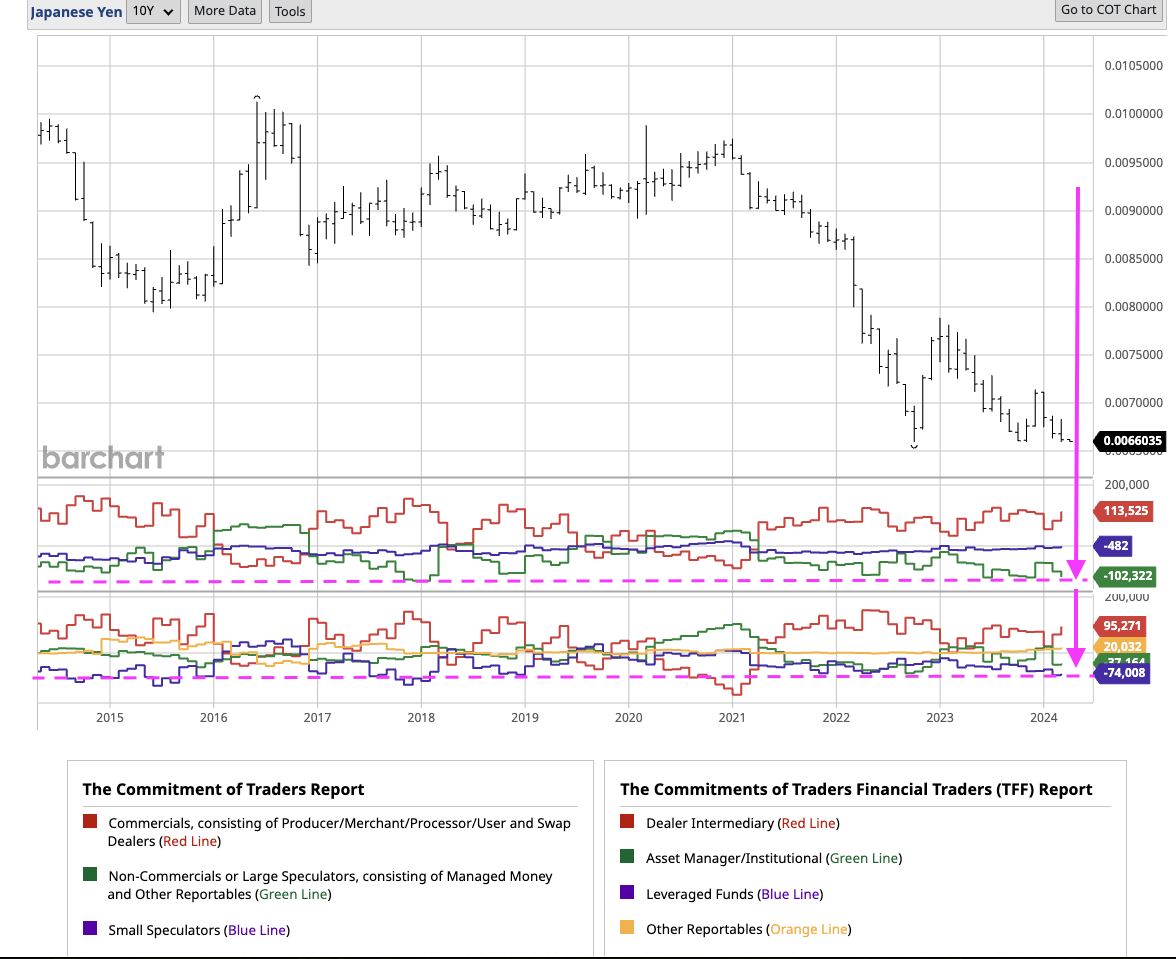

There’s a notable trend among speculative investors—they’re betting heavily against the yen, as seen in the substantial number of short positions in yen futures (highlighted by the purple dotted line). This surge in speculation is largely driven by the yen’s growing appeal as a carry trade currency, especially after the U.S. Federal Reserve’s interest rate hikes. However, this landscape could dramatically shift if the Bank of Japan (BOJ) decides to step in. Any intervention by the BOJ could lead to a rapid reversal of these bets, catapulting the yen’s value upwards and potentially sparking a significant adjustment in global markets.

Source: barchart.com

Technical overview

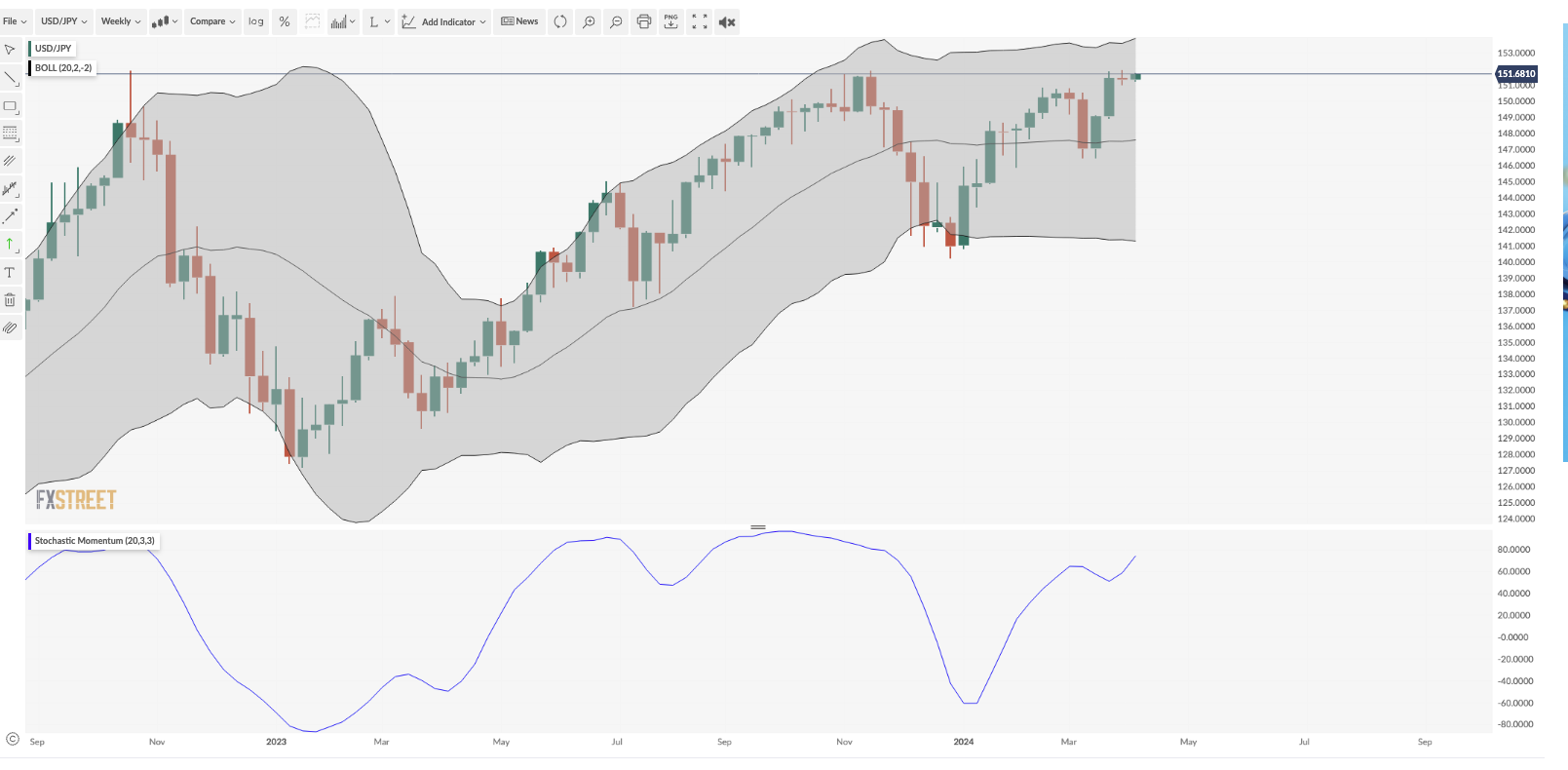

Source: FXstreet

The USD/JPY pair has rallied sharply, rebounding from the lower Bollinger Band as the Bank of Japan (BOJ) decisively moves away from its negative interest rate policy. On the weekly charts, we see the moving averages stabilizing, with a crucial resistance point at 153.4 on the Bollinger Band. Crossing this line could signal rising market volatility, drawing attention and potential concern from the finance ministry. This situation sets the stage for potential BOJ intervention if the pair moves between 153.4 and 155.4. Furthermore, the stochastic indicator suggests there’s still potential for upward momentum before reaching overbought levels. Should the BOJ intervene and traders start covering their short positions, the USD/JPY might then seek lower levels of support, possibly testing the 128 and 135 thresholds.

Trading conditions, products, and platforms may differ depending on your country of residence. For more information, visit the deriv.com website.

Recommended Content

Editors’ Picks

EUR/USD hovers near 1.0700 ahead of US data

EUR/USD struggles to build on Wednesday's gains and fluctuates in a tight channel near 1.0700 on Thursday. The US Dollar holds its ground following the Fed-inspired decline as market focus shifts to mid-tier US data releases.

GBP/USD holds steady above 1.2500 following Wednesday's rebound

GBP/USD stays in a consolidation phase slightly above 1.2500 on Thursday after closing in the green on Wednesday. A mixed market mood caps the GBP/USD upside ahead of Unit Labor Costs and Jobless Claims data from the US.

Gold retreats to $2,300 despite falling US yields

Gold stays under bearish pressure and trades deep in negative territory at around $2,300 on Thursday. The benchmark 10-year US Treasury bond edges lower following the Fed's policy decisions but XAU/USD struggles to find a foothold.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.