USD/JPY Forecast: Yen stronger amid trade tensions, upbeat local data

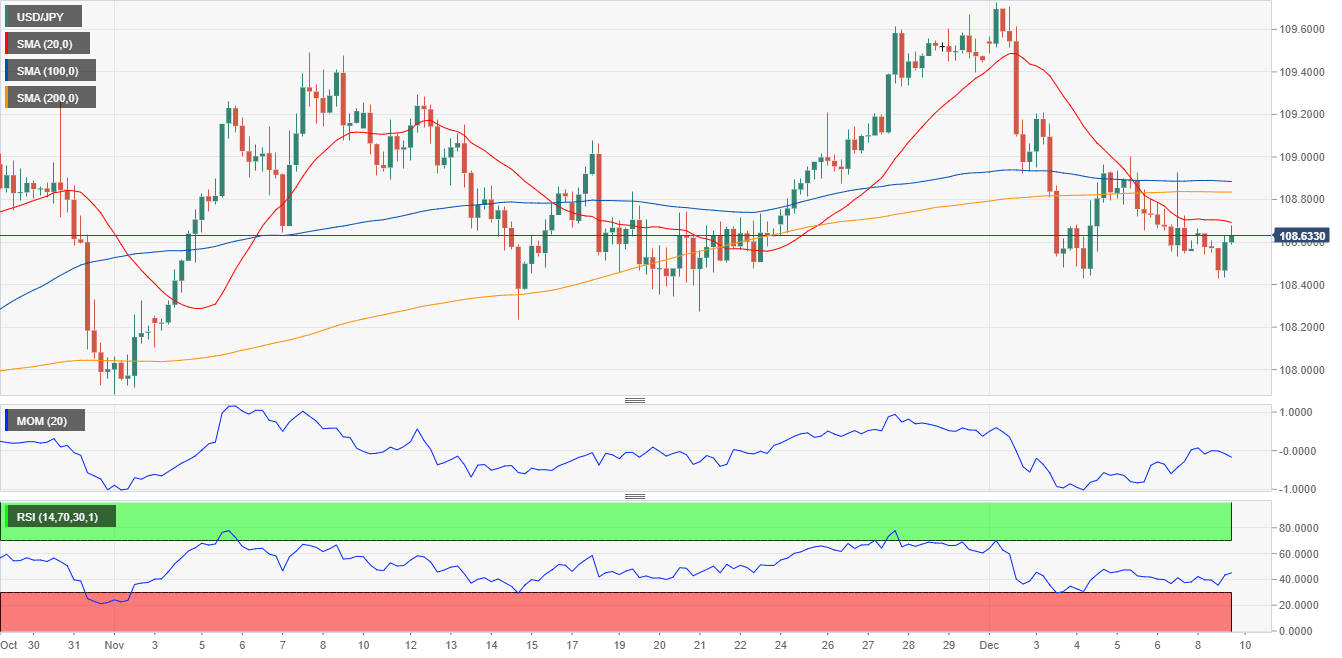

USD/JPY Current Price: 108.63

- The Japanese Gross Domestic Product double the market’s expectations in Q3.

- Trade tensions between the US and China fuel demand for safe-haven assets.

- USD/JPY technically bearish, room to break below the 108.00 figure.

The USD/JPY pair has traded within a well-limited range, ending this Monday unchanged around 108.60. The JPY appreciated at the beginning of the day on the back of mounting tensions between the US and China after US President Trump tweeted during the weekend that the World Bank shouldn’t lean money to China.

Encouraging Japanese data also helped, as the economy grew by 0.4% in the three months to September, doubling the market’s forecast of 0.2%. The annualized GDP jumped to 1.8% from 0.2%, while the Eco Watchers Survey for November printed 39.4, up from 36.7 in the previous month. The country’s macroeconomic calendar will be light this Tuesday, as it will only include November Money Supply data.

USD/JPY short-term technical outlook

The USD/JPY pair is bearish, as, in the 4-hour chart, it is trading below all of its moving averages, although they lack directional strength. Technical indicators, in the meantime, remain within negative levels, but also lack directional strength. The pair held above the post-NFP low at 108.39, with a break below the level, probably resulting in an extension sub-108.00.

Support levels: 108.40 108.10 107.75

Resistance levels: 108.70 109.00 109.30

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.