USD/JPY Forecast: Holding ground, at risk of falling

USD/JPY Current price: 107.19

- Japanese trade surplus surpassed the market’s expectations in February.

- Equities are plummeting worldwide, indicating panic remains the same.

- USD/JPY short-term neutral could resume its decline once below 106.70.

The USD/JPY pair was unable to advance beyond the 108.00 level, easing within familiar levels this Wednesday, as risk aversion remains high. The US announced measures on Tuesday that led to Wall Street closing in the green, but sentiment turned again sour, with Asian and European equities trading in the red. US futures collapsed, triggering a trading halt, now frozen ahead of the opening.

US Treasury yields are easing, although at their highest in two weeks, limiting the downside for USD/JPY. The yield on the benchmark 10-year note stands at 1.13% after hitting an intraday high of 1.23%.

Japan published the February Merchandise Trade Balance at the beginning of the day, which posted an impressive surplus of ¥1109.8B. Imports declined 14%, while exports contracted 1.0% in the same month, better than anticipated. The US will publish today Housing Starts and Building Permits for February. The global coronavirus crisis, however, will continue to overshadow old data, as the pandemic keeps expanding.

USD/JPY short-term technical outlook

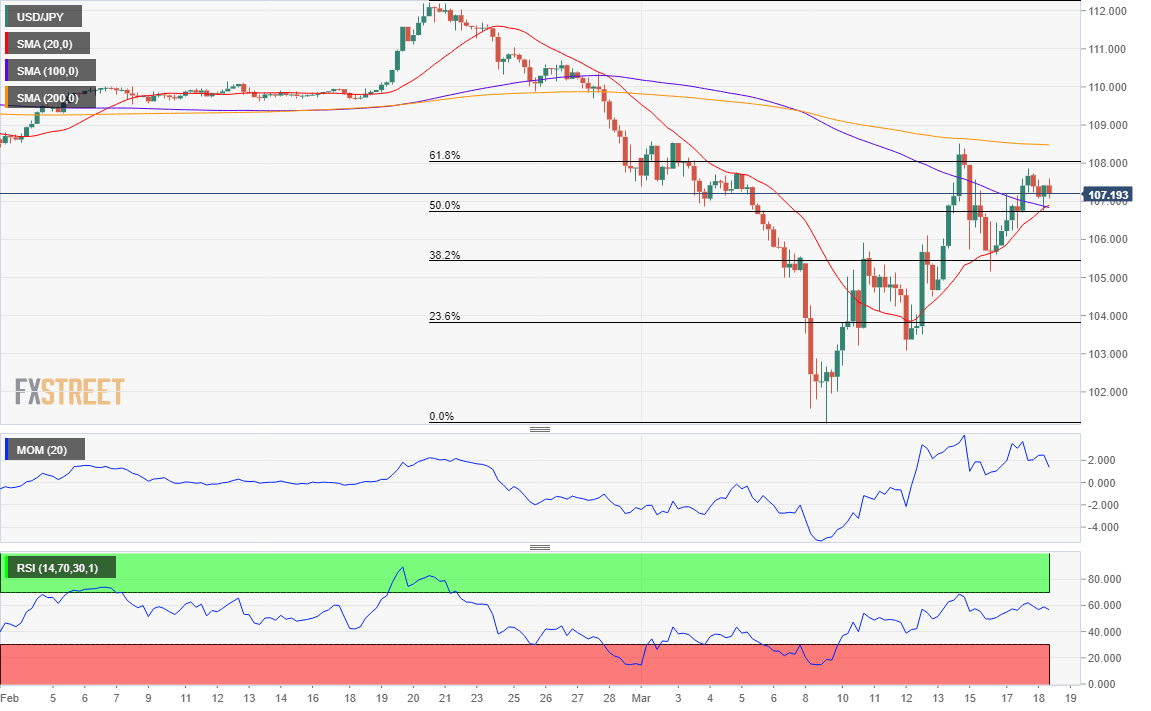

The USD/JPY pair is trading above the 50% retracement of its latest decline at 106.70, the immediate support. The 4-hour chart shows that the pair is holding above its 20 and 100 SMA, with the shortest advancing below the larger ones. Technical indicators, however, show no directional strength, above their midlines, but indicating the absence of buying interest. The pair would need to advance beyond 108.00, the 61.8% retracement of the same slump, to gain some traction upward, quite unlikely for these days.

Support levels: 106.70 106.25 105.80

Resistance levels: 107.60 108.00 108.50

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.