USD/JPY Forecast: Bulls still have chances of reaching 110.00

USD/JPY Current price: 109.45

- The yield on the US 10-year Treasury note retreated from the critical 1.70% threshold.

- Japanese data was mixed, as the trade surplus soared, buy confidence indicators contracted.

- USD/JPY holds near a fresh monthly high at 109.78, has room to extend its advance.

The USD/JPY pair extended its monthly advance by a few pips to 109.78 before retreating toward the 109.50 price zone, moving alongside US Treasury yields. The yield on the 10-year note surged to 1.70% ahead of Wall Street’s opening, underpinning the pair. It later retreated to settle around 1.66%, as the market mood improved and stocks bounced, despite another US report indicating mounting inflationary pressures.

Japanese data was mixed, as the Trade Balance posted a surplus of ¥983.1 billion in March, surpassing expectations, although the April Eco Watchers Survey Outlook contracted to 41.7 against an expected advance to 50.7. This Friday, the country will release April Money Supply, previously at 9.5% YoY.

USD/JPY short-term technical outlook

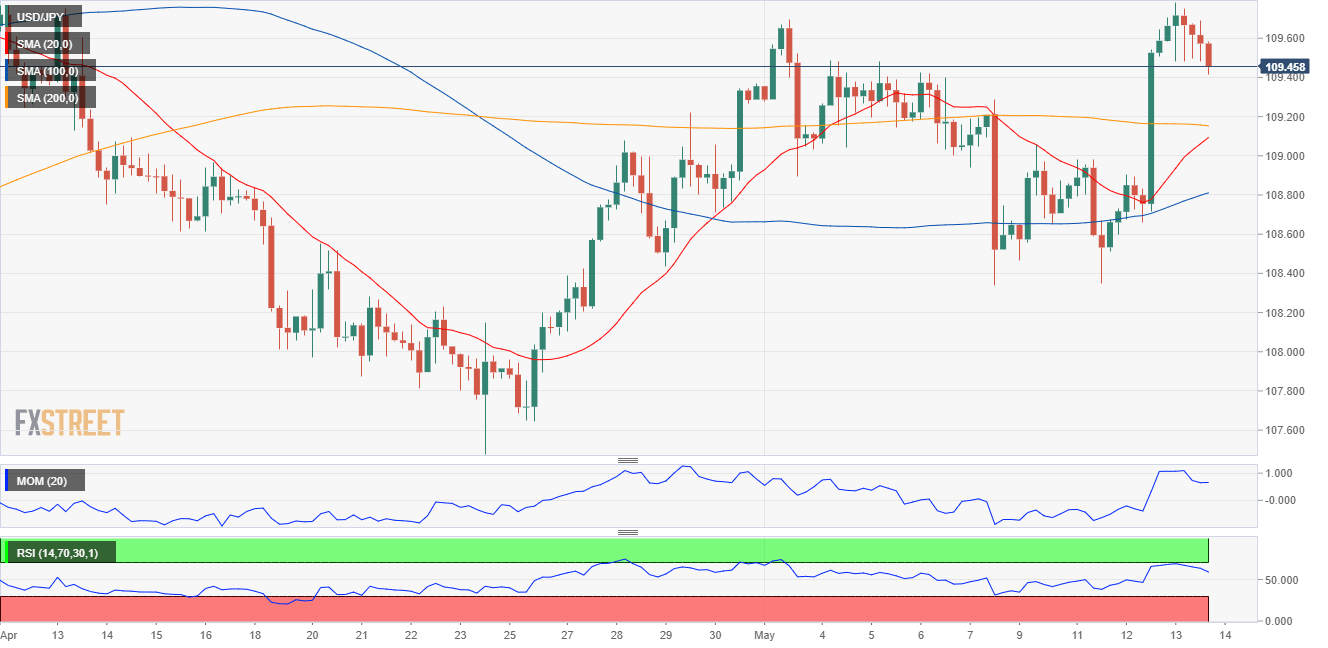

From a technical point of view, the USD/JPY pair maintains its positive stance. The 4-hour chart shows that the pair continues to develop above all of its moving averages, with the 20 SMA advancing between the longer ones. The Momentum indicator has resumed its advance near overbought readings, while the RSI consolidates at 59, both reflecting substantial buying interest.

Support levels: 109.25 108.80 108.30

Resistance levels: 109.70 110.10 110.50

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.