USD/JPY Forecast: Advancing ahead of critical US data

USD/JPY Current price: 109.01

- Gains in stocks and government bond yields underpin USD/JPY.

- The US Q1 Gross Domestic Product is expected at 6.1% QoQ.

- USD/JPY could accelerate its advance once above the 109.20 level.

The USD/JPY pair trades near its weekly high at around the 109.00 figure, with the greenback mixed across the board after the US Federal Reserve monetary policy announcement. The Fed didn’t surprise, maintaining rates and QE unchanged. Chief Jerome Powell reaffirmed its well-known stance of waiting for “further substantial progress” towards the central bank’s objectives in employment and inflation before changing the current policy. On tightening, Powell said that it is too early to discuss it.

US stocks closed in the red, but the mood improved in Asia, with indexes in the green and leading to positive developments among European ones. US Treasury yields tick higher, providing support to USD/JPY.

Data wise, Japan did not publish macroeconomic figures amid a local bank holiday. The US will publish later today the preliminary estimate of the first quarter Gross Domestic Product, foreseen at 6.1% from 4.3% in the previous quarter. The country will also publish March Pending Home Sales and Initial Jobless Claims for the week ended April 23.

USD/JPY short-term technical outlook

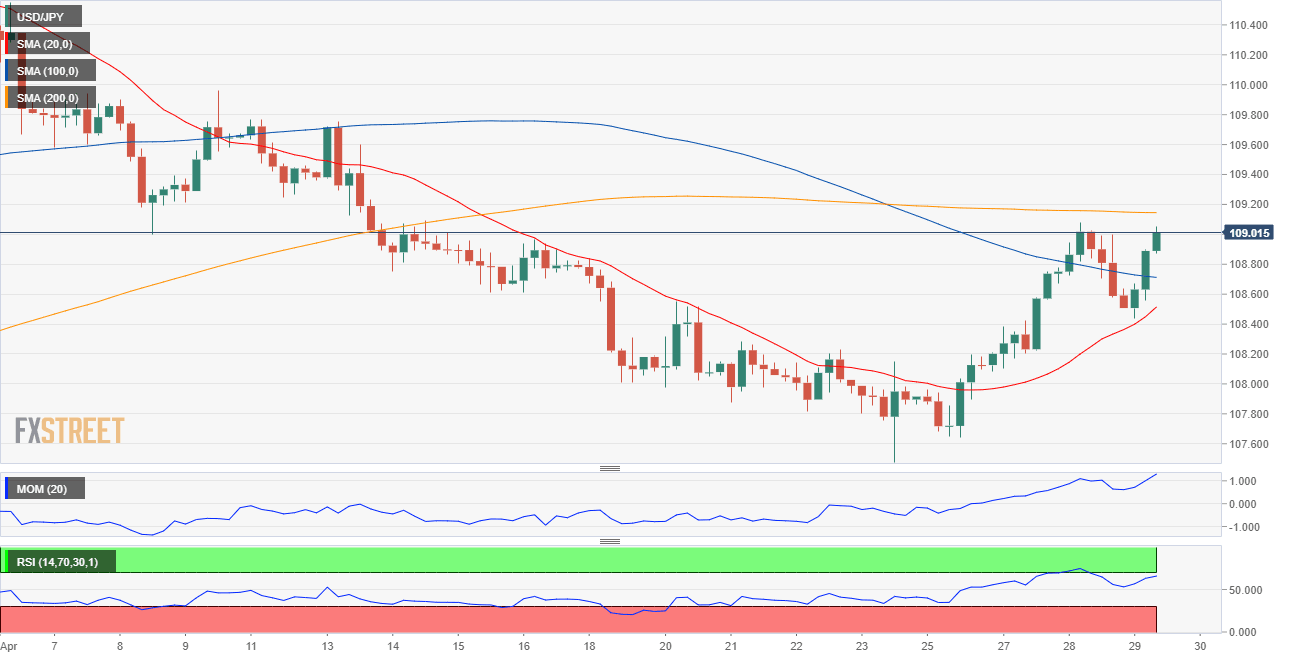

The USD/JPY pair seems poised to extend its advance in the near-term, but the upcoming direction will depend on the US GDP result. From a technical point of view, the 4-hour chart shows that the risk is skewed to the upside, as the pair is not only pressuring weekly highs, but it has also bounced from a bullish 20 SMA. Technical indicators have recovered from near their midlines, currently consolidating well into positive levels. The 200 SMA heads nowhere around 109.15, with a clear break above it hinting at additional gains ahead.

Support levels: 108.70 108.25 107.90

Resistance levels: 109.20 109.60 110.00

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.