USD/JPY Analysis: Refreshes 34-year top post-BoJ, could test ascending channel resistance

- USD/JPY rallies to its highest level since May 1990 in the wake of the post-BoJ JPY slump.

- Intervention fears prompt some profit-taking, though the downside remains cushioned.

- Bulls seem rather unaffected by a modest USD weakness ahead of the US PCE Price Index.

The USD/JPY pair builds on this week's breakout momentum through the 155.00 pivotal resistance and surges to a fresh multi-decade high after the Bank of Japan (BoJ) decided to keep its key interest rate unchanged on Friday. The central bank also said that it will continue buying government bonds in line with the guidance made in March, dashing hopes that it could taper purchases to stall the Japanese Yen's (JPY) decline. In the accompanying quarterly outlook report, the BoJ lowered its economic growth forecast for the current fiscal year 2024 to 0.8% from the 1.2% estimated previously. This comes on top of data showing that inflation in Tokyo – Japan's capital city – slowed for a second month in April and fell below the central bank's 2% target, raising doubts about further policy tightening and weighing heavily on the JPY.

The strong move up, meanwhile, raises the risk of an imminent intervention by Japanese authorities to support the domestic currency. Furthermore, the US Dollar (USD) adds to the previous day's weaker US GDP-inspired losses and drops to over a two-week low during the early European session, which, in turn, prompts some intraday selling around the USD/JPY pair. The Advance GDP report published by the US Commerce Department showed that the world’s largest economy grew by 1.6% at an annualized rate in the first quarter, marking the weakest reading since mid-2022. Additional details of the report revealed that underlying inflation rose by 3.7% in the first quarter, reaffirming bets that the Federal Reserve (Fed) will keep rates higher for longer. This acts as a tailwind for the USD ahead of the critical US inflation data.

The US Personal Consumption Expenditures (PCE) Price Index, due for release later during the early North American session, will be looked upon for cues about the Fed's rate-cut path. This, in turn, will play a key role in influencing the near-term USD price dynamics and help in determining the next leg of a directional move for the USD/JPY pair. Meanwhile, the aforementioned fundamental backdrop suggests that the interest rate differential between Japan and the US will remain wide for some time. This, in turn, suggests that the path of least resistance for spot prices is to the upside. Nevertheless, the currency pair remains on track to register strong weekly gains.

Technical Outlook

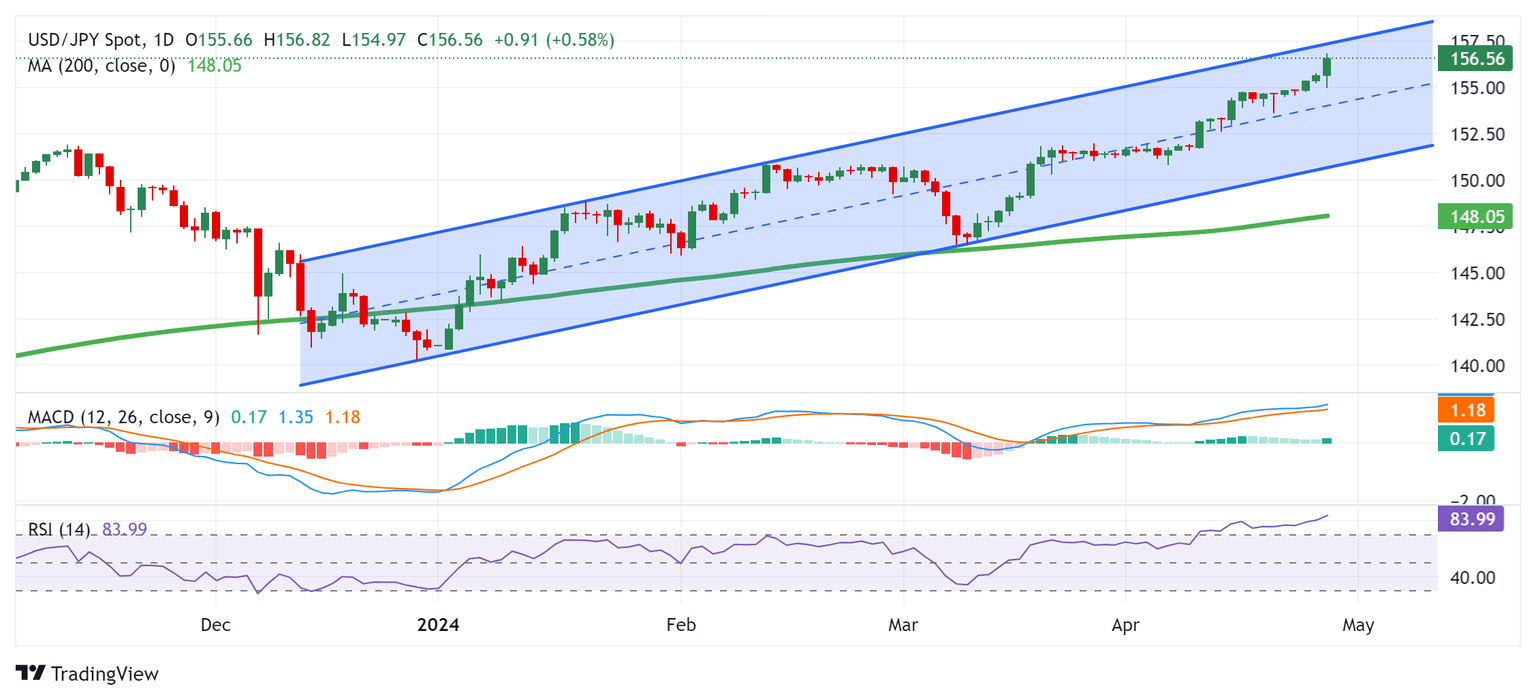

From a technical perspective, the recent strong rally witnessed since the beginning of the year has been along an upward-sloping channel. This points to a well-established bullish trend and supports prospects for a further near-term appreciating move. That said, the Relative Strength Index (RSI) on the daily chart is flashing extremely overbought conditions and warrants some caution for bulls. Hence, any subsequent move up might prompt some profit-taking near the 157.00 round figure and remain capped near the top boundary of the aforementioned trend channel, currently pegged near the 157.25 region.

On the flip side, the 156.00 mark could protect the immediate downside ahead of the 155.60 area and the intraday swing low, around the 155.00 psychological mark. The latter should act as a key pivotal point, which if broken decisively could pave the way for some meaningful corrective decline and drag the USD/JPY pair towards the 154.65-154.60 intermediate support en route to the 154.25 zone and the 154.00 mark.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.