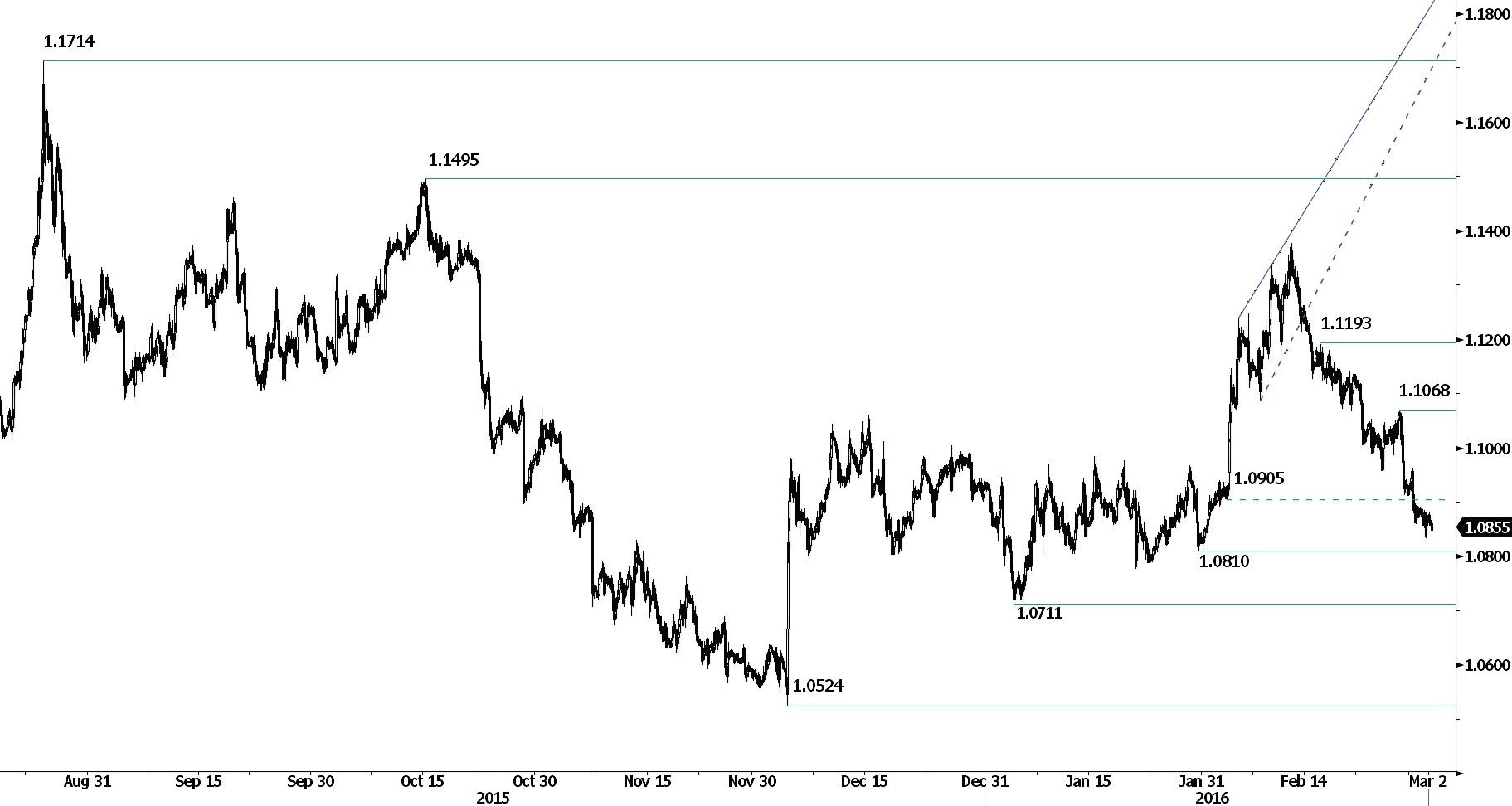

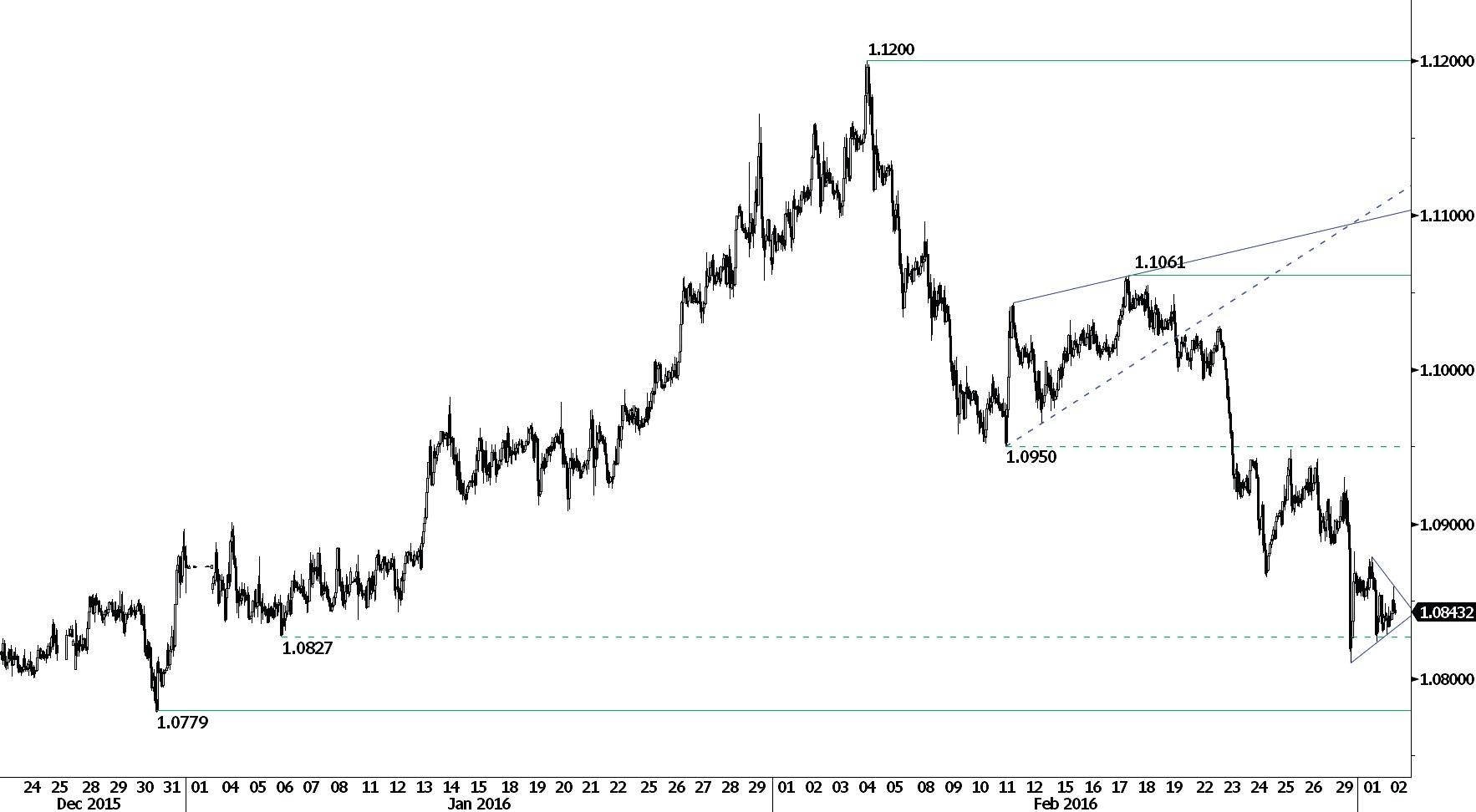

EUR/USD

Drifting lower.

EUR/USD continues to retrace the rebound that started from the low at 1.0810.The shortterm technical structure still suggests a further bearish move. Hourly resistance lies at 1.0891 (i01/03/2016). Hourly support can be found at 1.0810 (29/01/2016 low). Expected to show continued weakness.

In the longer term, the technical structure favours a bearish bias as long as resistance holds. Key resistance is located region at 1.1453 (range high) and 1.1640 (11/11/2005 low) is likely to cap any price appreciation. The current technical deteriorations favours a gradual decline towards the support at 1.0504 (21/03/2003 low).

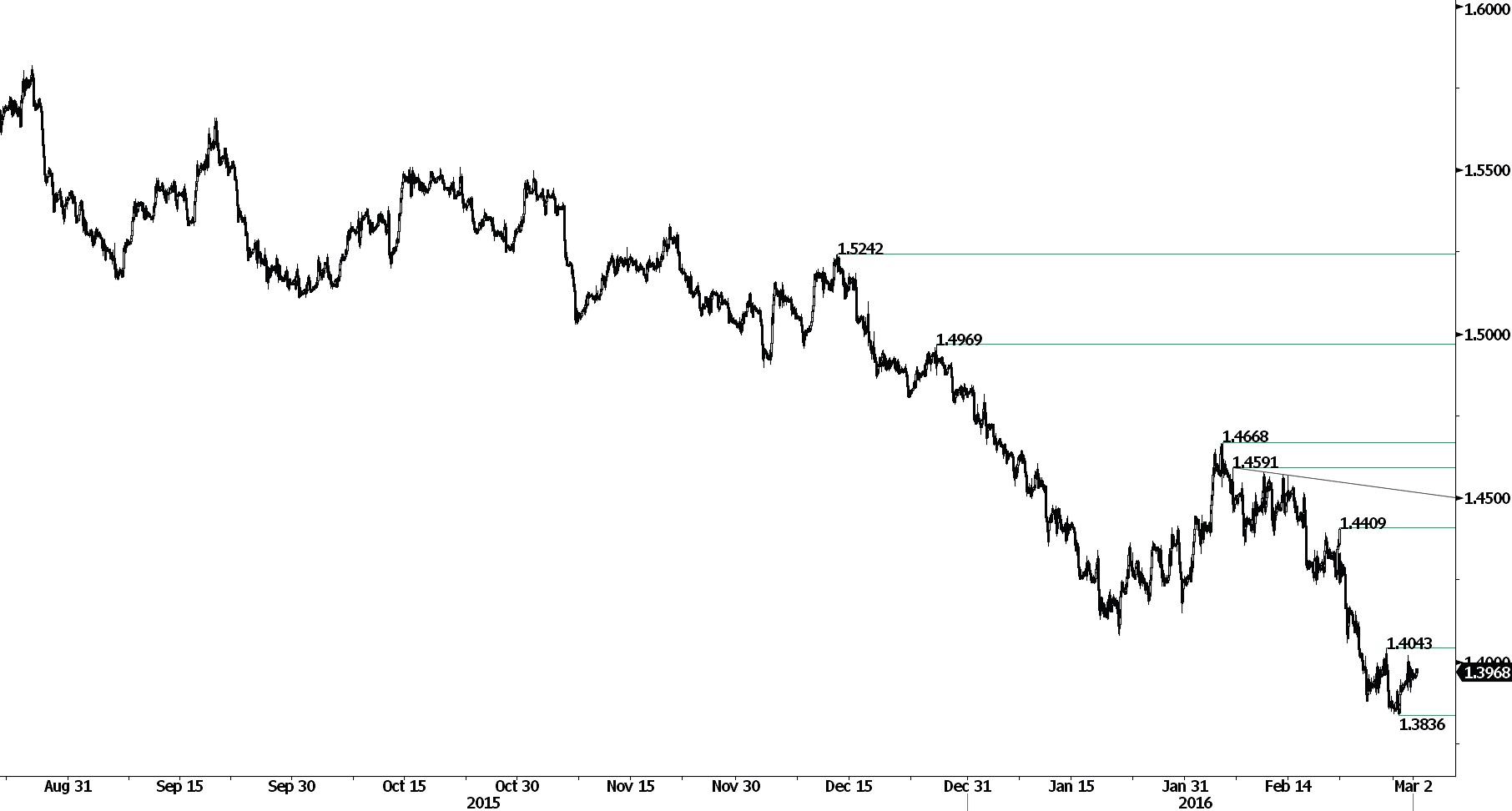

GBP/USD

Further consolidation.

GBP/USD is now consolidating. Hourly support lies at 1.3836 (29/02/2016 low) and hourly resistance is given at 1.4043 (26/02/2016 high). The technical structure suggests further decline. The road is wide open to stronger support at 1.3657 (11/03/2009 low).

The long-term technical pattern is negative and favours a further decline towards the key support at 1.3503 (23/01/2009 low), as long as prices remain below the resistance at 1.5340/64 (04/11/2015 low see also the 200 day moving average). However, the general oversold conditions and the recent pick-up in buying interest pave the way for a rebound.

USD/JPY

Pushing higher.

USD/JPY is lifted by a strong bullish momentum, as can be seen by the break of the short-term resistance found at 114.00 (29/02/2016 high). Stronger resistance is given at 114.91 (16/02/2016 high). Hourly support can be located at 113.74 (base) then next support lies at 112.16 (intraday low).

We favour a long-term bearish bias. Support at 105.23 (15/10/2014 low) is on target. A gradual rise towards the major resistance at 135.15 (01/02/2002 high) seems now less likely. Another key support can be found at 105.23 (15/10/2014 low).

USD/CHF

Moving sideways.

USD/CHF is moving sideways between the support at 0.9950 and the resistance at 1.0034 (29/02/2016 high). The break of the support at 0.9857 (30/12/2015 low) suggests further selling pressures.

In the long-term, the pair is setting highs since mid-2015. Key support can be found 0.8986 (30/01/2015 low). The technical structure favours a long term bullish bias.

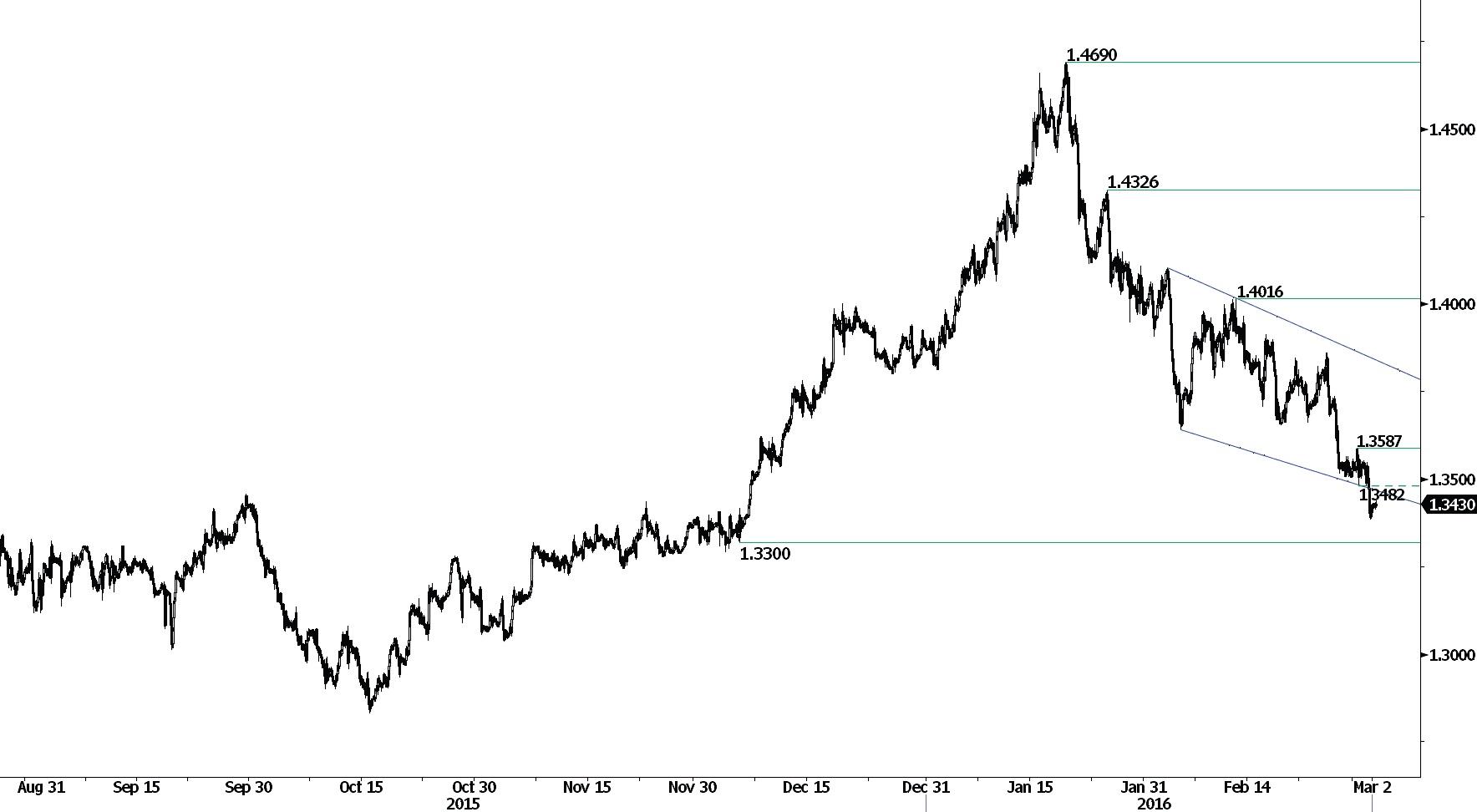

USD/CAD

Remains weak.

USD/CAD's bearish momentum is now pausing, after failing to test strong support at 1.3300. Hourly support is given at 1.3482 (01/03/2016 low). Hourly resistance can be found at 1.3587 (29/02/2016 high). Expected to see further consolidation.

In the longer term, the break of the key resistance at 1.3065 (13/03/2009 high) has indicated increasing buying pressures, which favours further medium-term strengthening. Strong resistance is given at 1.4948 (21/03/2003 high). Support can be found at 1.2832 (15/10/2015 low) then 1.1731 (06/01/2015 low).

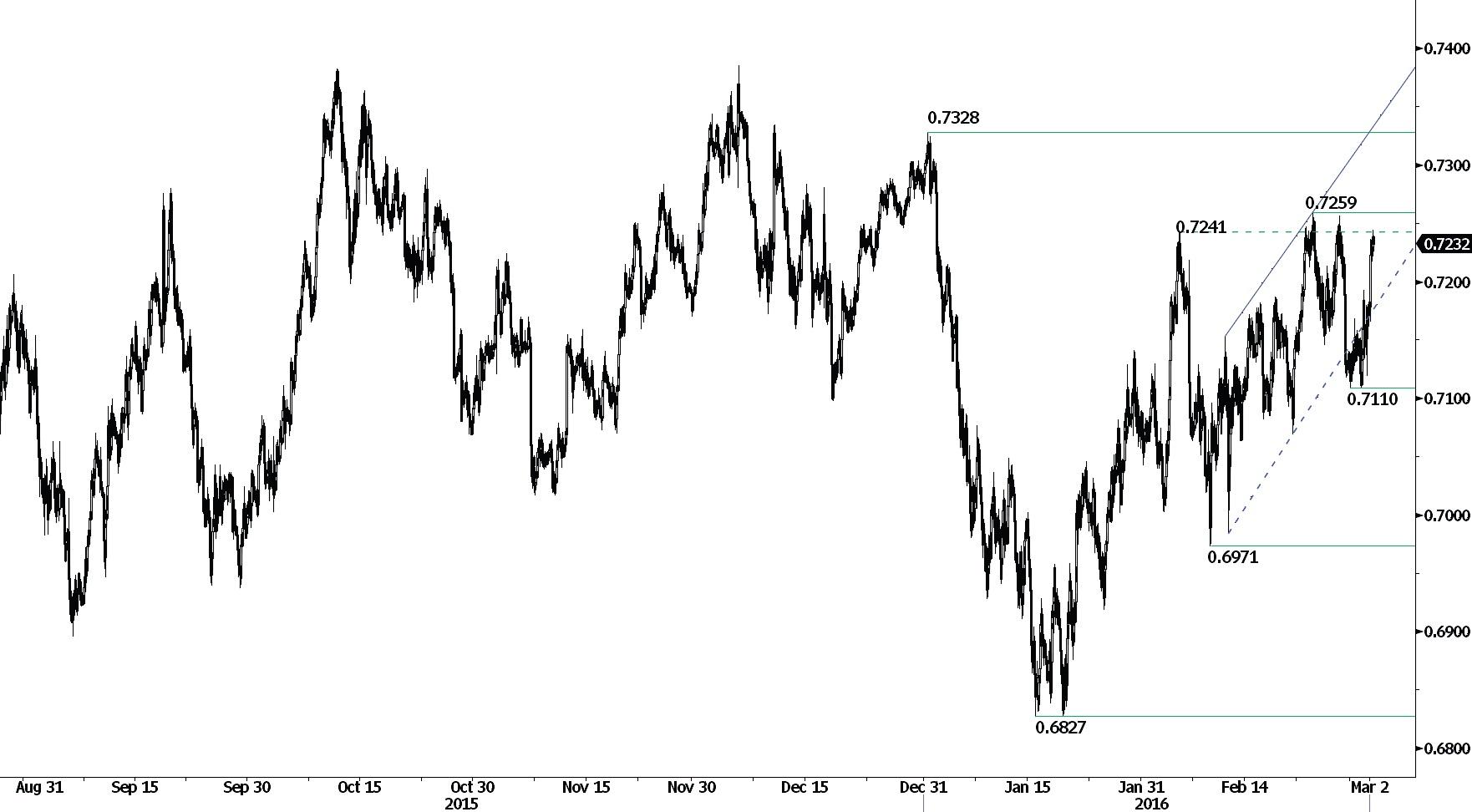

AUD/USD

Lack of follow-through.

AUD/USD is very volatile but series of lower highs indicates downside pressure. Hourly support is given at 0.7110 (intraday low). Strong hourly resistance is given at 0.7191 (01/03/2015 high). Expected to show continued weakness.

In the long-term, we are waiting for further signs that the current downtrend is ending. Key supports stand at 0.6009 (31/10/2008 low) . A break of the key resistance at 0.8295 (15/01/2015 high) is needed to invalidate our long-term bearish view. In addition, we still note that the pair is approaching the 200-dma which confirms fading selling pressures.

EUR/CHF

Unimpressive bounce thus far.

EUR/CHF's failed to break upside resistance suggesting a weakening buying interest. Hourly support can be found at 1.08320 (02/03/2016 low) is on target. Resistance lies at 1.0946 (25/02/2016 high). The technical structure suggests further weakening.

In the longer term, the technical structure remains positive. Resistance can be found at 1.1200 (04/02/2015 high). Yet,the ECB's QE programme is likely to cause persistent selling pressures on the euro, which should weigh on EUR/CHF. Supports can be found at 1.0184 (28/01/2015 low) and 1.0082 (27/01/2015 low).

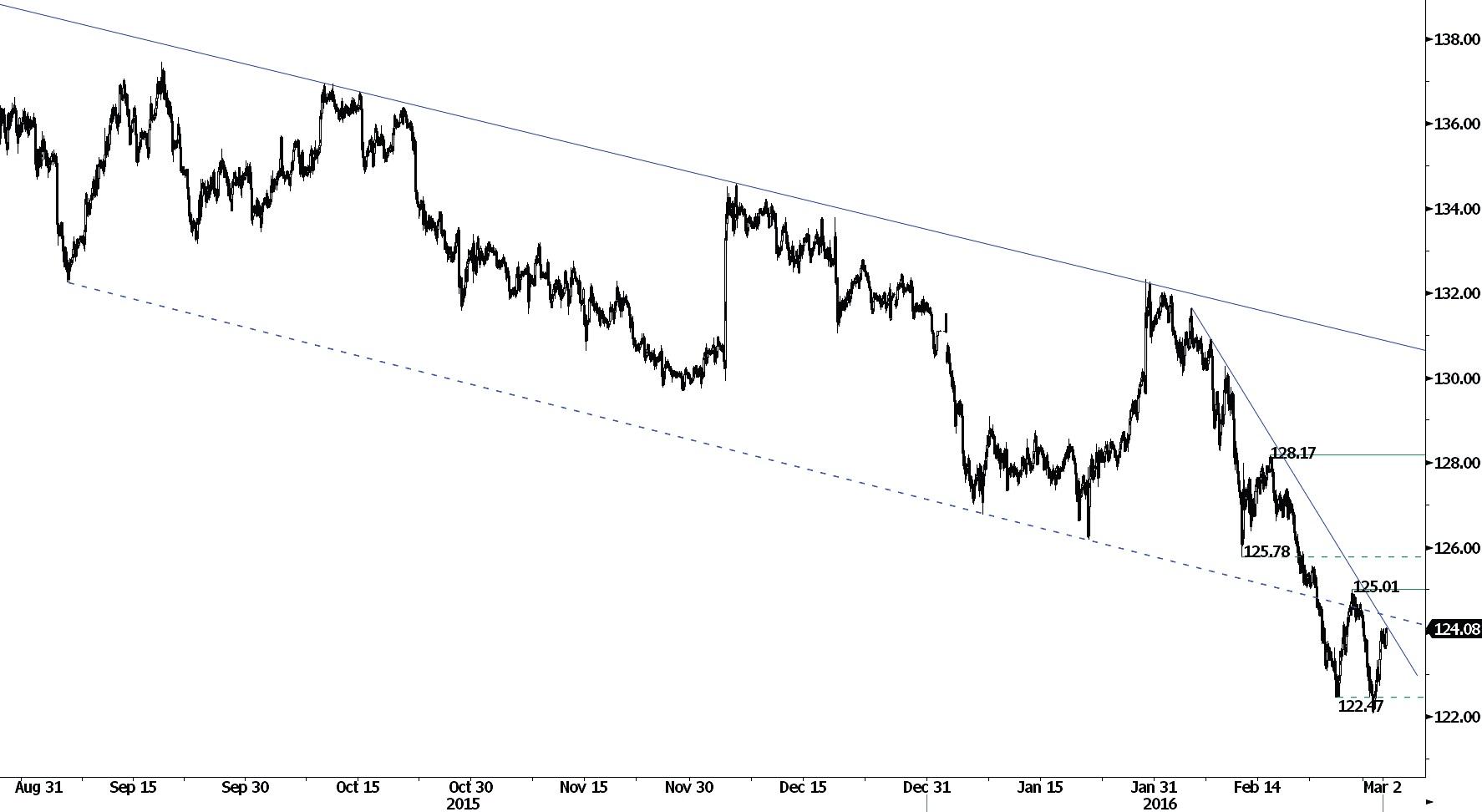

EUR/JPY

Successful test of the support at 122.45.

EUR/JPY has bounced near the significant support region around 122.47 (24/03/2016 low), breaking downtrend channel at 124.13. Hourly resistance can be found at 125.01 (01/03/2016 high).

In the longer term, the technical structure validates a medium-term succession of lower highs and lower lows. As a result, the resistance at 149.78 (08/12/2014 high) has likely marked the end of the rise that started in July 2012. Key support at 124.97 (13/06/2013 low) has been broken. Stronger support is given at 118.73 (25/02/2013 low). A key resistance can be found at 141.06 (04/06/2015 high).

EUR/GBP

Challenging its recent lows.

EUR/GBP declined sharply yesterday, indicating persistent selling pressures. Monitor the hourly support at 0.7758. A key support stands at 0.7695 (16/02/2016 low), whereas a key resistance lies at 0.7877.

In the long-term, the technical structure suggests a growing upside momentum. The pair is trading well above its 200 DMA. Strong resistance can be found at 0.8066 (10/09/2014 high).

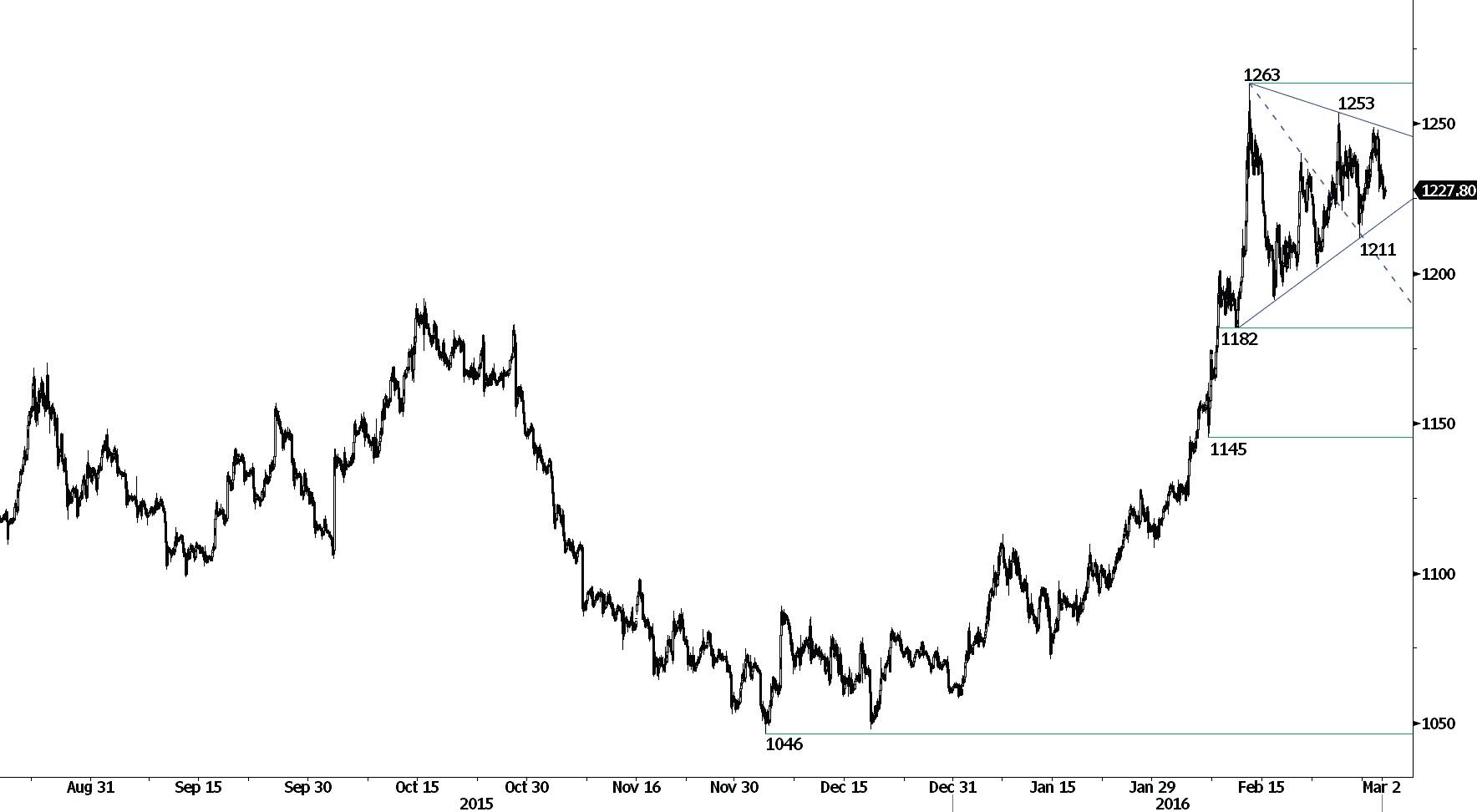

GOLD (in USD)

Fading near the resistance at 1253.

Gold's bullish momentum faded ahead of key resistance at 1253. The metal is pushing slightly higher. Hourly supports lies at 1211 (26/02/2016 low). Daily resistance can be found at 1263 (11/02/2016 high).

In the long-term, the technical structure suggests that there is a growing upside momentum. A break of 1392 (17/03/2014) is necessary ton confirm it, A major support can be found at 1045 (05/02/2010 low).

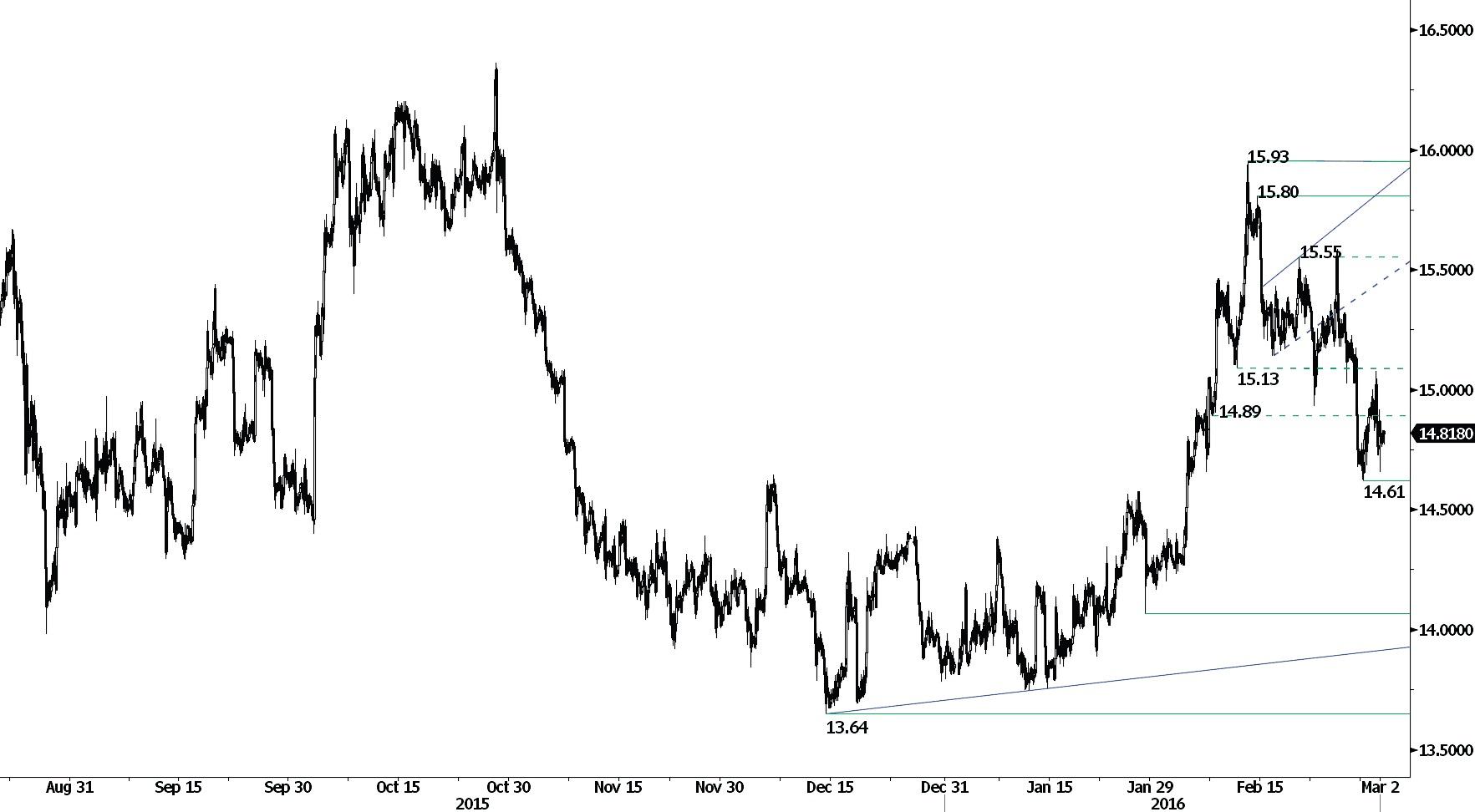

SILVER (in USD)

Unimpressive bounce thus far.

Silver made a bearish intraday reversal yesterday, suggesting a weakening buying interest. Support can be located at 14.61 (29/02/2016 low). Hourly resistance can be found at 15 (intraday high).

In the long-term, the break of the major support area between 18.64 (30/05/2014 low) and 18.22 (28/06/2013 low) confirms an underlying downtrend. Strong support can be found at 11.75 (20/04/2009). A key resistance stands at 18.89 (16/09/2014 high).

Crude Oil (in USD)

Riding short-term uptrend channel.

Crude oil's continues to move within a rising channel. The hourly support at 33.37 (intraday low). A more significant support stands at 33.30 (rising channel). Resistances can be found at 34.82 (28/01/2016 & 04/02/2016 high). Expected to see continued strength in the short-term.

In the long-term, crude oil is on a sharp decline and is of course no showing any signs of recovery. Strong support at 24.82 (13/11/2002) is now on target. Crude oil is holding way below its 200-Day Moving Average (setting up at around 47). There are currently no signs that a reverse trend may happen.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.