EUR/USD

Monitor the resistance at 1.2456.

EUR/USD has bounced after having posted new lows. However, as long as prices remain below the hourly resistance at 1.2456 (see also the declining trendline), the technical structure favours a short-term bearish bias. Another resistance can be found at 1.2532. Hourly supports now lie at 1.2341 (intraday low) and 1.2247.

In the longer term, EUR/USD is in a downtrend since May 2014. The break of the strong support area between 1.2755 (09/07/2013 low) and 1.2662 (13/11/2012 low) calls for a decline towards the strong support at 1.2043 (24/07/2012 low). A key resistance stands at 1.2600 (19/11/2014 high).

Sell limit 2 units at 1.2522, Obj: Close unit 1 at 1.2305, remaining at 1.2070., Stop: 1.2610

GBP/USD

Succession of lower highs is still in place.

GBP/USD has bounced after having broken the support at 1.5593. However, the hourly resistance at 1.5726 (04/12/2014 high) has held thus far. Hourly supports can be found at 1.5626 (09/12/2014 low) and 1.5542. A key resistance stands at 1.5826 (see also the declining trendline).

In the longer term, the break of the support at 1.5855 (12/11/2013 low) confirms an underlying bearish trend. A conservative downside risk is given by a test of the support at 1.5423 (14/08/2013 low). Another support can be found at 1.5102 (02/08/2013 low). A key resistance lies at 1.5945 (11/11/2014 high).

Await fresh signal.

USD/JPY

Successful test of the support at 117.87.

USD/JPY declined sharply during yesterday's session. However, yesterday's long daily shadow indicates a surge in buying interest near the support at 117.87. Hourly resistances can be found at 119.92 (intraday high, see also the 50% retracement of the recent decline) and 121.00 (09/12/2014 high). A key support stands at 117.24.

A long-term bullish bias is favoured as long as the key support 110.09 (01/10/2014 high) holds. Given the major resistance at 124.14 (22/06/2007 high) and the overextended rise, the odds to see a medium-term consolidation phase are elevated. However, there is no sign to suggest the end of the long-term bullish trend.

Await fresh signal.

USD/CHF

The support at 0.9649 has held thus far.

USD/CHF has weakened near the key resistance at 0.9839 (22/05/2013 high). However, the steepest rising trendline and the successful test of the support at 0.9649 continue to favour a short-term bullish bias. Hourly resistances can be found at 0.9743 (intraday high) and 0.9778 (09/12/2014 high).

From a longer term perspective, the technical structure favours a full retracement of the large corrective phase that started in July 2012. A major resistance area stands between 0.9972 (24/07/2012 high) and 1.0067 (01/12/2010 high). A key support can be found at 0.9351 (19/11/2014 low).

Await fresh signal.

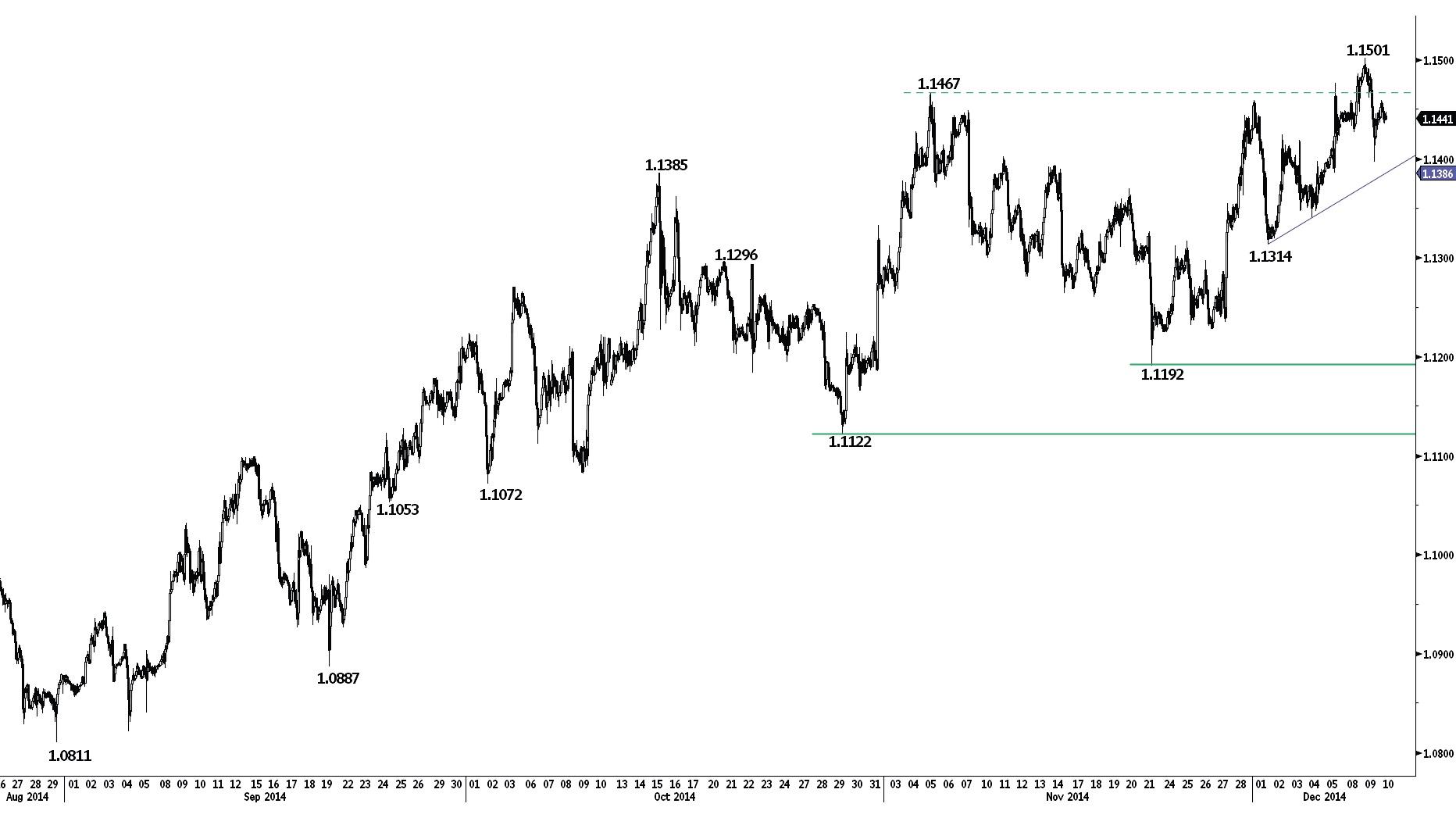

USD/CAD

Slow gradual rise underway.

USD/CAD has broken the resistance at 1.1467 (05/11/2014 high), confirming the underlying bullish trend. Despite yesterday's decline, the short-term rising trendline remains in place. An hourly support stands at 1.1386 (intraday low, see also rising trendline). Another support lies at 1.1340 (04/12/2014 low). An hourly resistance can now be found at 1.1501.

In the longer term, the technical structure looks like a rounding bottom whose minimum upside potential is given by the strong resistance at 1.1725 (08/07/2009 high). However, as highlighted by the recent prices behaviour, this expected rise is likely to be very gradual. A strong support stands at 1.1072 (02/10/2014 low).

Await fresh signal.

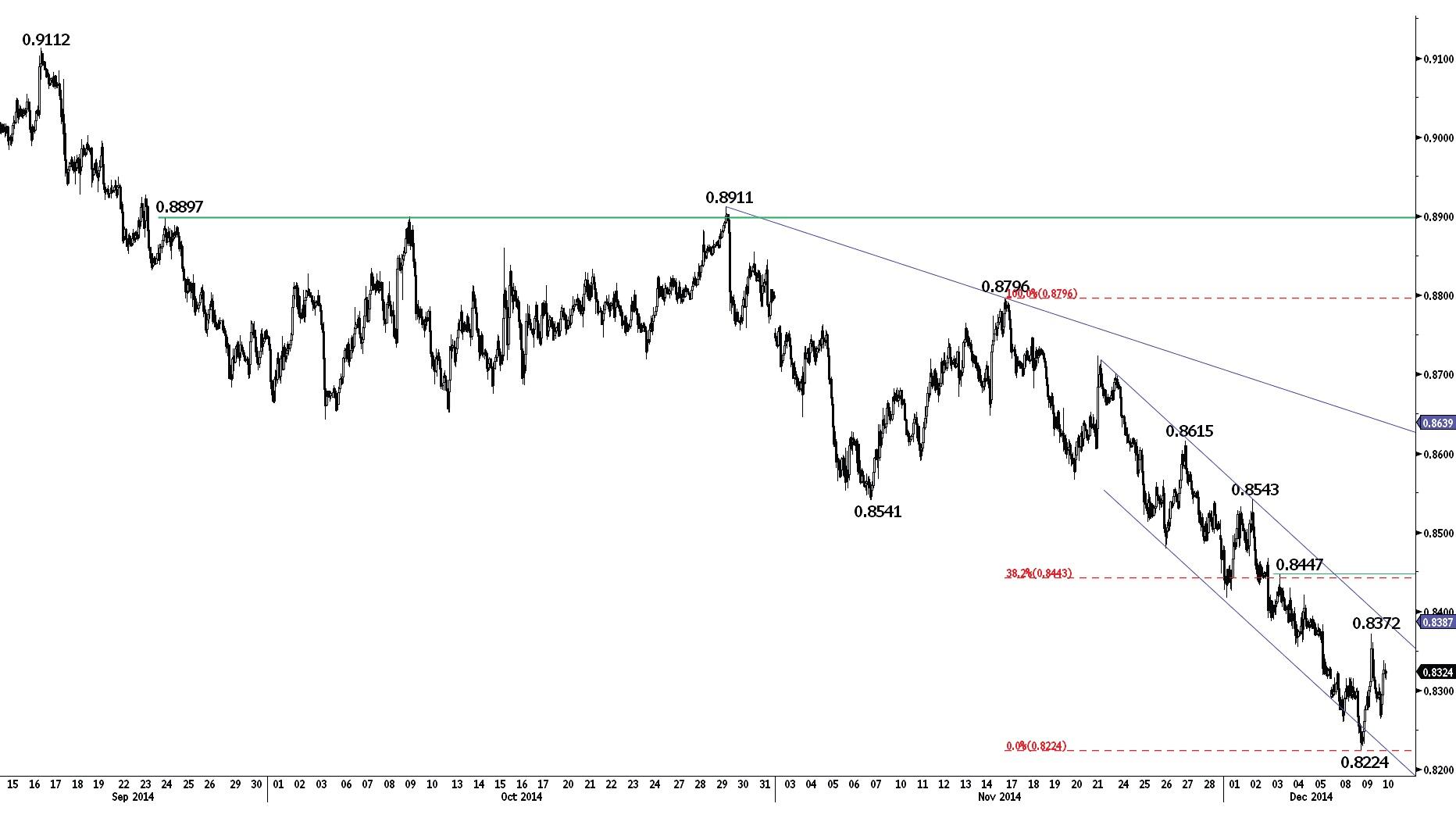

AUD/USD

Short-term indecision.

AUD/USD is making new lows, confirming a negative underlying downtrend. However, the daily dojis of the last two days suggest some short-term indecision. Hourly resistances can now be found at 0.8372 and 0.8447 (see also the 38.2% retracement). An hourly support lies at 0.8224.

In the long-term, the break of the strong support at 0.8660 (24/01/2014 low) confirms the underlying long-term bearish trend and opens the way for further weakness. A strong support area stands between 0.8067 (25/05/2010 low) and 0.7947 (61.8% retracement of the 2009-2011 rise). A key resistance can be found at 0.8615 (27/11/2014 high).

Await fresh signal.

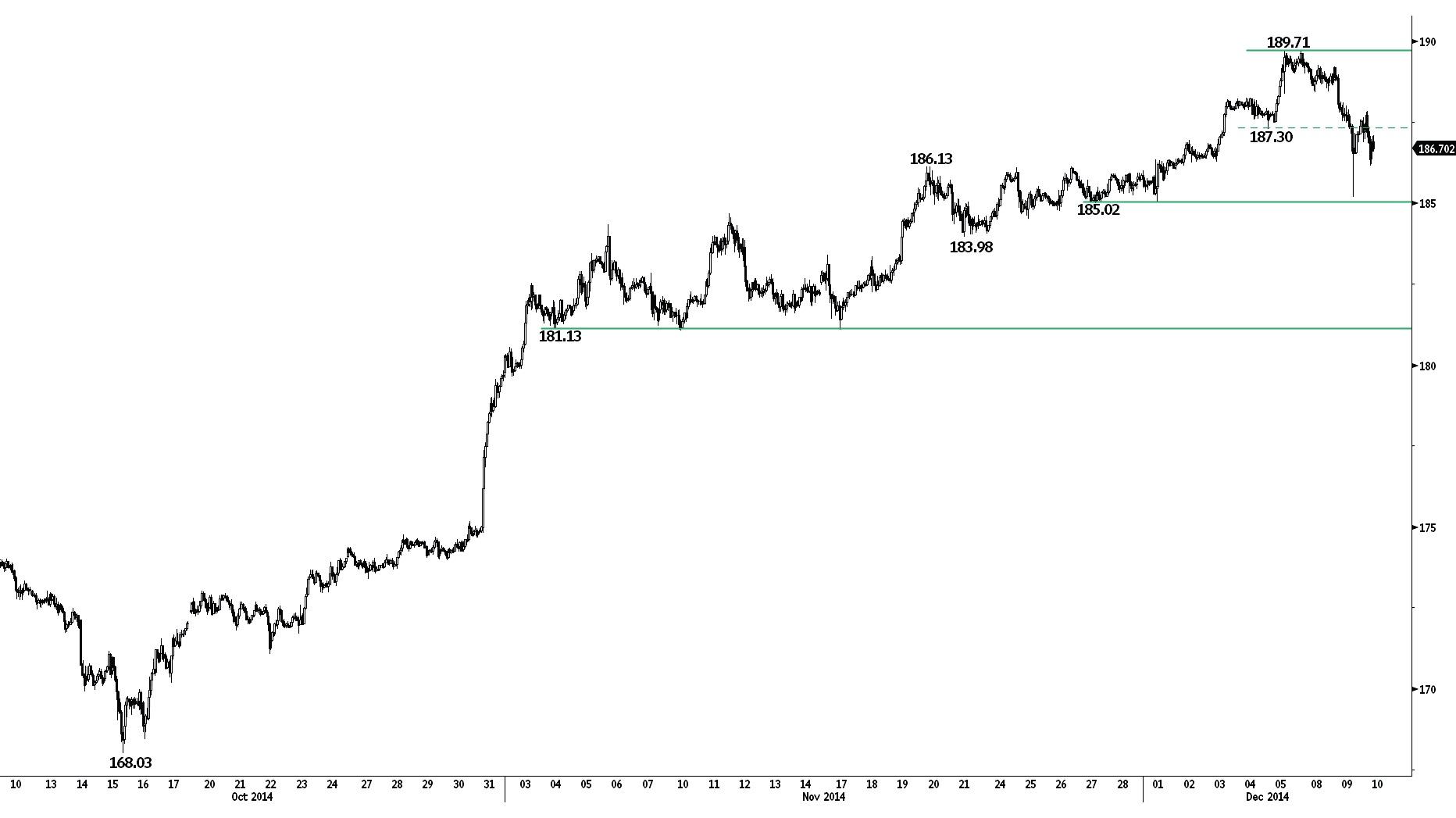

GBP/JPY

Successful test of the support at 185.02.

GBP/JPY has declined sharply near the psychological resistance at 190.00. However, the support at 185.02 has spurred some buying interest, favouring a more sideways evolution. Hourly resistances can be found at 187.83 (intraday high) and 189.27 (intraday high). Another key support lies at 183.98.

In the long-term, the trend is positive as long as the key support at 178.74 (23/09/2014 high) holds. The break of the strong resistance at 180.72 (19/09/2014 high) opens the way for further strength. A key resistance stands at 197.45 (24/09/2008 high). A key support lies at 180.72 (19/09/2014 high).

Await fresh signal.

EUR/JPY

Monitor the support at 147.09.

EUR/JPY has weakened near the psychological resistance at 150.00. Monitor the test of the support at 147.09 (see also the 61.8% retracement). A break of the hourly resistance at 148.37 (intraday high) would favour a sideways consolidation. Another hourly resistance can be found at 148.88 (09/12/2014 high), whereas another support stands at 146.30.

The long-term technical structure remains positive as long as the key support at 141.23 (19/09/2014 high) holds. Monitor the test of the psychological resistance at 150.00. Another resistance stands at 157.00 (08/09/2008 high). A key support stands at 144.79.

Await fresh signal.

EUR/GBP

Fading near the resistance at 0.7924.

EUR/GBP is moving sideways. However, as long as prices remain below the resistance at 0.7924 (see also the declining trendline), a bearish bias is favoured. Hourly supports can be found at 0.7833 and 0.7799. Another resistance stands at 0.7977.

In the longer term, the major support area between 0.7755 (23/07/2012 low) and 0.7694 (20/10/2008 low) has held thus far. However, a decisive break of the resistance at 0.8034 (25/06/2014 high, see also the declining channel and the 200-day moving average) is needed to confirm an improving technical structure.

Sell limit 2 units at 0.7939, Obj: Close unit 1 at 0.7833, remaining at 0.7705., Stop: 0.7987

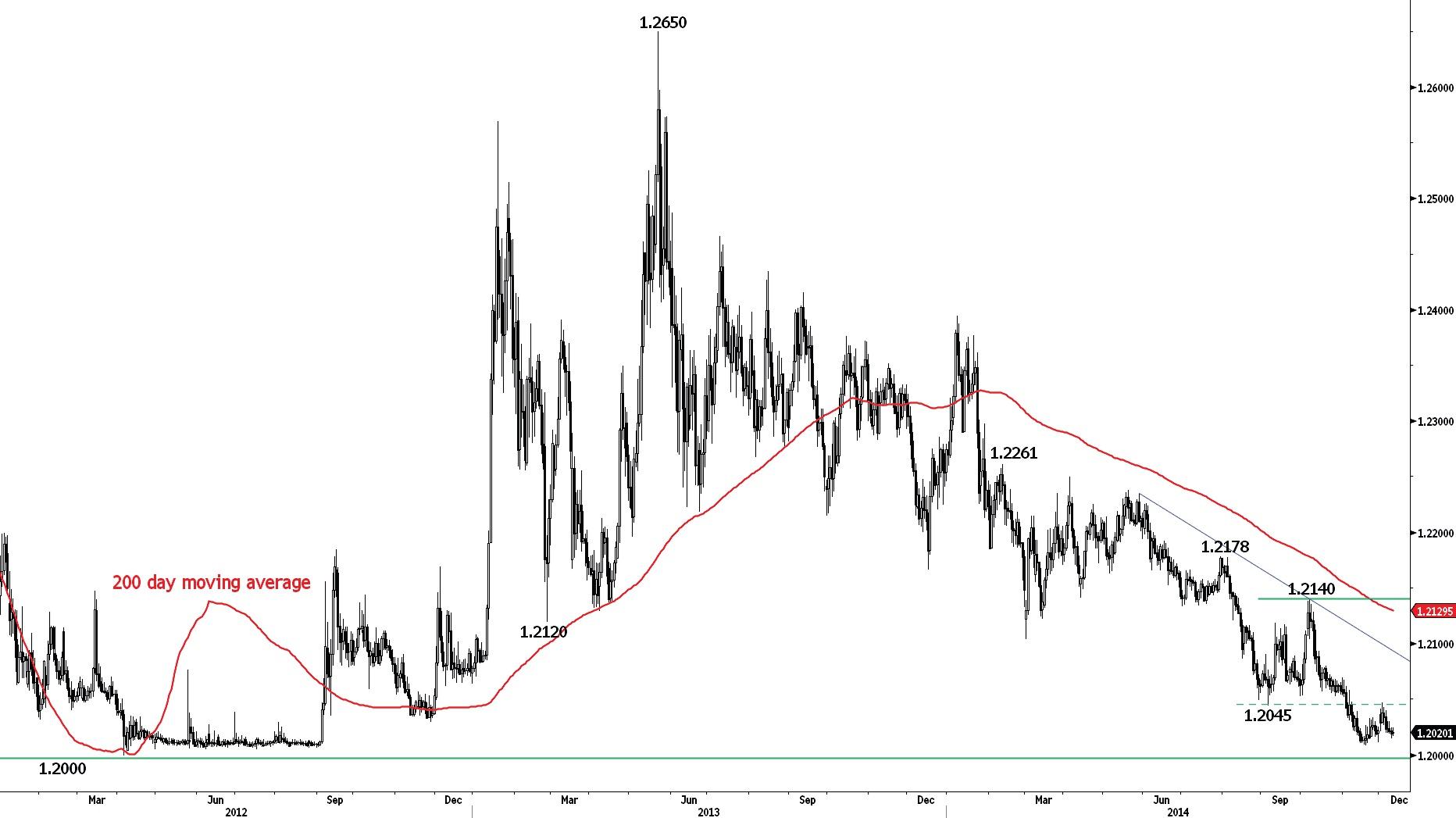

EUR/CHF

Buying interest remains shallow.

EUR/CHF's recent strength is unimpressive, highlighting a light buying interest. An hourly resistance area can be found between 1.2045 (previous support) and 1.2058 (06/11/2014 high).

In September 2011, the SNB put a floor at 1.2000 in EUR/CHF, which will be enforced with the "utmost determination". For the time being, a break of this threshold is very unlikely. As a result, further tight sideways moves are favoured.

Await fresh signal.

GOLD (in USD)

Pushing higher.

Gold has resumed its short-term uptrend by breaking the hourly resistance at 1221 (01/12/2014 high). The resistance at 1236 (see also the declining trendline) is challenged. A key resistance stands at 1255. Hourly supports can be found at 1221 (01/12/2014 high) and 1199 (09/12/2014 low).

In the long-term, the move below the strong support at 1181 (28/06/2013 low) confirms the underlying downtrend and opens the way for further declines towards the strong support at 1027 (28/10/2009 low). A break of the strong resistance at 1255 (21/10/2014 high) is needed to invalidate this bearish outlook.

Await fresh signal.

SILVER (in USD)

Bullish breakout of the resistance at 16.73.

Silver has resumed its short-term uptrend by breaking the key resistance at 16.73 (25/11/2014 high, see also the declining trendline). Another resistance lies at 17.41 (28/10/2014 high), while a key resistance stands at 18.00 (23/09/2014 high). An hourly support can be found at 16.80 (01/12/2014 high).

In the long-term, the break of the major support area between 18.64 (30/05/2014 low) and 18.22 (28/06/2013 low) confirms an underlying downtrend. Although the strong support at 14.66 (05/02/2010 low) has held thus far, the lack of any base formation continues to favour a long-term bearish bias. A key resistance lies at 18.00 (23/09/2014 high). Another key support can be found at 11.77 (20/04/2009 low).

We have raised the stop-loss of our long position.

Long 1 unit at 16.83, Obj: Close position at 17.28., Stop: 16.98 (Entered: 2014-12-09)

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

AUD/USD drops toward 0.6500 after dismal Aussie Retail Sales, mixed China's PMIs

AUD/USD is extending losses toward 0.6500, hit by an unexpected drop in the Australian Retail Sales for March while China's NBS April PMI data came in mixed. Upbeat China's Caixin Manufacturing PMI data failed to lift the Aussie Dollar amid a softer risk tone and the US Dollar rebound.

USD/JPY holds rebound to 157.00 after Monday's suspected intervention-led crash

USD/JPY is trading close to 157.00, staging a solid rebound in the Asian session on Tuesday. The pair reverses a part of heavy losses incurred on Monday after the Japanese Yen rallied hard on probable FX market intervention by Japan's authorities. Poor Japan's jobs and Retail Sales data weigh on the Yen.

Gold price traders remain on the sidelines ahead of FOMC decision on Wednesday

Gold price remains confined in a narrow range as traders prefer to wait on the sidelines. Reduced Fed rate cut bets revive the USD demand and act as a headwind for the metal. Investors now await the FOMC decision and US macro data before placing directional bets.

BNB price risks a 10% drop as Binance founder and ex-CEO Changpeng Zhao eyes Tuesday sentencing

Binance Coin price is dumping, with the one-day chart showing a defined downtrend. While the broader market continues to bleed, things could get worse for BNB price ahead of Binance executive Changpeng Zhao sentencing on Tuesday, April 30.

FX market still on intervention watch

Asian foreign exchange traders will be particularly attentive to any signs of Japanese intervention on Tuesday, following reports of Tokyo's involvement in the market on Monday. This intervention action propelled the yen upward from its 34-year low of 160 per dollar, setting off shockwaves of volatility.