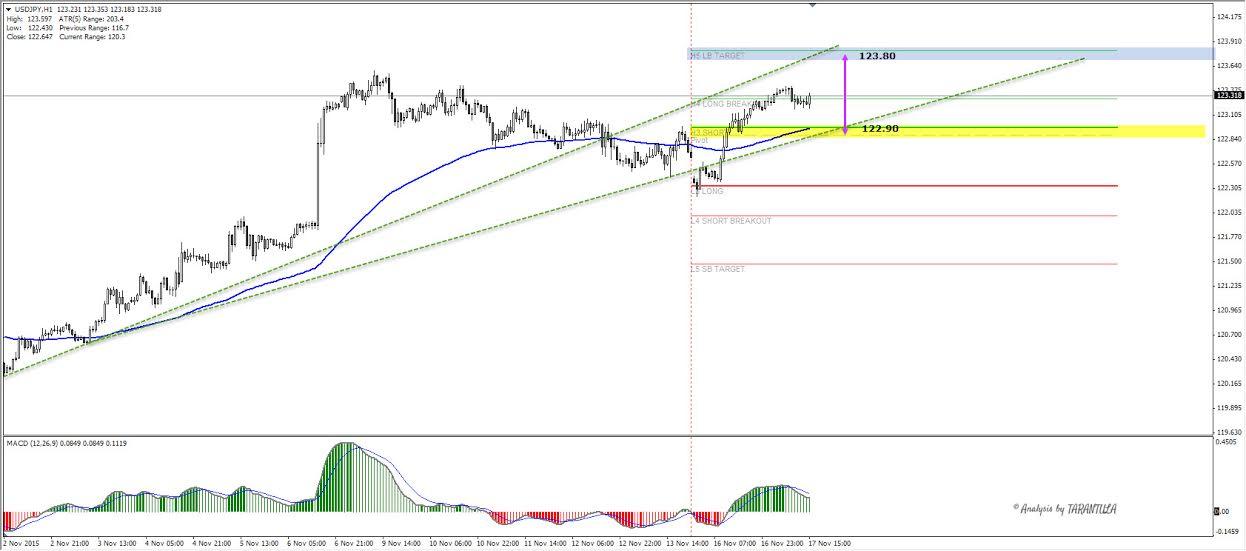

The CPI report has come as expected (0.2 % vs 0.2 %) and we can see that the USD is still looking strong. Technically we can spot range bound price action with 2-way trading as USDJPY is moving without a clear trend. H4 timeframe shows V shaped reversal and when we zoom into H1 timeframe we can clearly see 122.90 to the downside and 123.80 to the upside. If price retraces to 122.90 POC (H3,WPP,EMA89,trendline) we should expect some bounce towards 123.40 and if the price rallies towards 123.80 it could be rejected towards 123.40.

For a clear trend I am still looking to buy the dips but the price needs to proceed above 123.80 making it support instead of resistance. That is why I favor 122.90 POC for buying into dips.

The analysis and the article presents Nenad's opinion. Remember, financial trading is highly speculative & may lead to the loss of your funds. Proper risk management is the Holy Grail of trading.

Recommended Content

Editors’ Picks

EUR/USD stays near 1.0750 following Monday's indecisive action

EUR/USD continues to fluctuate in a tight channel at around 1.0750 after posting small gains on Monday. Disappointing Factory Orders data from Germany limits the Euro's gains as investors keep a close eye on comments from central bankers.

AUD/USD drops below 0.6600 after RBA policy announcements

AUD/USD stays under bearish pressure and trades deep in negative territory slightly below 0.6600. The RBA left the policy settings unchanged as expected but Governor Bullock said that there was no necessity to further tighten the policy.

Gold price turns red amid the renewed US dollar demand

Gold price trades in negative territory on Tuesday amid the renewed USD demand. A downbeat US jobs data for April prompted speculation of potential rate cuts by the Fed in the coming months.

Bitcoin miner Marathon Digital stock gains ground after listing by S&P Global

Following Bitcoin miner Marathon Digital's inclusion as an upcoming member of the S&P SmallCap 600, the company's stock received an 18% boost, accompanied by an $800 million rise in market cap.

The impact of economic indicators and global dynamics on the US Dollar

Recent labor market data suggest a cooling economy. The disappointing job creation and rising unemployment hint at a slackening demand for labor, which, coupled with subdued wage growth, could signal a slower economic trajectory.